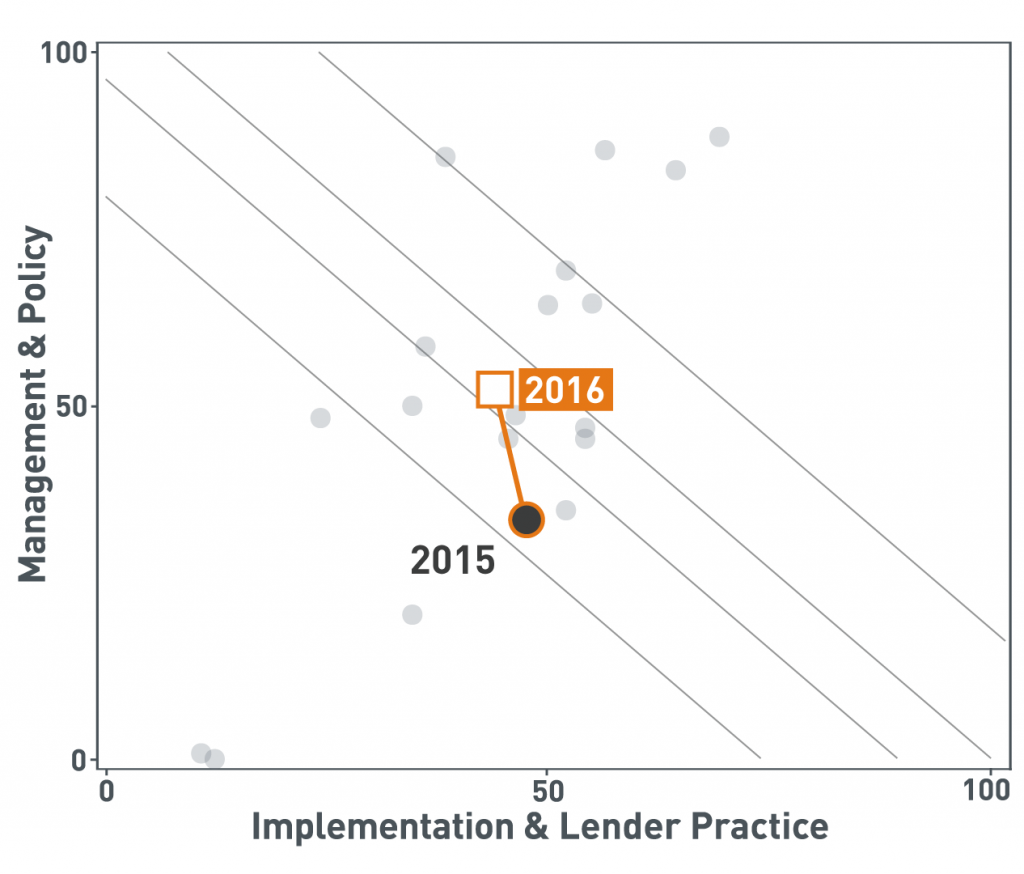

September marked the release of the 2016 GRESB Debt Assessment results which were simultaneously released alongside the GRESB Real Estate Assessment results [see results presentation]. The 2016 global snapshot of the lending market results reflects GRESB’s improved Debt Assessment framework. This resulted in increasing the number of participants from 10 to 18, including two primary lenders which underlines the importance of environmental, social and governance (ESG) issues to leading banks. The average GRESB Debt score increased from 42 to 48 indicating deeper engagement with ESG in risk management, underwriting and ongoing portfolio monitoring.

Current state

The 2016 GRESB Debt Assessment data offer a glimpse into the lending industry’s ESG mindset at present, providing insights and offering a roadmap for potential near-term improvements.

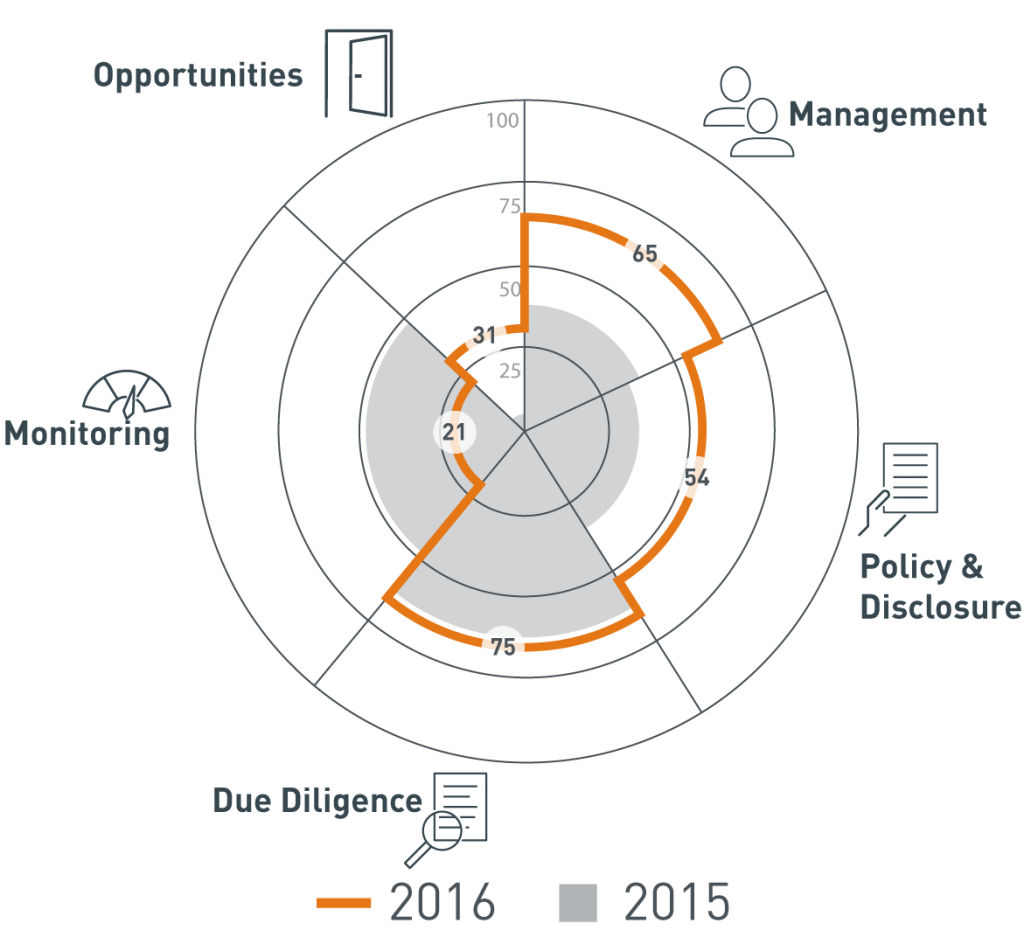

The 2016 results are encouraging with a significant jump in the Management and Policy section to 51 from 34 in 2015 [50% increase]. This shift was driven in part by the increased sample size demonstrating expanded interest in ESG. The 2015 GRESB Debt Report underlined the importance of having dedicated employees and ESG related policies/thresholds that are reflected in the overall strategy of the lending entity. Results suggest the number of executives focused on sustainability metrics within the loan portfolio increased with 67% of participants reporting on this aspect. Another notable improvement is majority of participants maintain robust communication and reporting processes between team members and sustainability agents. From various conversations with participants it is clear internal sustainability experts from within the broader firm are more involved with real estate lending procedures and decision-making. Such cooperation can lead to improvements in risk assessment during underwriting and overall improvements to loan portfolio quality.

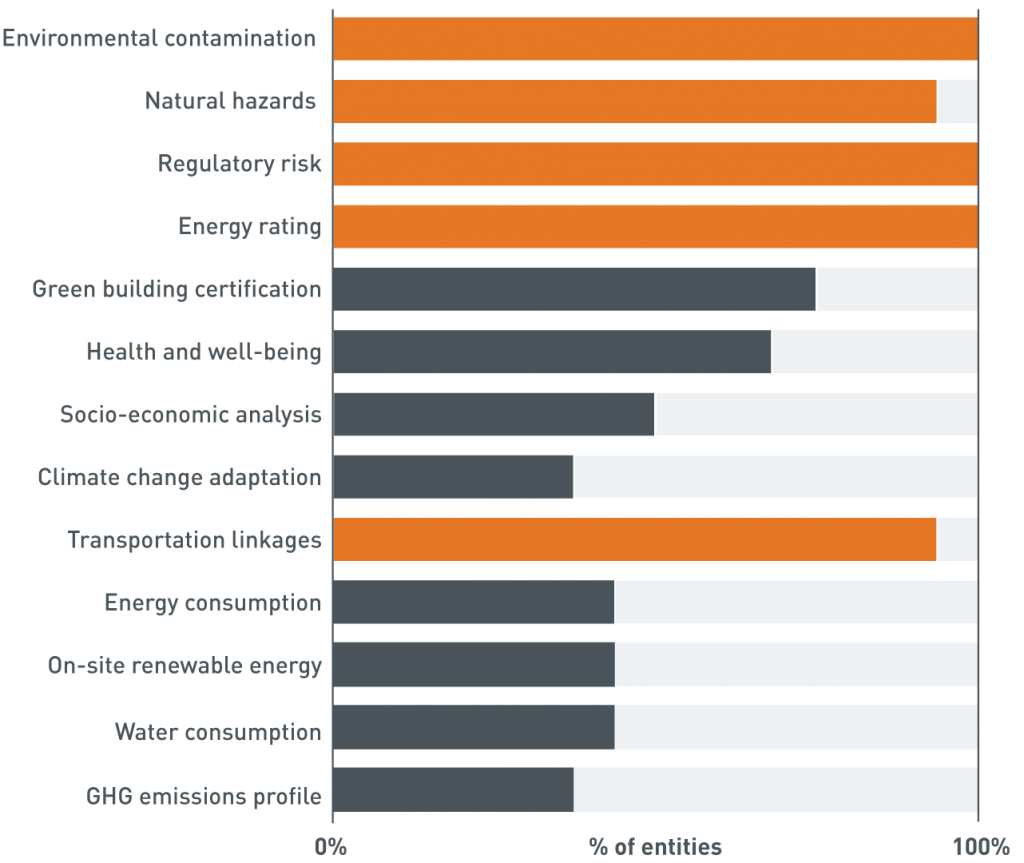

Similar to 2015, this year’s participants pay attention to due diligence procedures – this aspect has the highest average score two years running. Assessment results and one-on-one conversations suggest that participants continue to incorporate rigorous risk assessment policies that address various ESG factors. It is apparent that majority of participants have both written portfolio policies and also take property-level action by reviewing ESG risks at the borrower level. Results demonstrate that certain factors like socio-economic impact, climate change adaptation and health and well-being are analyzed only by a handful of leaders – these attributes should be accounted by the majority of participants over time.

A persistent trend is an overall lack of monitoring of actions and impacts following the initial loan. Results show a wide gap between leaders and other participants in terms of checks and follow-ups. Only a few participants have robust procedures to acquire regular updates on environmental performance of their loan portfolio, a characteristic typical of market leaders. While not every GRESB Debt participant sees benefit in such checks, this type of portfolio monitoring should be a natural extension of tracking collateral improvements and other borrower-based actions that are incorporated into underwriting due diligence processes. Incorporating ESG attributes into regular loan monitoring plays a crucial role in ensuring that both underwritten risks and the final environmental impact are in line with lender targets. There is little doubt that if real estate lenders are to contribute to meeting the COP21 targets – monitoring procedures/systems must be in place.

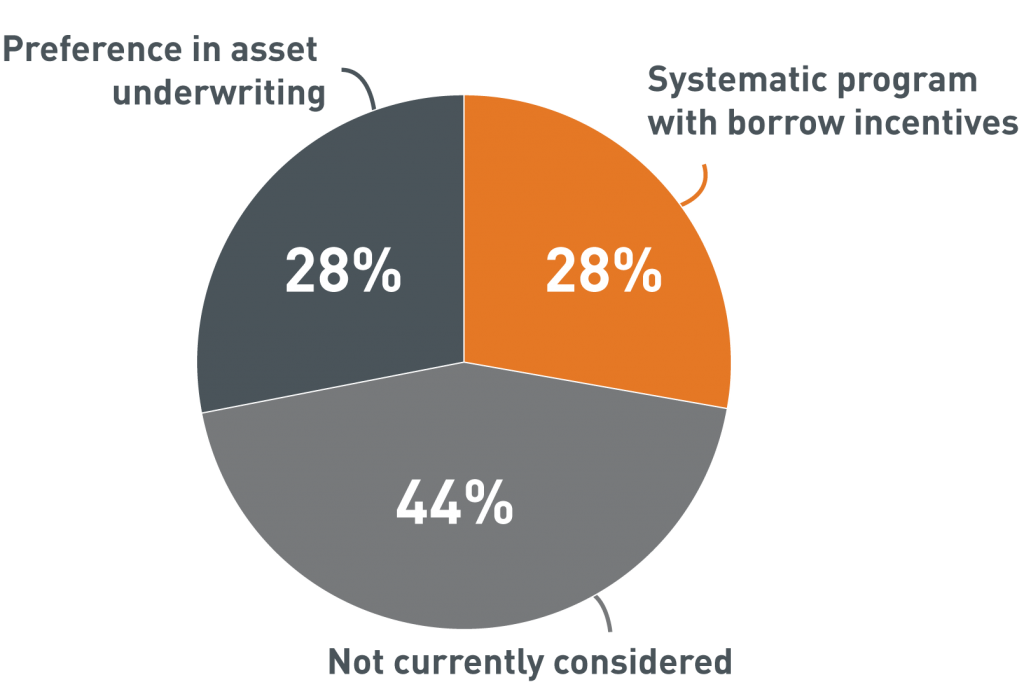

The final trend is related to ESG opportunities that lenders offer to borrowers. This aspect improved this year and it’s important to note that 28% of participants have robust lending (or similar) programs for property improvements. Primary lenders are the main driving force behind this shift and more institutional debt funds are offering efficiency-based programs. Such initiatives prove that some participants employ forward-looking attitude to underwriting and collateral improvements by providing additional capital for those projects designed to sustain the asset’s market competitiveness while yielding positive impacts.

Looking forward

The GRESB Debt 2016 results once again underline the wide range of market behaviors of how ESG integration in lending practices is incorporated by various entity groups. While some participants are willing to take a step forward others appear to be trying to develop and implement programs. It is apparent that ESG integration into CRE lending deserves more attention than it receives now, especially due to the recent COP21 agreement alongside the evolving notion of “responsible lending”.

Over the coming months GRESB will publish numerous in-depth blogposts designed to dive deeper into current results and discuss the lending industry’s feedback on various trends uncovered during the 2016 assessment period. In addition, GRESB will participate in several lender-focused events that will bring together various market participants and stakeholders to analyze and exchange their ESG program experience. These actions will help further refine the framework for the 2017 GRESB Debt Assessment — I encourage everyone interested in providing feedback and/or participating to reach out to the GRESB team and join with other leading peers from around the world.

This article is writen by Martins Zurko, Associate, Real Estate Debt at GRESB.