Solve the climate risk puzzle with Conservice

Read more

Another step towards green transition: EU’s deforestation regulation

Read more

The real-world parallel of “The Matrix”: loss of biodiversity

Read more

Navigating climate risk management: Strategies and steps for real estate organizations

Read more

Demystifying climate risk and the TCFD recommendations

Understanding your organization’s climate-related risks and opportunities has never been more critical. The most recent report from the UN’s IPCC on Climate Change Impacts, Adaptation, and Vulnerability is a review of climate impacts and how much we can adapt to them.

Read more

Taking a Proactive Approach to Managing Climate Crisis

A blow from increased novel coronavirus fears sent both financial market and stability into freefall. With the outbreak of the COVID-19 pandemic, daily necessities are becoming scarce because of the fear of supply chain disruptions. We now confront a key question: Is this the new market trend?

Read more

Why Decarbonization Strategies have the potential to transform the real estate market

The two central pieces of the Paris Climate Agreement, limiting the average global temperature rise to 1.5°C and becoming a carbon neutral economy by 2050, are starting to hit the real estate industry

Read more

Flood Risk and Climate Change: England Flood Planners must prepare for the worst?

Developers and investors must consider the risk of flooding to the development design, planning and investment process at the earliest opportunity to help inform the decision-making process. Early engagement with the Environment Agency (EA), local authorities and environmental consultants (such as Delta-Simons who specialise in flood risk and climate change for developers, occupier and investors) will ensure that the masterplan design includes suitable, viable and cost beneficial mitigation measures. By not considering climate change during the early stages of design and during the planning process, from a flood risk perspective, the risk of the planning application being objected to or occupiers being unwilling to sign leases increases along with potential delays to timescales due to reworking and spiralling costs.

Read more

Strengthening Urban Resilience through Managing Risks and Grasping Opportunities

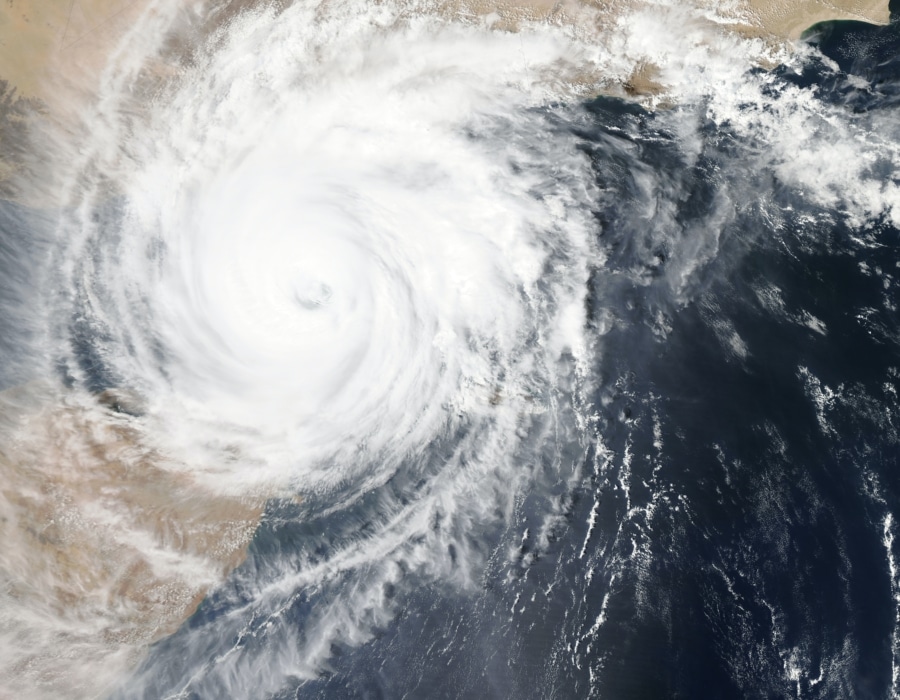

Without doubt, climate change has posed a fundamental threat to urban development around the world. Frequent adverse weather events and intense typhoons happening in many countries have drawn the attention of sustainability and green building professionals to the need for identification of climate-related vulnerabilities in their cities. Apparently, it is high time for us to strengthen the cities’ resilience through design, construction and operation of green buildings as well as investment in climate-resilient infrastructure.

Read more

Future Proofing our Built Environment

There are five global mega trends shaping the way that we are currently living, how we respond to them now determines how we are going to live into the future. These mega trends are affecting all aspects of our lives, from the food we eat to the technology running our cities, each carrying with them their own risks and opportunities.

Read more

Resilience Trends in Real Estate

Due to the increased severity and frequency of climate disasters, real estate investors are showing urgent concern for the risks that climate change is posing to their assets, turning their attention to resilience planning for their real estate portfolios as a top priority. Rapid strides are being made within the resilience landscape, with increasing adoption of the Task Force on Climate-related Financial Disclosures (TCFD) standards for financial disclosure in corporate climate reporting, along with the Global Real Estate Sustainability Benchmark (GRESB) Resilience Module, recently updated in 2019 to align with TCFD’s recommendations.

Read more

A practical approach to assessing and managing physical climate change risks in global portfolios

Every day it’s impossible to avoid learning about another catastrophic climate event in mainstream media. Extreme weather can destroy properties and valuables, threaten lives and cripple businesses. The Financial Stability Board has deemed climate change a risk to the global financial system and launched the Task Force on Climate-related Financial Disclosures (TCFD) to guide companies on how to disclose climate-related risks, opportunities and financial impacts.

Read more

Why we should care about climate resilience

As the effects of climate change on economic activity become more significant, there is increasing demand from investors, trustees and other fiduciaries for consistent, comparable, actionable information in company reports. Investors increasingly expect Boards and Executives to actively assess and respond to climate risks.

Read more

Tackling TCFD: Early Lessons in Climate Risk Disclosure

Recognizing the need to better understand and disclose risks associated with climate change, several industry initiatives have started to incorporate climate risk and resilience questions into reporting frameworks. In particular, the Financial Stability Board (FSB) Task Force on Climate-Related Financial Disclosures (TCFD) seeks to stimulate market dialogue and increased transparency on climate-related risks by providing information to investors, lenders, insurers, and other stakeholders.

Read more

2019 will be the year of adaptation to climate change: the French perspective

Decreasing energy consumption (of buildings in particular) is one of the major priorities of energy and climate policy in France following the Paris Agreement in 2015. This decrease considers all activity areas, especially real estate, which accounts for a large share of French carbon emissions (27%). With its first “Low Carbon National Strategy”, France is […]

Read more

Climate resilience and the search for ‘zero carbon’: Trends and expectations for sustainable real assets in 2019

The challenge of improving the sustainability of real estate portfolios is not new. However, the increasing pressure from investors, certification bodies and other industry drivers is creating a wave of change toward portfolios that can demonstrate increasingly resilient and efficient asset performance. Furthermore, a growing desire for occupants to have real time access to building […]

Read more

What to expect from China’s real estate industry in 2019

ESG as a global vision has enhanced compliance and reporting standards Sustainability is not rocket science yet the rapid global sustainability demand has encouraged overwhelmingly stringent laws and regulations from governments and investment institutions in 2018. The bell rings again for companies to step up their ESG disclosures in 2019. According to the EY Global […]

Read more

Trends and expectations for sustainable real assets in 2019: Taking Climate Resilience Mainstream

Climate resilience has emerged as a key field of practice; however, a concern is that thinking and knowledge of this topic, and most importantly actions are not progressing quickly or purposefully enough for real estate managers to adequately prepare their assets for the potentially perilous shocks and stresses caused by climate change. Resilience is becoming […]

Read more

Towards zero – a targeted approach

The Intergovernmental Panel on Climate Change’s recent report gave a stark warning that current pledges from governments are not enough to avoid dangerous levels of climate change. In order to avoid this, we need to be aiming for a maximum of 1.5 degrees of warming above pre-industrial levels. Current INDCs (Intended Nationally Determined Contributions) to 2030 mean that […]

Read more

Performance Targets and Climate Related Risks: KPIs Real Estate Companies Need to Track

There are growing concerns in the sustainability space over physical asset risk identification and mitigation, and transitional risks – not just due to policy and compliance, but reputational risk by not keeping up with the actions of peers. These concerns coupled with investor pressures (see TCFD), give the topic of climate-related financial risk two legs […]

Read more