Amsterdam, March 19, 2024 – GRESB, the global sustainability benchmark for real assets, proudly announces the forthcoming launch of REAL Solutions, a dynamic suite of tools designed to empower real assets managers and investors with actionable insights into the sustainability, resilience and efficiency of assets.

“REAL Solutions marks a significant milestone for GRESB. It was developed in response to the evolving needs of institutional investors and managers seeking deeper insights into the sustainability of individual assets,” said Roxana Isaiu, Chief Product Officer at GRESB. “This represents a decade-long commitment to understanding, measuring and benchmarking the real-world performance of investor-owned assets worldwide.”

Powered by aggregated asset-level data derived from GRESB’s annual real estate assessment, REAL Solutions encompasses actionable information on targets, operational performance, building certifications, energy ratings and efficiency measures, equipping investors and managers with the right tools to understand and improve asset performance.

In-depth asset-level insights and benchmarks for managers

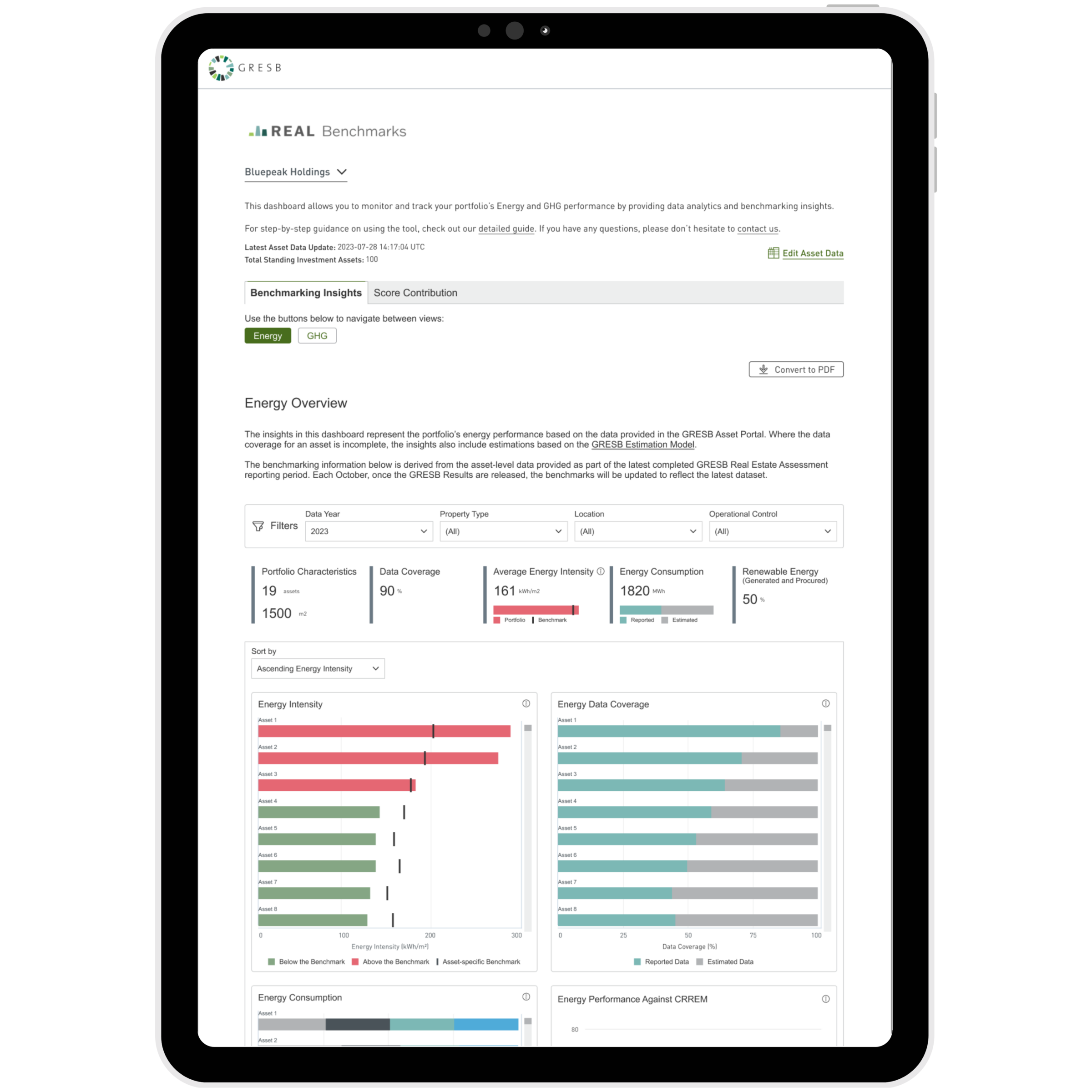

REAL Benchmarks is the first tool available from the REAL Solutions product family, which will be released in April. Designed for real estate managers and listed companies, REAL Benchmarks offers a customizable dashboard to privately and securely analyze the contribution of each individual asset to portfolio performance. The tool allows users to compare all or a filtered set of portfolio assets against a series of performance benchmarks derived from the GRESB database.

“REAL Benchmarks represents a leap forward for fund managers seeking comprehensive insights into their real estate portfolios. Recognizing the need for accurate asset-level data and tailored benchmarks to inform meaningful decisions within the portfolio, REAL Benchmarks empowers decision-makers to understand and optimize the performance of individual assets, ultimately driving positive environmental and financial outcomes,” said Sebastien Roussotte, Chief Executive Officer at GRESB.

REAL Benchmarks will be available year-round and seamlessly updates whenever data is edited in the GRESB Asset Portal. Over time, the dashboard will incorporate new functionalities for advanced analysis and simulation.

Setting the bar for sustainable investor-owned real estate

In addition to delivering actionable benchmarking insights for managers, REAL Solutions is setting the bar for sustainable investor-owned real estate – providing unprecedented insights into the performance of the best real estate across the globe.

Drawing on an aggregation of the measured, real-world performance of investor-owned property from the GRESB database, REAL Solutions shows median consumption for:

- Energy: Industrial, 64.4; Office, 152.6; Residential, 120.4; Retail, 214.5 (kWh/m2)

- Water: Industrial, 120.4; Office, 327.2; Residential, 1,073.9; Retail, 524.2 (liter/m2)

- Waste: Industrial, 3.5; Office, 3; Residential, 7.9; Retail, 8.9 (kg/m2)

Notes to editor: GRESB will be releasing more detailed global benchmark figures in the coming weeks and months.

REAL Statistics for financial institutions

Developed specifically for financial institutions, REAL Statistics is a global dataset covering energy and GHG intensity values and trends. When launched, REAL Statistics will provide aggregated asset-level ESG data points that are organized into 11,000 unique combinations of property type, electricity grid, location and climate zones.

Subscribers to REAL Statistics will be able to select from a range of performance indicators, including average, median and key thresholds, such as the top 15% of assets. The data is aggregated and not attributable to individual assets, funds or companies.

Learn more about REAL Solutions at gresb.com/REAL-Solutions.

About GRESB

GRESB is a mission-driven and industry-led organization providing standardized and validated Environmental, Social, and Governance (ESG) data to financial markets. Established in 2009, GRESB has become the leading ESG benchmark for real estate and infrastructure investments across the world, used by 150 institutional and financial investors to inform decision-making.