Due to the increased severity and frequency of climate disasters, real estate investors are showing urgent concern for the risks that climate change is posing to their assets, turning their attention to resilience planning for their real estate portfolios as a top priority. Rapid strides are being made within the resilience landscape, with increasing adoption of the Task Force on Climate-related Financial Disclosures (TCFD) standards for financial disclosure in corporate climate reporting, along with the Global Real Estate Sustainability Benchmark (GRESB) Resilience Module, recently updated in 2019 to align with TCFD’s recommendations. Both standards empower real estate and infrastructure organizations to create strategies to prepare for disruptive events and conditions, assess long-term trends and become more resilient over time.

Global Resilience Landscape

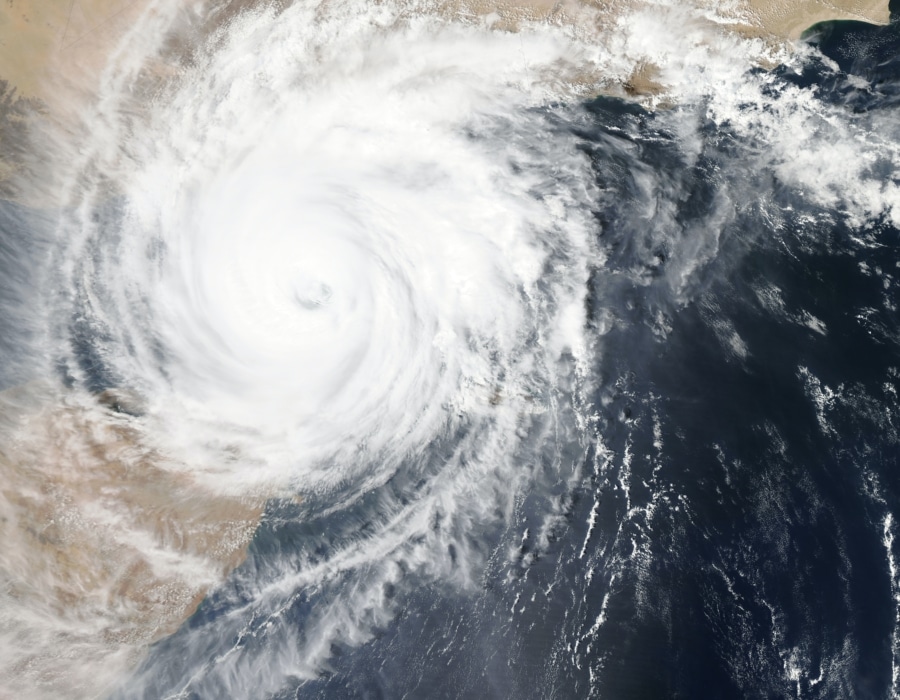

The GRESB Resilience Module defines resilience as “the capacity of companies and funds to survive and thrive in the face of social and environmental shocks and stressors.” Indeed, the stressors facing the world are escalating exponentially as climate change is shifting weather patterns in unpredictable ways. As of April 2019, the U.S. had experienced over 246 natural disasters since 1980 with losses totaling $1.69 Trillion. Climate change is already influencing real estate markets, with properties exposed to sea level rise in the United States selling at a seven percent discount to those with less exposure. Specifically, within U.S. markets, the cities facing the largest resilience challenges due to sea level rise include New York, Miami Beach, Honolulu, Boston, Ft. Lauderdale, Miami, and Newport Beach, San Mateo, Hilton Head Island, and Huntington Beach.[i] Aggressive resilience plans must be made for the upcoming challenges we face.

Global Resilience Timeline

- 2013: 100 Resilient Cities was founded by The Rockefeller Foundation

- 2014: NOAA developed the U.S. Climate Resilience Toolkit

- 2014: The Institute for Market Transformation to Sustainability (MTS) adopted the RELi resilience rating system

- 2015: Verdani Partners started performing risk assessments for its real estate client

- 2017: TCFD released recommendations on climate risk and resilience reporting

- 2018: GRESB released its Resilience Module

- 2019: Four Twenty-Seven developed a framework for assessing local adaptive capacity

- 2019: RELi 2.0 – USGBC and MTS launched RELi 2

Resilience Reporting Trends

In June of 2017, the TCFD released a report that outlined a clear and consistent framework for corporate climate reporting, providing an opportunity for companies to assess how climate change will affect their business. As of March 2019, more than 600 organizations from around the world had expressed support for the TCFD recommendations. In 2018, GRESB released its first Resilience Module and, in 2019, updated this module to align with TCFD’s framework, further establishing TCFDs as one of the leading tools to help lenders, insurers, and investors better understand and plan for climate-related risks.

What TCFD Recommendations Mean for Resilience

As stakeholders across the spectrum consider resilience, having access to the right information to determine risks becomes ever more essential. The TCFD initiative is critical because it responds directly to the need for adequate information to manage risk that threatens global financial stability. Dr. Nigel Sleigh-Johnson, Head of Financial Reporting for ICAEW stated, “We believe that support of G20 governments and the distinctive approach adopted by the TCFD – focusing on communication of the financial impact of climate change on the reporting organization – mean that the recommendations could act as a catalyst for significant improvement in the quality and consistency of disclosures and governance in this area.[ii]”

Resilience Strategies for Real Estate

In order to protect their physical, social and economic investments, real estate portfolios are taking the necessary steps to understand and mitigate risks and adapt to a changing climate. Key steps include (1) conducting a detailed TCFD-aligned portfolio risk assessment for building and regional-level risks categorized into transition, social and physical risks, (2) adopting resilience policies and strategies, (3) creating disaster preparedness plans to mitigate material risks, and (4) benchmarking their resilience capacity (GRESB) and prepare climate-related financial disclosures (TCFDs). Sustainability consultant, Verdani Partners, implements resilience programs for real estate portfolios, integrating a TCFD framework into their process (see diagram below). Verdani’s assessment of over 50 different risk indictors includes sea level rise scenarios and impacts according to the IPCC emission pathways to help their clients understand and prepare for different sea level rise events. Their programs helped two of their clients, Jamestown and Parkway, achieve a perfect score of 100 on GRESB’s 2018 Resilience Module.

Conclusion

Having better access to risk management information, such as TCFD aligned reporting data, opens new possibilities for resilience planning at even larger scales. Cities like New York, for example, are creating public/private partnerships to better address sea level rise and flooding in coastal areas. Other cities are introducing programs to protect open spaces, creating resilience officer positions, integrating local food production, and investing in technology to reduce dependence on fossil fuels. These efforts not only increase resilience to climate risks, but also allow cities to slow down climate change. According to Marshall Burke of Stanford University, “The estimated cost of meeting the toughest 1.5C climate target is about $0.5 [trillion] over the next 30 years but will save the world $30 [trillion] in damage.” Proactively implementing resilience measures will not only protect from future disasters, but will also help reduce their severity as well, all of which are essential to moving us towards a livable future.

About Verdani Partners

Verdani Partners is a leading full-service

sustainability consulting firm with over 20 years of experience in sustainable

real estate. Managing sustainability programs for over 550 million square feet

of real estate across 4,250 properties in 11 diversified portfolios

representing $275 Billion AUM, Verdani’s mission is to empower organizations

with cost-effective strategies to create sustainable and resilient buildings

and communities. Their leading Building Resilience program focuses on key

strategies for identifying and mitigating building and regional-level risks for

real estate portfolios.

This article is written by Daniele Horton, Andrea Paul, and Chika Acholonu; and edited by Lindsay Clark and Paulynn Cue

[i] Based on new analysis (Nov. 2018) and maps that pair Zillow’s housing data with Climate Central’s climate-science expertise, these are the U.S. cities with the most property, by dollar amount, at risk from sea level rise if we continue on the current path of greenhouse gas emissions. Retrieved from https://www.zillow.com/research/ocean-at-the-door-21931/

[ii] ICAEW, In Association with The Carbon Trust. (2019). Retrieved from https://www.icaew.com/-/media/corporate/files/technical/financial-reporting/tcfd.ashx