In Q4 2022, GRESB conducted an Investor Member Survey to explore how investors use GRESB data and how they engage with their managers and portfolio companies. See the survey results and takeaways below.

Key Findings

- A significant majority (75%) of surveyed investor members report actively engaging with their managers to request participation in the annual GRESB assessments, with approximately one-third of investor members requiring mandatory participation.

- All survey respondents report having a responsible investment strategy in place, with ESG integration and corporate engagement and shareholder action emerging as the most commonly used approaches.

- Around two-thirds of surveyed investor members use GRESB results and benchmarks as an engagement tool with their managers, and almost half of respondents use the data to analyze the environmental footprint of their overall portfolio.

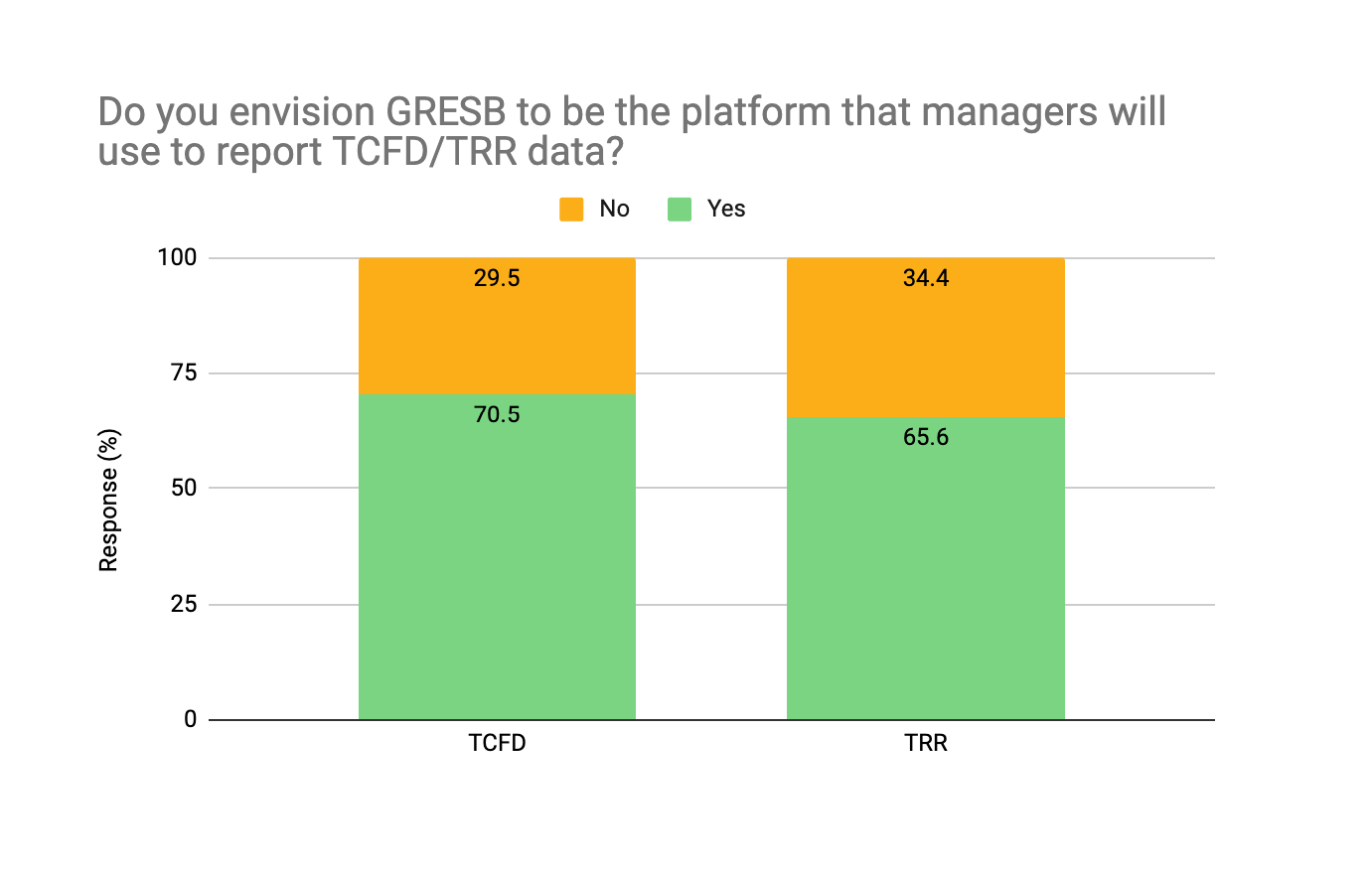

- The vast majority of respondents believe that GRESB will be the platform of choice for managers to report on climate-related financial disclosures and transition risk data.

Participation

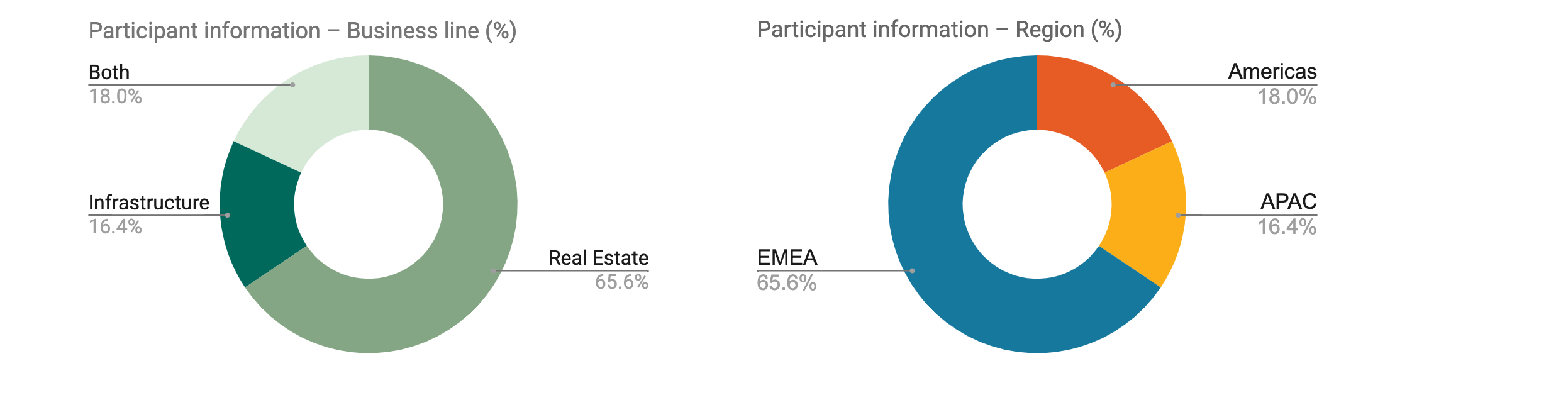

The survey features responses from 42% of the GRESB investor member base, for a total of 61 respondents. The majority of respondents represent investor members with access to the real estate dataset and with headquarters in EMEA.

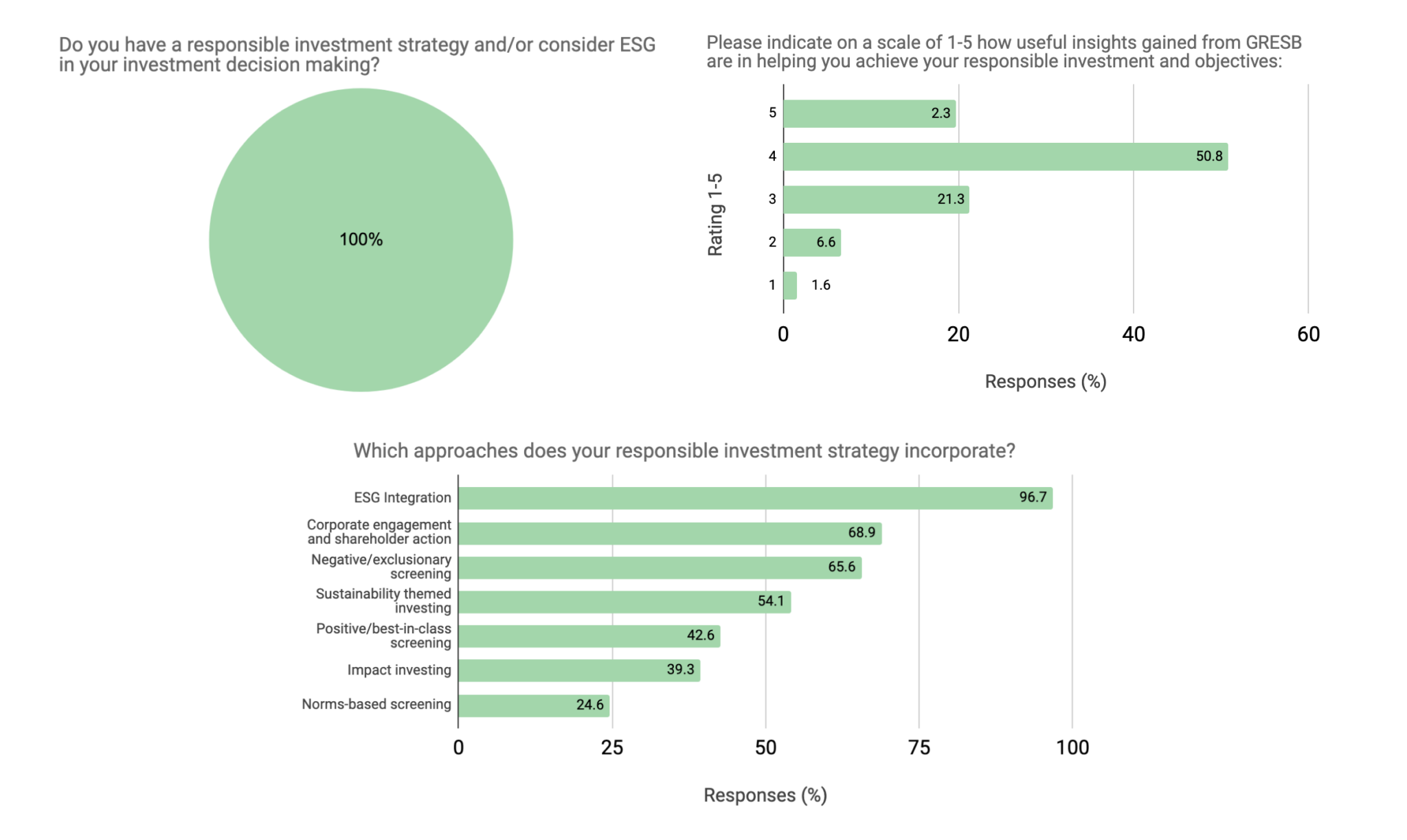

Responsible Investment Strategy

All survey respondents report having a responsible investment strategy in place, with ESG integration and corporate engagement and shareholder action emerging as the most commonly used approaches. The majority of respondents also believe that insight gained from GRESB helps them achieve their responsible investment goals.

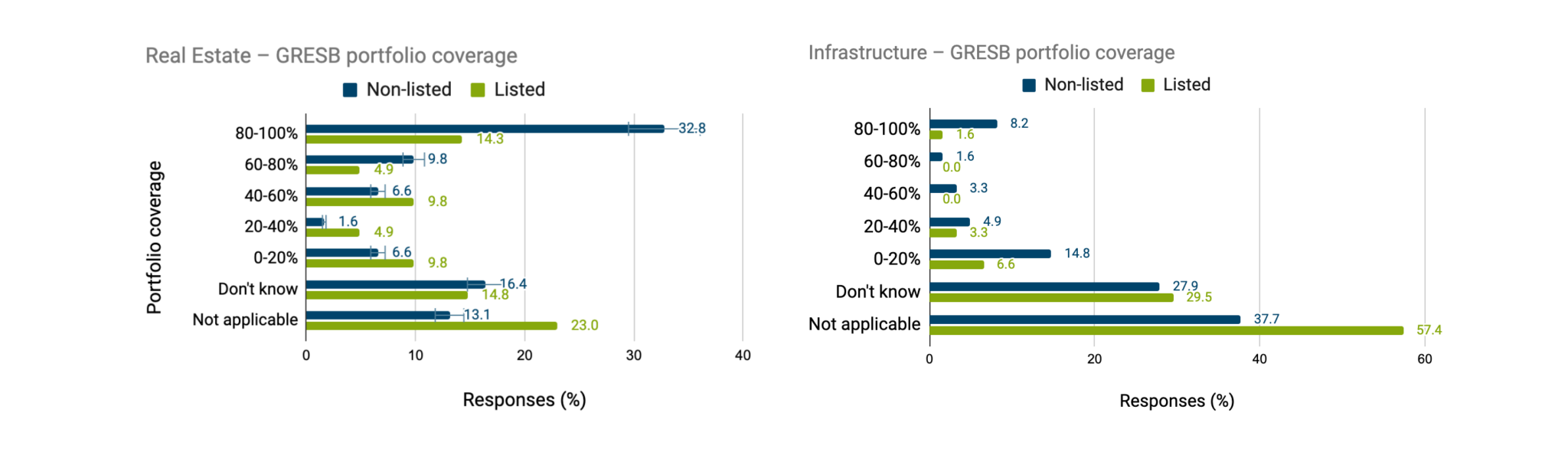

GRESB Portfolio Coverage

The survey shows that GRESB portfolio coverage for investor members is comparatively higher for real estate than it is for infrastructure.

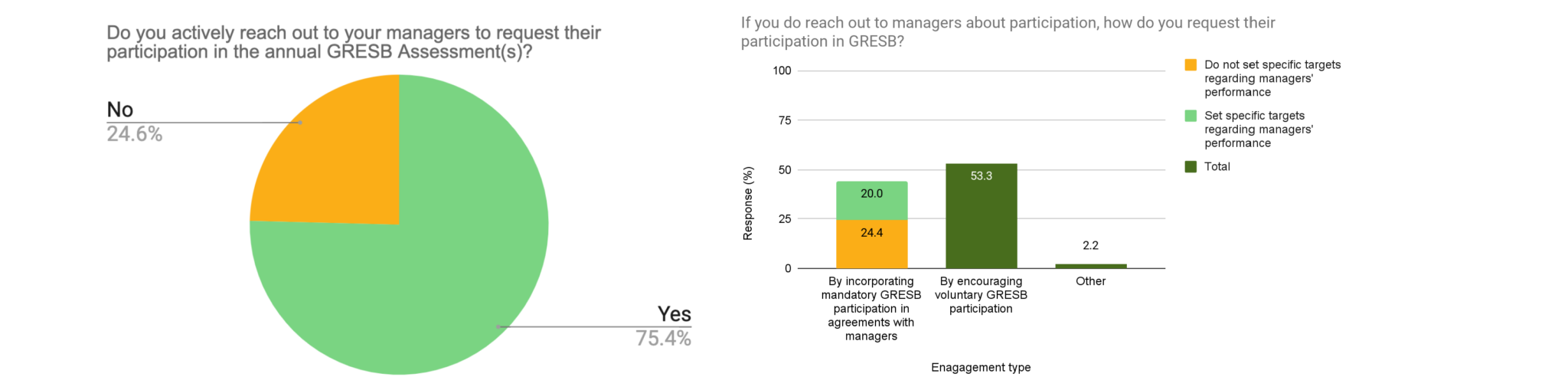

Engagement with Managers

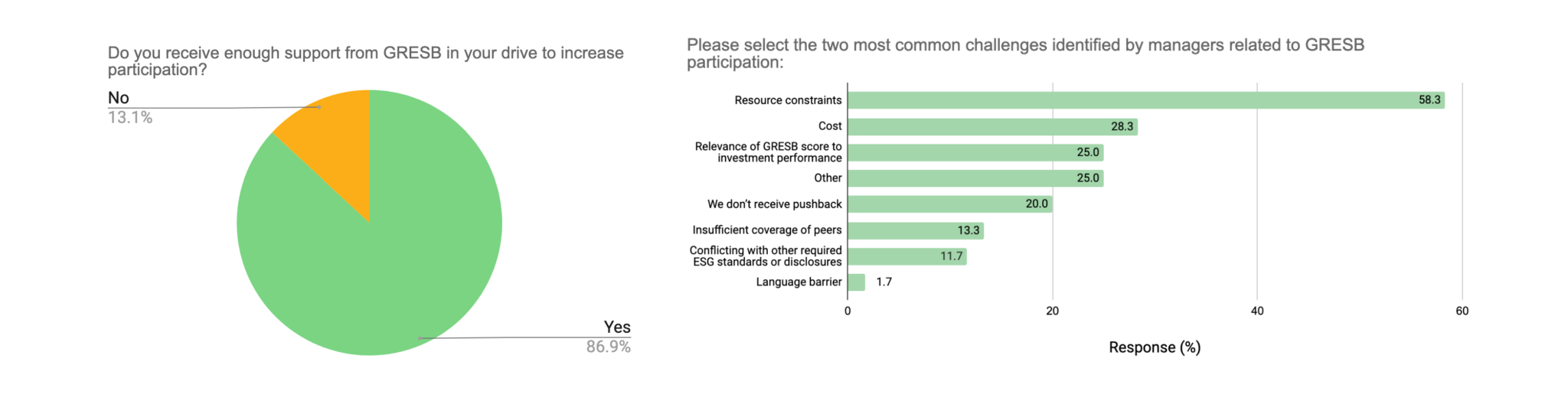

The survey largely demonstrates a high level of engagement between investors and managers, with 75% of investor members actively engaging with their managers to request participation in the annual GRESB assessments. Of these, 53% encourage voluntary participation and 44% incorporate mandatory participation in their agreements. Of those who make participation mandatory, the majority also sets specific targets regarding the GRESB performance of their investments.

The majority of investors feel that they receive enough support from GRESB to increase participation across their portfolio. The survey also reveals that the most common challenges identified by managers regarding their GRESB participation are tied to managers’ resource constraints and costs.

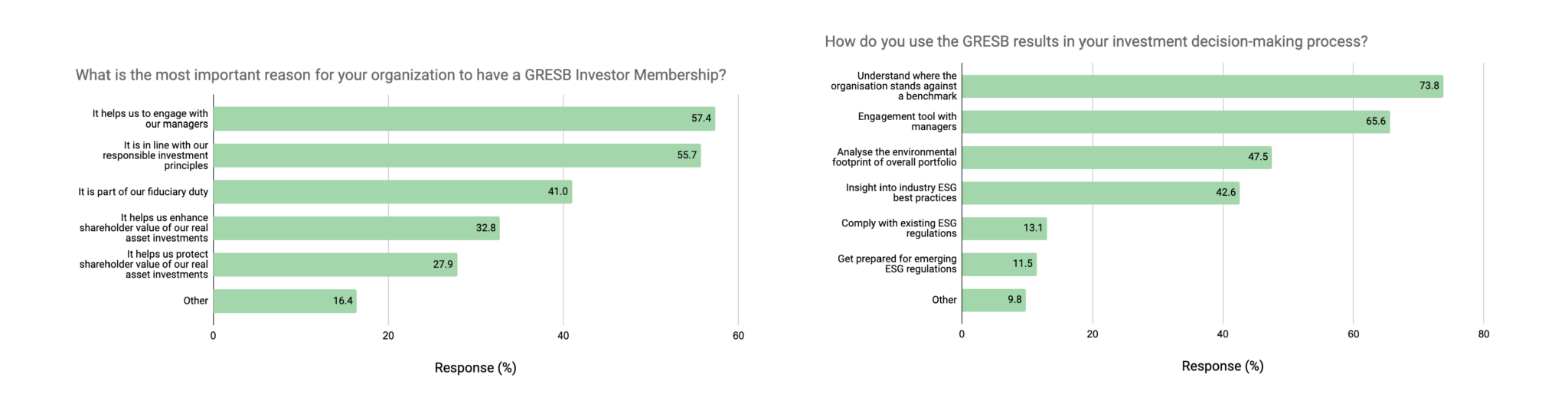

GRESB Membership

Most investors report joining GRESB because of the alignment of the framework with their responsible investment principles and because it helps them engage with their managers. Specifically, GRESB results and benchmarks help investors understand where their investments stand and monitor how managers are managing ESG risks, opportunities, and impact.

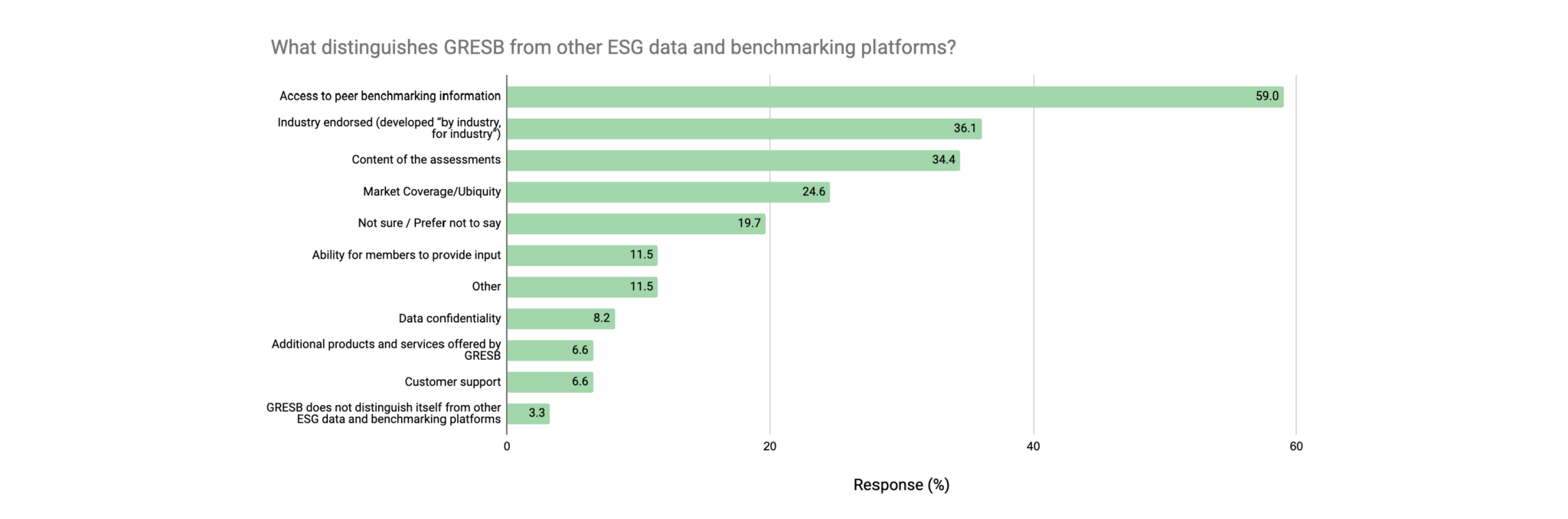

The survey also highlights that access to peer benchmarking information distinguishes GRESB from other benchmarking platforms, according to 59% of respondents. In addition, 36% of respondents also find that industry endorsement distinguishes GRESB from other benchmarking platforms.

Investor Member Tools

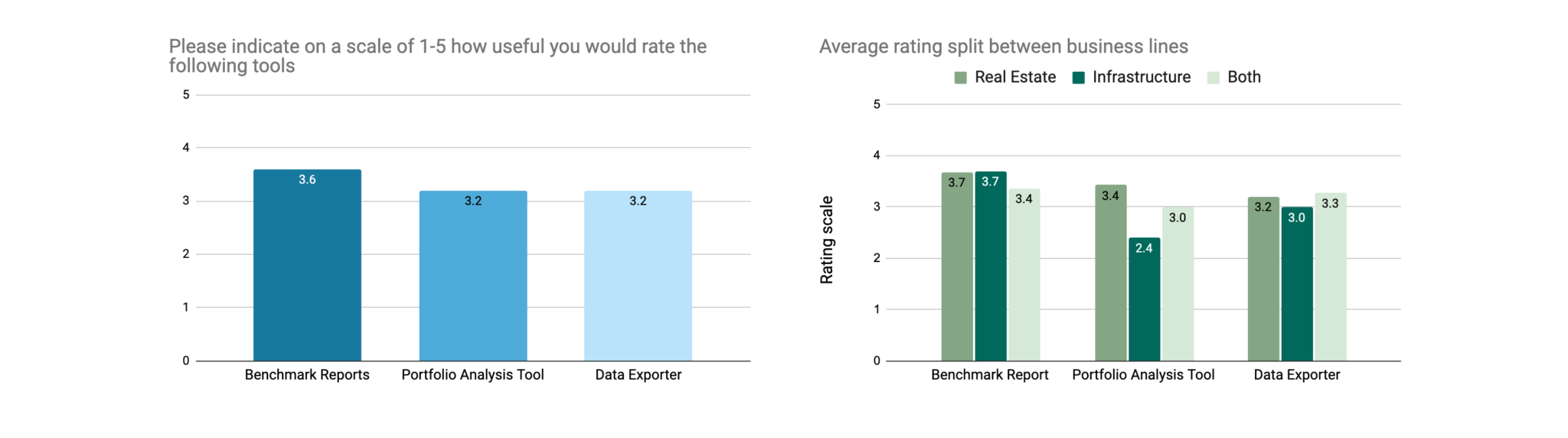

Out of all investor member tools and core products, respondents rated the Benchmark Report the highest, with the Portfolio Analysis Tool (PAT) and the Data Exporter receiving a rating 0.4 points lower than the Benchmark Report.

The most frequent feedback received from respondents regarding the PAT is that it is most insightful when investors’ portfolio coverage is sufficiently high. Additionally, the potential reason why the average rating for the investor member tools is neither particularly high nor low could be attributed to the fact that many respondents indicated that they don’t use all of the tools.

New Products: TCFD and Transition Risk

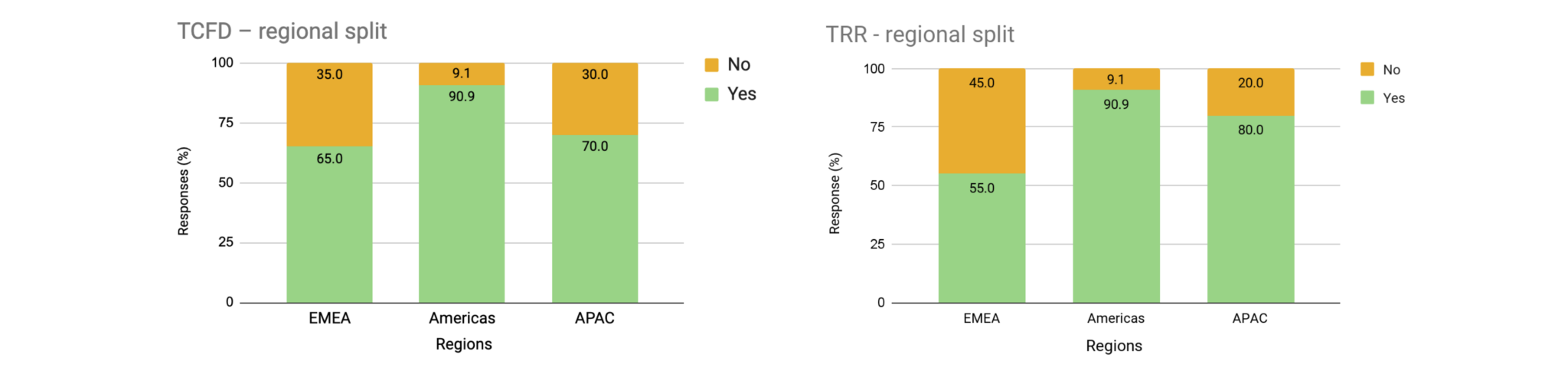

The vast majority of respondents believe that GRESB will be the platform of choice for managers to report on climate-related financial disclosures and transition risk data, with respondents in the Americas largely endorsing the TCFD Alignment Report and the Transition Risk Report.

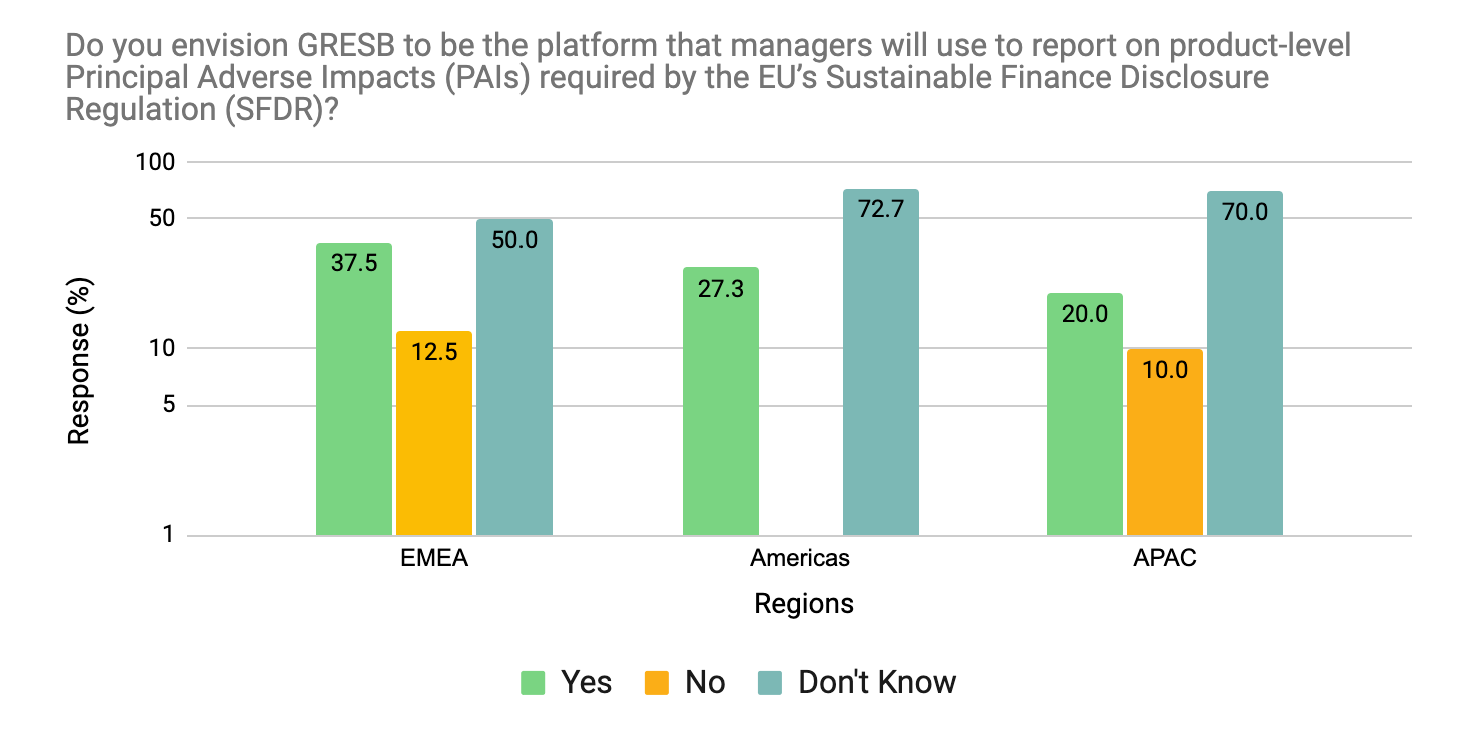

On SFDR (the EU’s Sustainable Finance Disclosure Regulation), survey respondents highlighted general uncertainty on the degree that GRESB will be the platform to report on product-level Principal Adverse Impacts. This may become more clear now that the first reporting year has started.