Welcome

Welcome to the second edition of our quarterly GRESB Oceania newsletter. With the imminent opening of the 2024 GRESB Assessments, it feels like we’re all poised at the starting line, ready for another record-breaking year of ESG performance and benchmarking.

Whenever we have international GRESB visitors in town, as we had this month, they praise the openness, leadership, and collaboration demonstrated by our market. Thank you for warmly welcoming Chris Pyke, our Chief Innovation Officer, and Steven Pringle, Director, Member Relations this month.

We look forward to welcoming you at the 2024 GRESB Assessment finish line. And don’t forget, we’re here to hold your hand (sometimes literally) through the reporting process.

Sarah Blankfield

Manager, Member Relations Oceania

Preparing for reporting

It’s nearly that time when we come down off our Easter chocolate sugar high and enter the 2024 GRESB Assessment Portal:

- The 2024 GRESB Assessments open in the Portal on April 1 – remind yourself of the Assessment timeline on our website.

- Refresh your knowledge of the changes to the 2024 Real Estate and Infrastructure Standards before the Assessments open:

- Real Estate Standards changes

- Infrastructure Standards changes: Fund, Asset, and don’t forget our brand-new Infrastructure Development Asset Assessment!

- Review our step-by-step guide to successfully completing your GRESB Assessment

- ICYMI: the 2024 GRESB SFDR Assessment is now open. Learn more.

We encourage all participants to use the Pre-submission Check. In 2023, those who utilized the Pre-submission Check scored 2.9-7.4 points higher on average than those who did not, so it’s a no-brainer! You can request a Pre-submission Check as soon as the Assessments open on April 1 up until June 1. No rush; just note that there is limited availability.

Upcoming events & engagements

We received fabulous feedback about our online Assessment Q&A sessions hosted by our Member Success Team. There are still two sessions available – one for Real Estate and one for Infrastructure:

- Infrastructure Assessment Q&A | April 2, 14:00 AEDT / 16:00 NZST

- Real Estate Assessment Q&A | April 3, 14:00 AEDT / 16:00 NZST

We are egg-cited to host a webinar to help you navigate Aotearoa’s climate standards, with industry-leading speakers from Westpac, NZGBC, and Precinct Properties NZ.

- Navigating Aotearoa’s Climate Standards | April 4, 14:00 AEDT / 16:00 NZST

The GRESB Foundation is due to begin a public consultation process on building certifications in the GRESB Real Estate Standard, which applies several evaluation criteria to recognize and score building certification schemes.

- April-June 2024. Read more and sign up to provide feedback.

Exclusively for our GRESB Investor Members, we are hosting an Investor Masterclass to share knowledge about responsible investing in real estate, including using GRESB data and tools for positive screening and investee engagement.

- May 14, 10:00-11:30 | Melbourne | Register your interest

Let us know if you’re attending the RIAA Conference Australia 2024, as Ruben and I would love to catch up over a cup of coffee, tea, kombucha, or anything else they’re serving.

- May 1-2 | Sydney | Register

Webinars available on demand

We currently have two webinars available to access on demand:

- It was a joy to speak with Tamara Williams, Director of ESG at Barings Real Estate Australia about her experiences of submitting to the GRESB Real Estate Assessment. You can watch this webinar on demand by registering here.

- For our Investor Members and Partners who missed the latest GRESB update, you can watch our flash webinar (under 15 minutes) on demand.

Product launches

The GRESB team has been busy working on new product launches:

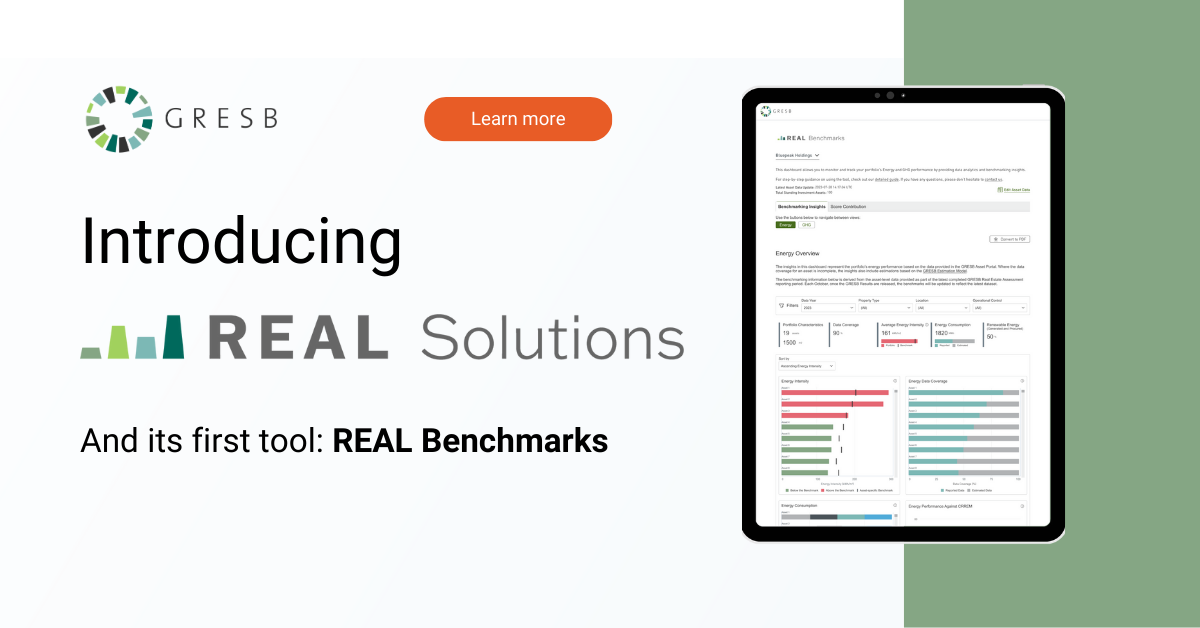

- REAL Solutions – last week, we announced REAL Solutions, GRESB’s new dynamic suite of tools designed to empower real assets managers and investors with actionable insights into the sustainability, resilience, and efficiency of their assets. REAL Benchmarks, the first tool available from the REAL Solutions product family designed for real estate managers and listed companies, will be released in April. Read more here.

- GRESB Accredited Professional (AP) Program – launched to Partners last week, and coming soon to everyone else, the GRESB AP credential distinguishes professionals based on knowledge of real asset sustainability reporting. Reach out to me to learn more.

What we’ve been talking about

We’ve been talking with many of you about several big-picture topics this month including, but certainly not limited to:

GRESB Foundation roundtable

Thank you to our Partner, JLL, for hosting our GRESB Foundation Roundtable. We brought together representatives from more than 30 different Real Estate and Infrastructure Participant Members and Partners for a lively discussion about the future of the GRESB Standards.

Our key takeaways:

- We discussed key areas of development such as net zero, materiality, building certifications, indicator retirement, and Like-for-Like scoring

- Challenges include balancing the needs of different stakeholders across the real asset industry and ensuring high data quality

- Related to emissions calculations, we discussed the ability to normalize for climate zones and occupancy rates

- Homemade Dutch brownies are now a tradition for formal GRESB stakeholder engagement events

Bummer, I missed it! If you were unable to attend and would like a fuller summary of the discussion, drop me a line and I can share the summary notes with you.

Social sustainability roundtable

We were delighted to co-host a packed room for a roundtable on the topic of investor engagement with social sustainability, alongside our Industry Partners GBCA and IWBI.

Our key takeaways:

- “Being a jerk isn’t good for business anymore”

- You can’t capture the complexity of social value/impact through metrics alone. It’s also about storytelling

- Nevertheless, investors do require comparability

- Data is good, but you need to be incredibly transparent about the methodology of how you collect, measure, and assess social value/impact

Darn it, I missed it! Get in touch and I’ll share the follow-up when available.

Materiality in the Real Estate Assessment

As per the GRESB Foundation 2024 Roadmap, the Foundation is exploring the concept of sectoral materiality in the Real Estate Assessment, beginning with the residential sector. Many thanks to our GRESB Investor Members who took the time to discuss this concept with our colleague Charles van Thiel, Director, Real Estate.

GBCA TRANSFORM

It was fantastic to see so many friendly faces at GBCA TRANSFORM and to have our Chief Innovation Officer, Chris Pyke, on the main stage as a speaker.

Our highlights:

- The incredible and complex interaction of First Nations communities with nature and ecology — how centering cities with First Nations-led design can help us live better as part of nature

- In the world of regulations, we need to ensure that standards are aligned with the green building movement. If not, we might get dragged under the train

- Untrashing the world through sustainable sunglasses truly is possible

Holy moly, I missed it! Look out for conference-related content on the GBCA website.

MECLA Roundtable

Thank you to our new Industry Partner, MECLA, for the invite to their roundtable session discussing the role of the finance sector in supporting the decarbonization of the built environment with a primary focus on reducing embodied carbon.

What you can read or listen to

After you finish the Easter egg hunt, break the fast at Eid al-Fitr, or await your Passover celebrations, make sure to check out:

Article on social sustainability

In The complexity of defining and measuring social value, I wrote about why investors are increasingly demanding reliable social impact data, prompting real estate management entities to intensify efforts to gather, report, and analyze such indicators.

Hassell & GBCA’s discussion paper on social value

Hassell and GBCA have come together for a discussion paper, Social Value in the Built Environment. We loved that it brings together global and Australian work about social value to raise awareness and that it is a very accessible document.

GBCA’s discussion paper on nature

GBCA is keeping itself busy and released a discussion paper, A nature roadmap for the built environment. The paper evaluates environmental risks and opportunities pertinent to the industry, explores innovative concepts for nature regeneration, and clarifies the collaborative roles required. Your feedback is much appreciated by both the GBCA and by Mother Nature.

Finding Nature

Check out this monthly curation from Nathan Robertson-Ball comprised of contributions from people he admires and respects who work in sustainability, ESG, and impact-oriented professions. Subscribe.

The Pulse by GRESB

The Pulse by GRESB is a new audio content series from GRESB, focusing on important topics related to GRESB and broader ESG issues within the real assets industry. Each episode is shorter than 10 minutes! You can find the series on Spotify, LinkedIn, and YouTube.

Just for fun

As a reward for reaching the end of our newsletter, let us know which 2024 GRESB Real Estate Assessment indicator you would most wish to vote off the GRESB Assessment Island!

- PO3 – Policies on governance issues

- SE1 – Employee training & development

- TC4 – Sustainability-specific requirements in lease contracts (green leases)

- Other, namely……

Vote here! We’ll let you know the results in our next newsletter.

If you’ve been forwarded this newsletter and would like to subscribe, please click here – we’re giving away a slave-free Tony’s Chocolonely easter egg to every 10th new subscriber!