Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

As ESG gains traction among investors and businesses, there has been a growing backlash against the strategy in recent years. The ESG backlash or anti-ESG movement is concentrated among conservative factions in the United States (U.S.) and garnered significant media coverage during 2022. During 2021–2022, Idaho and North Dakota enacted laws that limit the extent to which ESG can be considered when investing state funds (e.g., pensions). In other states with strong fossil fuel industries, like Texas, Oklahoma, and West Virginia, another set of laws were enacted that prohibit states from doing business with financial entities that “boycott” (i.e., divest from) fossil fuel companies. As of 2023, additional state bills have been introduced, some of which have broader restrictions and harsher penalties for noncompliance (see Figure 1).[i]

While this trend is understandably disconcerting, thus far we see little evidence to suggest that the ESG backlash is significantly undermining progress around corporate sustainability. It is Verdani’s view that ESG is an essential consideration for businesses and investors because financially material ESG issues present risks and opportunities that would be unwise to ignore, especially over the long term. ESG is especially relevant in light of the Intergovernmental Panel on Climate Change’s (IPCC’s) Sixth Assessment Report (AR6), finalized on March 20, 2023, which conclusively urges the global economy to rapidly reduce greenhouse gas (GHG) emissions and adapt to a changing climate. Collectively moving toward these goals would not only help ensure a livable planet for future generations, but also a stable economy and financial system. Given the financial materiality of ESG, particularly around climate risk, we therefore expect ESG to remain a central and growing concern among asset managers, companies, and investors, even during an economic downturn.

Our confidence in ESG and sustainability aside, we recognize that the ESG backlash has raised concerns among commercial real estate (CRE) companies that operate or own assets inside states with anti-ESG laws. To aid in discussions with tenants, investors, and other stakeholders, this article presents common questions and concerns raised by ESG skeptics and provides talking points, recommendations, and resources to help meaningfully address them.

1. Is ESG bad for business? Could ESG undermine long-term investment returns and U.S. capital markets?

ESG centers on financially material issues

- From both a business and investment perspective, the concept of ESG fundamentally centers around the consideration of financially material environmental, social, and governance issues (e.g., climate change, human rights, corporate transparency).

- ESG as investment strategy was coined in 2004 by the UN Global Compact and a group of financial institutions (e.g., Goldman Sachs, Morgan Stanley), who made the case for including ESG issues in the scope of investors’ fiduciary duty.[ii]

- Most major ESG reporting frameworks, including PRI, GRESB, SASB, IFRS, and TCFD, and third-party ESG aggregators, including MSCI and Sustainalytics, evaluate corporate sustainability from a financial perspective, not an impact perspective (though impacts are the focus of GRI)

- Some sustainable investing strategies do place more emphasis on environmental and social impacts or benefits, as opposed to financial performance. For example, some investors use negative screening to remove fossil fuel investments from portfolios.

ESG is good for business: risk mitigation

- Climate change, unethical business practices, and poor corporate governance are among many ESG issues that present potential risks to businesses and economies.

- As climate change impacts (e.g., hurricanes, droughts, floods) intensify and economies shift toward renewable energy, physical and transition climate risks are becoming increasingly important considerations for the CRE industry. Climate change impacts can accelerate the deterioration of assets, increasing maintenance and operating costs.[iv] Buildings may also face write downs or be prematurely retired (i.e., become stranded) if they fail to decarbonize and electrify on a 1.5°C-aligned pathway.[v]

- Because buildings and construction are responsible for 37% of global energy and process-related carbon emissions, decarbonizing the CRE industry will play a critical role in mitigating climate change risks.[vi]

ESG is good for business: regulatory compliance

- Complying with or going above and beyond regulations is conventionally thought to mitigate financial risks, such as lawsuits and asset stranding.

- For decades, CRE has been subject to mandatory building energy codes and energy benchmarking regulations that improve buildings’ energy efficiency.[vii]

- New EU regulations, like the Sustainable Finance Disclosure Regulation (SFDR), EU Taxonomy, and the Corporate Sustainability Reporting Directive (CSRD), mandate disclosures on environmental and social issues. Most U.S. companies are not directly affected, but we believe it is possible EU investors with U.S. investments will increasingly demand U.S. companies and funds align reporting with the EU sustainability disclosure requirements.

- Under the forthcoming SEC climate-related disclosure rule (final rules anticipated in April 2023), U.S. public companies will soon be required to disclose their GHG emissions and climate risks on an annual basis. While businesses have raised many concerns regarding the rules, a recent survey of U.S. business executives by Workiva indicated most companies are preparing to comply.[viii]

ESG is good for business: operational cost savings

- Improving corporate ESG performance can reduce operating costs through a variety of avenues:

- Improving energy and water efficiency can reduce utility costs.[ix]

- Improving assets’ resilience to climate impacts can mitigate costs for repairs and maintenance.[iv]

- A healthy indoor environment can contribute to improved cognitive function and productivity among employees.[x]

ESG is good for business: market competitiveness

- Green buildings tend to have lower risk and vacancy rates and higher rental premiums and occupancy rates, altogether leading to higher net operating income and lower capitalization rates, and by extension, higher valuations and sale prices.[xi],[xii]

- Cultural and ethnic diversity in the workplace have been associated with higher profitability.[xiii]

- Corporations’ environmental sustainability and social responsibility are increasingly important factors to today’s consumers and workforce.[xiv]

ESG is good for business: transitioning to renewable energy is less costly than unmitigated climate change

- The global economy must rapidly transition away from fossil fuels to avoid severe and irreversible climate change impacts. In order to limit global warming to no more than 1.5°C above pre-industrial levels, the recommended limit as outlined by the IPCC and codified in the 2015 Paris Climate Agreement, GHG emissions must be reduced by 45% by 2030 and reach net zero by 2050.[xv]

- Authors of the March 2023 IPCC assessment report noted “the global economic and social benefit of limiting global warming to 2°C exceeds the cost of mitigation in most of the assessed literature.”

- A 2021 study from the Swiss Re Institute estimated that climate change could reduce the world’s total economic value by approximately 10% by 2050.[xvi]

- The costs of climate change are accelerating — over a third of all U.S. natural disaster costs across the past four decades were incurred between 2017–2021, amounting to USD 803.7 billion dollars of damage in those five years alone.[xvii]

‘Unintended consequences’ of anti-ESG bills

- In 2023, lawmakers in North Dakota, Indiana, and Kentucky voted down anti-ESG bills that were seen as threatening to the states’ investments and economies or conflicting with investors’ fiduciary duty.[xviii]

- A 2022 study assessing Texas’ anti-ESG laws (SB 13 and 19) estimated “Texas issuers will incur between USD 300–500 million in additional interest on the USD 31.8 billion borrowed during the first eight months following enactment.”

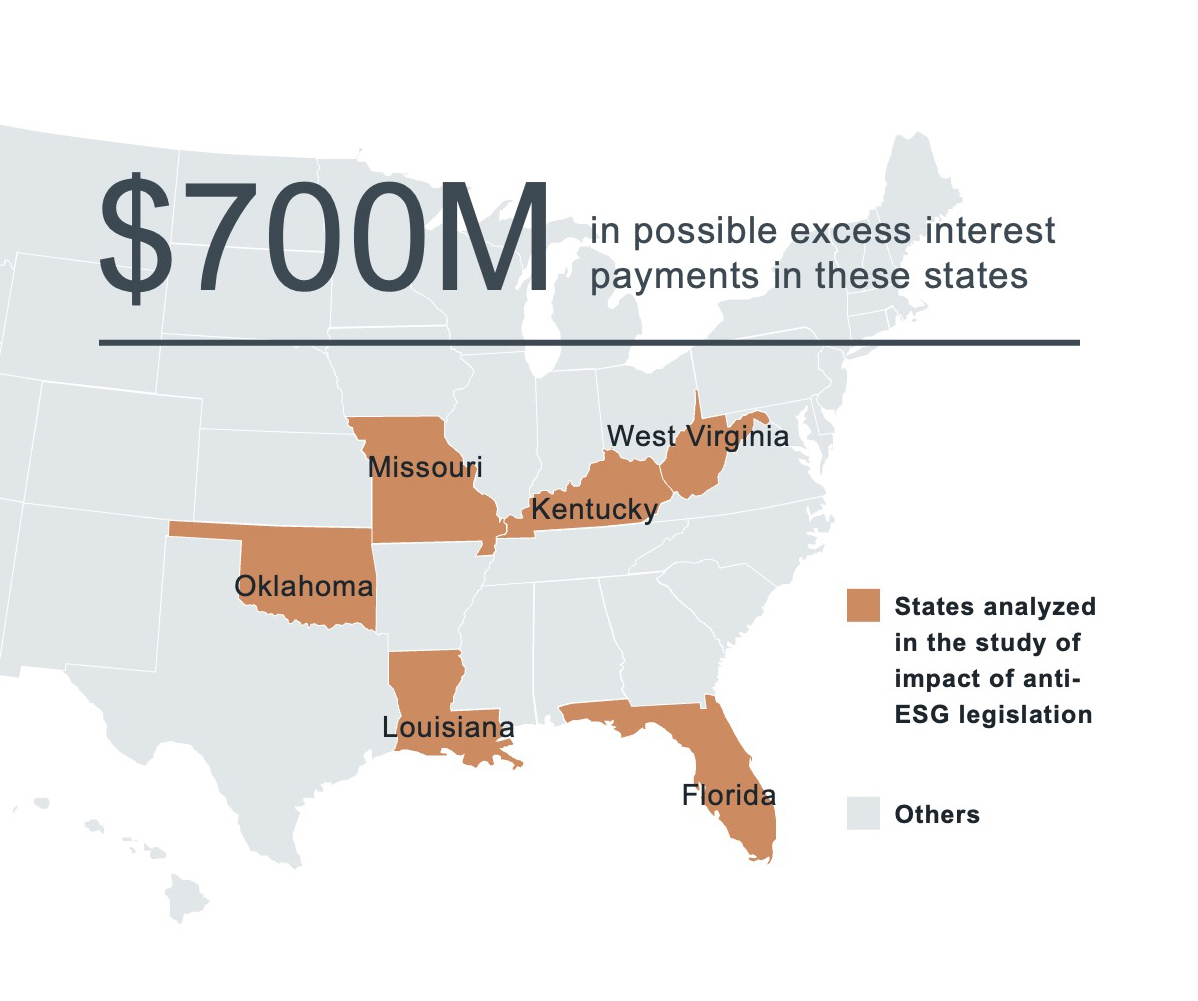

- Based on the 2022 study mentioned above, additional analyses indicate similar anti-ESG bills could cost taxpayers in six states — Kentucky, Florida, Louisiana, Oklahoma, West Virginia, and Missouri — upwards of “USD 700 million in excess interest payments” (see Figure 2).

- On March 20, 2023, U.S. President Biden vetoed a bill that would have prohibited retirement plan managers from considering ESG factors in investment decisions. In his statement about the veto, Biden maintained that there is “extensive evidence showing that environmental, social, and governance factors can have a material impact on markets, industries, and businesses” and that the bill “would force retirement managers to ignore these relevant risk factors” and “prevent plan fiduciaries from taking into account factors like the physical risks of climate change and poor corporate governance, that could affect investment returns.”[xix]

2. Is ESG investing effectively a fossil fuel boycott?

No

- Rather than a singular, fixed strategy, ESG is an umbrella term that encompasses a variety of sustainable investment strategies, including ESG integration, screening, best-in-class, and impact investing. Given the trajectory of emerging clean energy technologies and the increased regulatory focus on decarbonization, ESG-oriented investors may look unfavorably at investing in the expansion of fossil fuel production. However, this does not equate to a boycott. In our current energy landscape, fossil fuels play too significant a role for a complete and immediate boycott to be a responsible strategy. Therefore, while some ESG funds intentionally screen out companies with large carbon footprints,[xx] many popular ESG funds actually contain fossil fuel investments.[xxi]

3. Didn’t ESG funds perform poorly in 2022?

Not exactly and not as much as detractors claim

- Though ESG funds did perform below expectations in 2022, poor performance is likely more of a reflection of the broader stock market than the funds’ ESG characteristics. Despite the ESG backlash, large-cap stock ESG funds only performed 2.4 percentage points worse in 2022 compared to the S&P500 index, according to Morningstar.[xxii]

- Multiple meta-analyses, assessing thousands of studies, show a correlation between ESG and improved financial performance.[xxiii],[xxiv]

4. What are regulators doing about ESG and greenwashing?

Regulators are adopting additional disclosures to prohibit misleading claims

- In 2021, the U.S. SEC issued a risk alert that noted many investment firms marketed ESG funds with misleading statements around risk and return metrics or lacked formal policies and documentation around ESG-related investment decisions.

- In 2022, the U.S. SEC put into force the Modernized Marketing Rule for Investment Advisors, which helps combat false ESG advertising. In 2022, the U.S. SEC proposed rules that would prohibit investors from making misleading ESG claims and require disclosures from ESG funds.

- In the EU, the EU Taxonomy Regulation requires companies and financial market participants to disclose the extent to which their activities and investments are sustainable, according to standardized technical screening criteria; similarly, SFDR requires standardized disclosures on ESG funds’ sustainable characteristics and objectives and adverse impacts on sustainability factors.

- As of April 2023, ESG funds marketed in Japan must abide by new labeling guidelines that prohibit naming new funds with words like “green,” “decarbonization,” or “sustainable” unless ESG is a “key factor” to the fund’s investment strategy.

5. What if legislators in my state are penalizing companies that prioritize ESG?

There are no specific penalties that we know of at this time

- At this time, Verdani is unaware of any laws or regulations related to the ESG backlash that prohibit U.S. companies (including CRE firms) from implementing ESG programs or communicating about sustainability efforts.

- While many states are pushing for less ESG influence, other states are mandating that state investments consider ESG or divest from fossil fuels (see Figure 1).[xxv] For example, as of 2021, Maine began prohibiting their state retirement system from investing in the 200 largest publicly traded fossil fuel companies (by carbon reserves).[xxvi]

Conclusion

Despite the recent backlash against ESG investing, the importance of considering environmental, social, and governance factors has only intensified for investors and businesses. Climate change presents a dire threat to both our planet and economy, making it imperative for the real estate industry to mitigate climate risks and shift toward decarbonized construction and operations. For climate change and other ESG issues (e.g., DEI, indoor air quality), there is compelling evidence that improving ESG performance can mitigate risk and enhance financial performance. To overcome skepticism surrounding ESG initiatives, it is crucial for CRE companies to present a transparent, compelling, and data-driven argument for the benefits of ESG. To that end, we hope the talking points and recommendations above prove useful in supporting discussions with stakeholders.

References

[ii] U.N. Global Compact (2004). Who cares wins: Connecting financial markets to a changing world.

[iii] Schoenleber, C. (August, 2022). Navigating ESG reporting frameworks: A comprehensive guide. Verdani Institute for the Built Environment.

[iv] Urban Land Institute (2019). Climate risk and real estate investment decision-making.

[v] Carbon Risk Real Estate Monitor (2020). Carbon risk integration in corporate strategies within the real estate sector.

[vi] U.N. Environment Programme (2022). 2022 global status report for buildings and construction.

[vii] Evans, M. (2017). An international survey of building energy codes and their implementation. Journal of Cleaner Production.

[viii] Workiva & pwc (2023). Change in the climate key findings from our survey measuring how U.S. business leaders are preparing for the SEC’s climate disclosure rule.

[ix] Eichholtz, P. et al. (2019). Environmental performance of commercial real estate: New insights into energy efficiency improvements. The Journal of Portfolio Management. DOI:10.3905/jpm.2019.1.099

[x] MacNaughten, P. et al. (2017). The impact of working in a green certified building on cognitive function and health. Building and Environment.

[xi] Leskinen, N. et al. (2020). A review of the impact of green building certification on the cash flows and values of commercial properties. Sustainability.

[xii] Institute for Market Transportation & Appraisal Institute (2013). Green building and property value: A primer for building owners and developers.

[xiii] Dixon-Fyle, S. (2020). Diversity wins: How inclusion matters. McKinsey & Company.

[xiv] IBM Institute for Business Value (2022). Balancing sustainability and profitability: How businesses can protect people, planet, and the bottom line.

[xv] Intergovernmental Panel on Climate Change (2018). Special Report: Global warming of 1.5 ºC summary for policymakers.

[xvi] Swiss Re Institute (2021). The economics of climate change: No action not an option.

[xvii] National Centers for Environmental Information (2023). Billion-dollar weather and climate disasters. National Oceanic and Atmospheric Administration.

[xviii] Rives, K. (February, 2023). Some states backtrack on anti-ESG efforts, citing ‘unintended consequences’. S&P Global.

[xix] Watson, K. (March, 2023). Biden issues first veto of presidency, rejecting GOP-led bill to reverse investing rule. CBS News.

[xx] Fossil Free Funds (2023). Search mutual funds and ETFs: Compare the fossil fuel investments of different funds.

[xxi] Carlson, D. (2022). A dirty secret: Here’s why your ESG ETF likely owns stock in fossil-fuel companies. MarketWatch.

[xxii] Mullaney, T. (2022). The market’s most political stock picks had a bad year, but they’ll be back in 2023. CNBC.

[xxiii] Friede, G. et al. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance & Investment.

[xxiv] Whelan, T. et al. (2021). ESG and financial performance: Uncovering the relationship by aggregating evidence from 1,000 plus studies published between 2015 – 2020. NYU Stern Center for Sustainable Business.

[xxv] Ropes & Gray (2023). State initiatives.

[xxvi] Goodlett, B. et al. (2023). The “anti-ESG” movement: Balancing conflicting stakeholder concerns and inconsistent regulatory regimes. DLA Piper.

Written by Carli Schoenleber, ESG Content and Engagement Specialist for Verdani Partners, Paulynn Cue, Chief Communications Officer at Verdani Partners, Gabe John, Communications Manager for Verdani Partners and Jackie Royds, Graphic Designer.