More than 95% of investors incorporate ESG into their decision-making, and they increasingly expect this data to be standardized and easily accessible. While some investors push their portfolio companies to become best in class, the vast majority simply need ESG data and tools to monitor overall performance, protect against risk, and stay ahead of emerging regulations – which is why they place enormous value on GRESB participation.

With many jurisdictions across the world introducing new mandatory ESG-related rules and reporting requirements, it’s now more important than ever for investors to ensure their portfolio companies can answer basic ESG questions.

What are the GRESB Assessments?

Put simply, the GRESB Assessments provide a consistent framework for managers to measure and improve upon their ESG strategies and performance based on self-reported data that is validated, scored, and peer benchmarked.

Investors can request access to GRESB data and the resulting benchmarks to better understand their investments, engage with managers, and inform overall decision-making.

GRESB is used by 170 institutional and financial investors with USD 51 trillion in assets under management. Read our investor case studies to see why investors want you to participate in GRESB.

“If a company isn’t already thinking about ESG, they’re lagging.”

John White, Senior Managing Director and Global Investment Strategist, Heitman

How it works

Real estate and infrastructure managers, companies, and asset owners and operators report their ESG data to GRESB on an annual basis. The GRESB Assessments open in April and submissions are accepted until the end of July. See the full GRESB timeline here.

From their submission, assessment participants receive comparative business intelligence on where they stand against their peers, a roadmap with the actions they can take to improve their ESG performance, and a communication platform to engage with investors.

Because reporting to GRESB can take time and expertise that does not always exist in-house, many first-time participants choose to work with a GRESB Partner on their submission. Partners can help you collect, report, and manage your ESG data as well as complete the GRESB Assessments and improve your overall sustainability performance. See a list of our Partners here or reach out to us to discuss your specific needs.

Are there any downsides to participating?

Reporting on ESG can be time intensive, and many first-year participants to GRESB are concerned that a lack of data or assessment mistakes may be seen negatively by investors. This is why we offer all new members what we call a “Grace Period” – the ability to participate in the assessment in the first year without the pressure or expectation to share results with investors who may ask.

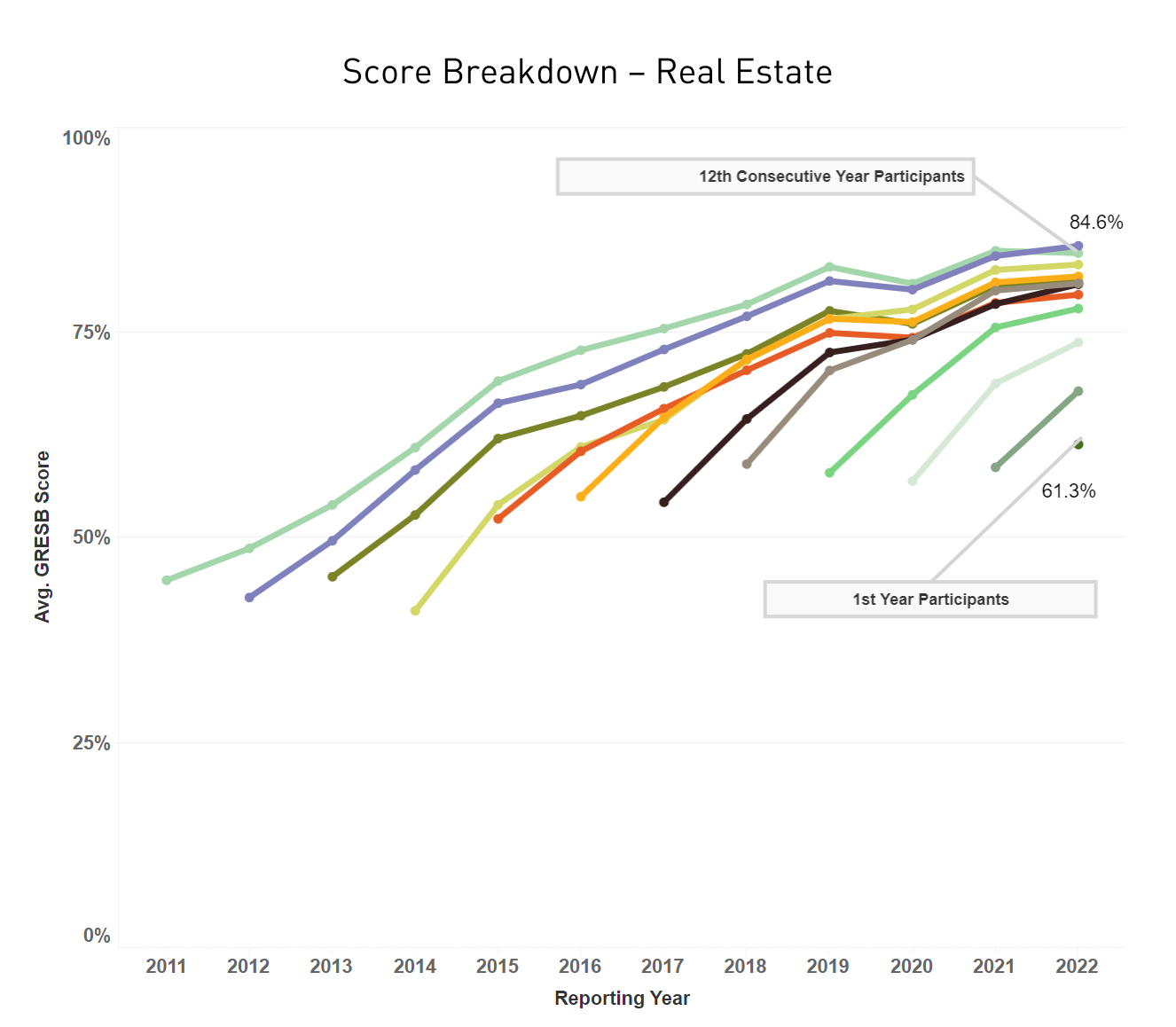

This will allow you time to familiarize yourself with the GRESB reporting and assessment process without undergoing scrutiny from investors, should you wish to keep your results confidential. All participants can also request a Response Check and take advantage of the Review Period to check and verify submissions. On average, GRESB participants see a 10 percentage point increase in their GRESB score in their second year of reporting.

In addition to providing a key communication platform with investors, GRESB Participants report benefiting greatly from the GRESB Assessment on multiple fronts, from benchmarking their performance against peers to identifying risks and opportunities. Read our manager case studies to see why managers choose to participate in GRESB.

Getting started

Getting started is simple. Get in touch with us and ask questions about how investors use GRESB data, how the GRESB assessments work, and more.

You can learn more about the Assessments below: