Our industry is engaged in an important dialogue to improve the efficiency and resilience of real assets through transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Achieving and maintaining strong data coverage remains an annual challenge for real estate owners, operators, and occupiers. Typically, companies can easily obtain information for buildings and utilities supplies relating to their own operations, which they are responsible for (e.g., landlords and occupiers). However, where tenants directly procure their own utilities, landlords will not automatically have visibility of this without engagement efforts. This can create significant challenges for portfolios with low levels of operational control. Asset classes such as industrial and residential are often impacted by this more than others due to the nature of leases, such as fully repairing and insuring (FRI) or triple net (NNN).

While we all understand and appreciate the importance of data privacy, being able to access ESG data belonging to tenants holds significant importance in the context of decarbonizing real estate, as this supports:

- Insights: Gaps in data can result in non-representative trends, which can reduce the impact of analysis. While data gaps can be filled with estimations, this is inherently inaccurate by nature. Without actual data, there is no way of knowing the true impact of a building within a wider portfolio.

- Action: In order to make effective and impactful decisions, a complete picture is required to understand if/where underperformance is being observed. This includes identifying what interventions are appropriate and where these are needed most urgently, which is critical for decarbonization to achieve net zero.

- Reporting: Incomplete reporting provides less transparency to stakeholders around the overall impact of a business and its operations. This could also reduce attractiveness to investors, due to the challenges in benchmarking performance.

Inability to access and leverage this data can create a variety of barriers and ultimately result in risks, which businesses must carefully navigate.

Technological solutions using data aggregators and automation

There are a variety of solutions to address the challenge that obtaining data and maintaining coverage present. The most common of which include tenant engagement and green leasing. However, whilst these can be effective measures, they present a number of challenges. There is no guarantee that engagement efforts will result in sharing of data, and companies may not be willing to renegotiate green clauses into their leases or may already hold leases with long expirations multiple years into the future.

As always, technological innovation is prevailing in the form of data aggregators and automation. Within the UK, there are now a number of companies operating, such as Arbnco, which facilitate access to supplier specific information from the national energy grid via the “Legitimate Interest” process. This enables access to supplier-specific data, which provides a variety of advantages, such as increased data quality and accuracy due to information being captured and automated from the source.

Following meter mapping, the previous calendar year of data can be accessed down to a meter level within buildings, subject to the number of meters/tenants and authorization where required. This data can then be aggregated to an asset or portfolio level, providing a high-impact and low-effort solution that can result in significant increases in data coverage and quality, making 100% data coverage an achievable goal. For complex portfolios and targeted initiatives, these programs can in turn then be integrated into wider technology stacks and data platforms where required, enabling companies to complement their existing data management protocols and select the scale at which they want to implement this.

Case Study 1 | How can data aggregators and automation impact data coverage and sustainability benchmark performance?

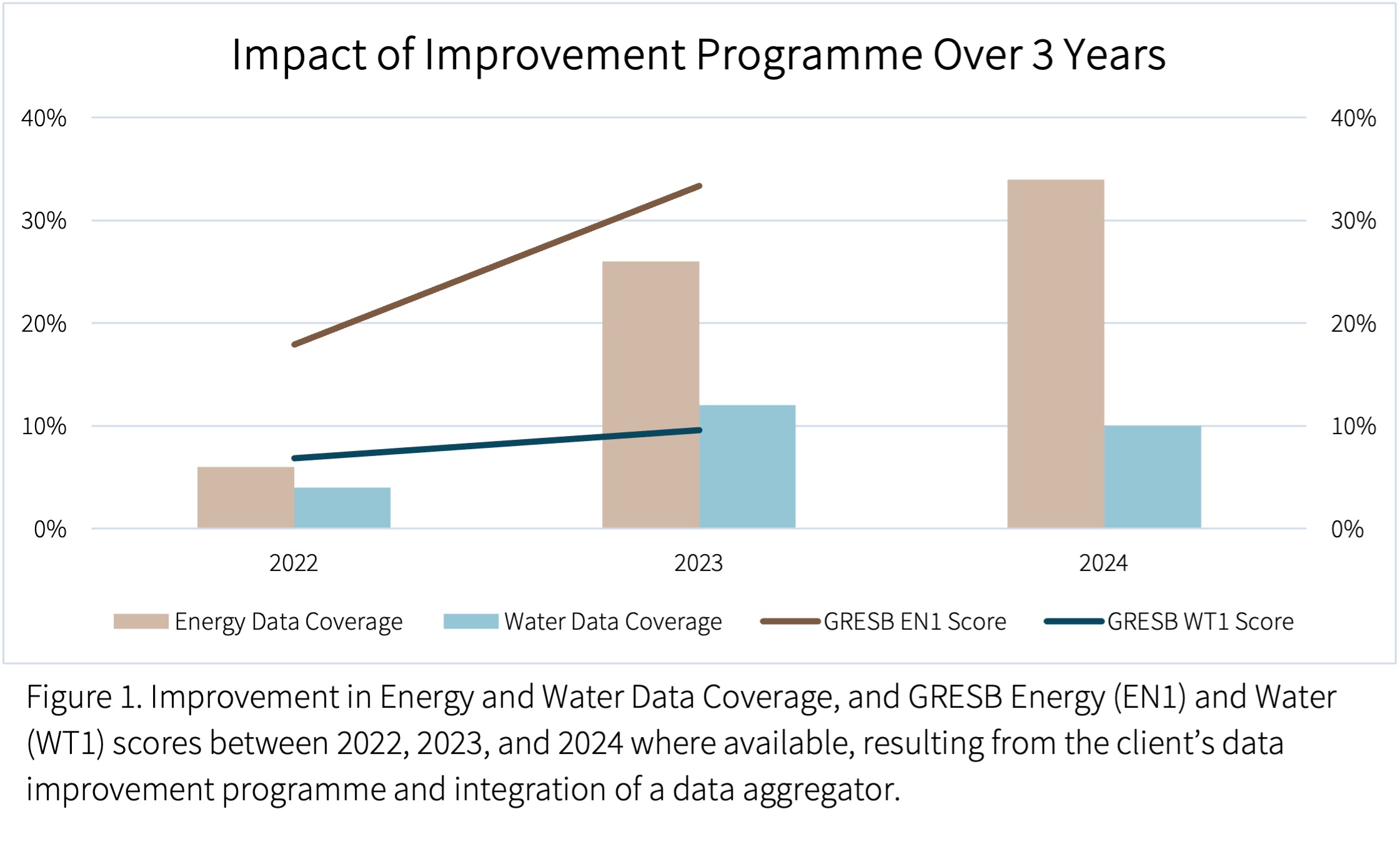

JLL’s client, a diversified portfolio weighted towards industrial warehouses, was achieving low data coverage. The client wanted to improve and enhance their reporting and performance insights, as well as increase their GRESB scoring, which was being weakened by this. A tenant engagement plan was established in 2023 to target direct requests to tenants, which was combined with the integration of a data aggregator to automate the process for energy data with a view to preventing the need for such extensive ongoing engagement. Progress was monitored to ensure effectiveness, with 2022 used as a baseline, and the results are presented in the table below.

The program delivered strong results in 2023 for data relating to both energy and water, which also saw a corresponding increase in GRESB scoring for the respective indicators (EN1 and WT1) as presented in the graph. The largest step-up observed was in energy data coverage, as a subset of meters that did not require authorization were initially targeted. This result was despite only being able to access data for 6 months of the reporting period, due to the time of implementation. Responses to direct tenant outreach also supported boosting water data coverage.

Whilst further improvements were achieved through the data aggregator for 2024 energy data, largely driven by the fact that data acquisition was now automated for the full reporting period and expansion into targeted meter authorization was being leveraged, water remained relatively consistent year-on-year.

While the GRESB scoring associated with the clients’ 2024 data will not be available until October 2025, it is anticipated that there will be a continued score improvement achieved for energy.

Case Study 2 | What insights can data aggregators and automation provide for portfolio analysis?

JLL’s client engaged with a data aggregator to increase data coverage across multiple funds, which consisted largely of tenant-controlled buildings. After data was acquired, reviews were conducted to establish comparisons and identify differences in instances where estimations were previously being made.

This process uncovered some extreme variances, whereby one asset, which was previously benchmarked, saw an EUI increase of 2262%. The significance of the tenant operating a manufacturing plant had previously not been evaluated or considered as it was unknown, which resulted in large underestimations in data. This improvement in data quality now meant that the assets individual consumption comprised over 50% of the total for the fund. The other asset’s within the same fund, which were also distribution warehouses, also saw an average increase from their benchmarked EUI of 35%. This improved the wider understanding of the portfolio and allowed for targeted scrutiny at an asset level, enabling insights beyond what had previously been possible.

Whilst this may not have been an expected or desired outcome, the insights from obtaining this data enabled the client to gain a clear understanding of how best to prioritize its assets and where to direct focus. Although no action has been taken yet, the client can now make more strategic decisions around future leases, asset improvements, and wider sustainability considerations.

Final thoughts

The challenges of data coverage and quality continue to persist in 2025, impacting real estate owners, operators, and occupiers’ abilities to accurately report on their performance and derive sufficient insights to accelerate decarbonization efforts. Unavailability of data can also prevent targeted action and create blind spots from “unknow unknowns,” resulting in increased business risks if not addressed.

There are various means to resolve this issue, but the technological innovation of data aggregators and automation provides streamlined solutions with low effort required following setup. Whilst this is largely of benefit to the UK market currently, there is strong potential for expansion across other geographies, which will create significant value and help to drive progress towards net zero ambitions and targets.

This article was written by Robert Moore, Associate Sustainability Consulting EMEA and Jack Roy, Senior Consultant Sustainability Consulting EMEA. Learn more about JLL here.