Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

The world of ESG reporting has looked a lot like a game of Pac-Man lately as reporting entities converge with the goal of one ESG framework to rule them all. While ESG professionals like us are on the edge of our seats awaiting the winner and crossing our fingers for one standard, we must continue to work with the systems and frameworks we currently have.

Thankfully, in commercial real estate (CRE), GRESB has long been recognized as the go-to platform for reporting and aligning with ESG frameworks. Cutting through some of the noise, it provides a comprehensive ESG framework focused on the key topics and metrics important to investors and the market.

Why is GRESB a standout reporting framework for CRE, and how can companies use it to benchmark their performance against peers and uplevel their ESG program? Let’s get into it.

Advantages of GRESB

GRESB aligns to and includes many other frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD), Global Reporting Initiative (GRI), Science-Based Targets Initiative (SBTi), United Nations Principles for Responsible Investment (UN PRI), and the Sustainable Finance Disclosure Regulation (SFDR). While reporting to GRESB may not satisfy all requirements of these other frameworks or regulations, GRESB has also developed separate assessments and reports to help companies understand their level of compliance and areas of improvement.

In addition to providing investors with standardized, comparable ESG information, the GRESB framework can serve as a powerful tool when creating or enhancing a company’s overall ESG strategy. Many investors now mandate certain levels of ESG performance, including reporting to GRESB and earning four or five stars. Aligning an ESG program to GRESB from the beginning not only positions companies to perform well on GRESB, but also positions them to comply with other regulations, stay competitive with peers, and ensure all relevant ESG topics are addressed in their programs.

Prioritizing ESG strategies with GRESB

One core challenge companies across all industries face is how to narrow down the many ESG topics to what is most important to their company’s business and stakeholders. At Stok, we address this question in four activities (example):

- Conducting a gap assessment

- Conducting a materiality assessment

- Analyzing relevant frameworks and regulations

- Reviewing peers’ practices

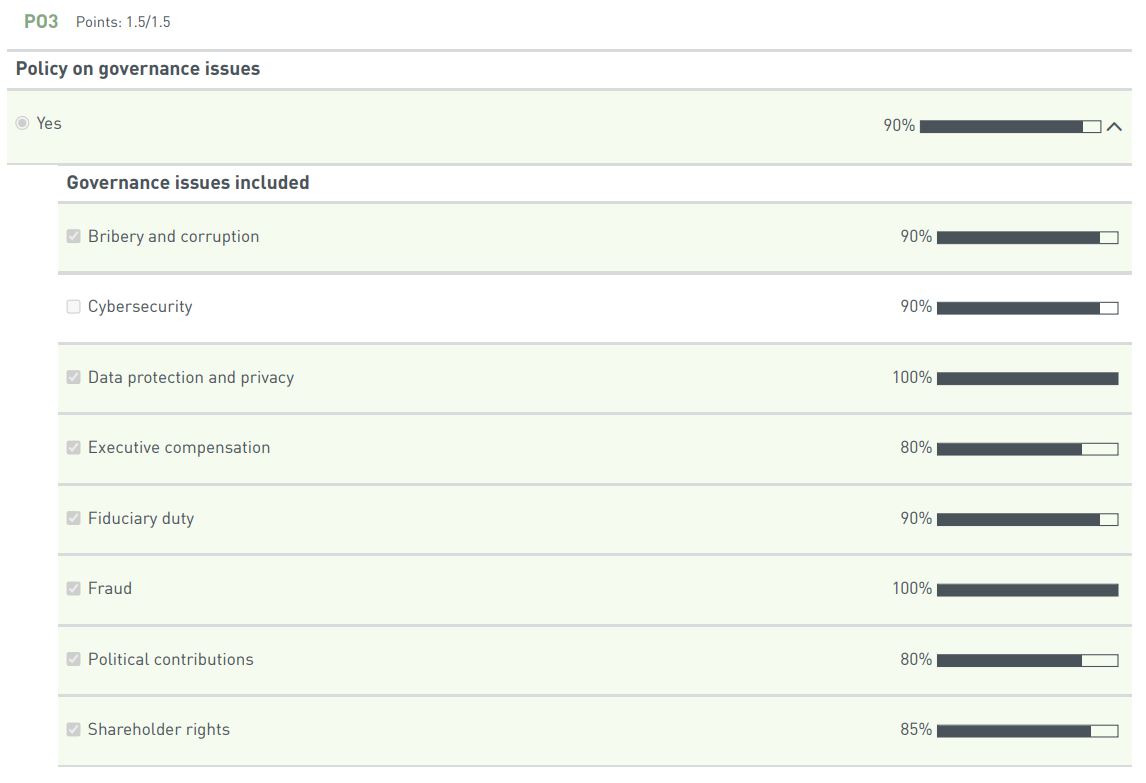

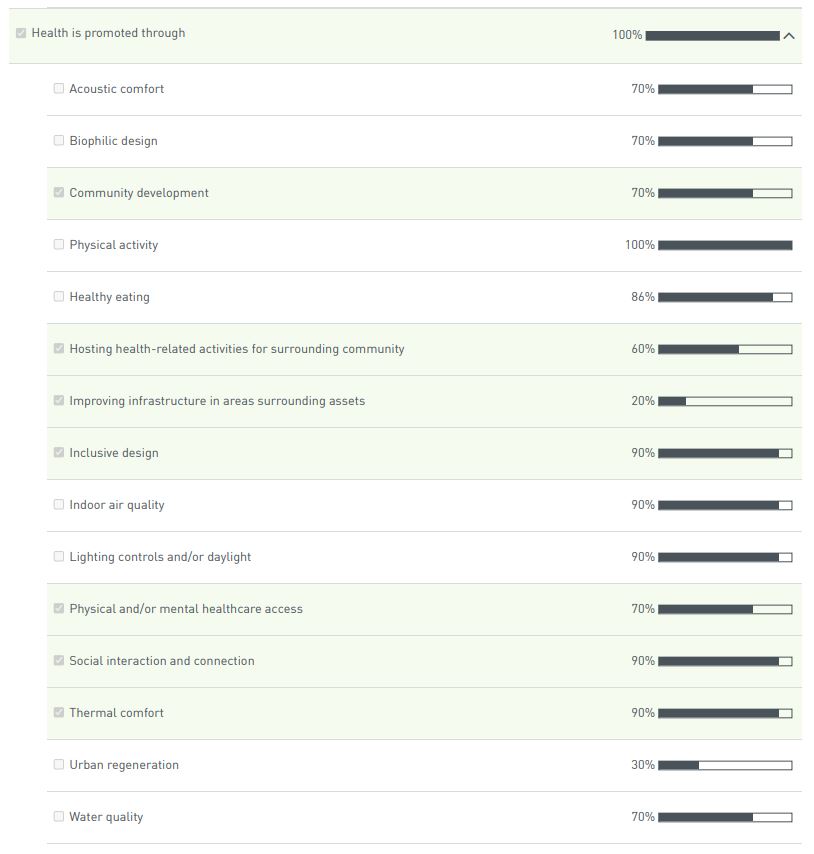

This is where the GRESB benchmark report can help. GRESB has done the groundwork to understand which additional frameworks are relevant for the commercial real estate sector. Moreover, the benchmark report offers insights into what peers are doing, as each response includes a percentage that indicates the adoption rate of specific initiatives by peers.

Using the GRESB Benchmark Report

Let’s examine the example on the right from a sample benchmark report. For this question about governance policies, this entity has selected more than enough to earn full points; however, they have not selected a cybersecurity policy despite 90% of their peers having one. In this case, GRESB data can be used to identify cybersecurity as an important topic to investors, customers, and other stakeholders, indicating it may need to be included in the entity’s overall ESG strategy.

For another example, let’s assume this fictional company has no health and well-being amenities or features at their properties and wants to know which ones to prioritize. While a tenant survey is the best place to start to gauge tenant preferences, the benchmark report is another valuable data source. Considering the percentages on the right, the entity may determine that anything with 90% or higher would be a worthwhile initiative to explore.

Going deeper with GRESB

There are many tips and tricks for how to utilize the benchmark report to uplevel your ESG program and prioritize initiatives. Check out Stok’s past GREBS insight “GRESB Results: A Guide to Interpreting and Improving Your Score” for more information on how to create an action plan to improve ESG performance utilizing the results of the GRESB assessment.

For a deeper dive into this topic, tune in on September 7 to Stok’s and GRESB’s co-hosted webinar, “Road to 2024: Unpacking GRESB and the 2023 Results to Upscale Your ESG Program”.

This article was written by Kelly Hagarty, ESG Director at Stok.

References:

SFDR Reporting Solution, GRESB.

TCFD Alignment Report, GRESB.

Consulting Firm Materiality Assessment and ESG Roadmap, Stok, 2023.

Benchmark Report, GRESB.

GRESB Results: A Guide to Interpreting and Improving Your Score, Kelly Hagarty, Stok, October 19, 2022.