We are pleased to share a series of important improvements to the GRESB Benchmark Report across real estate and infrastructure. These improvements are part of GRESB’s ongoing commitment to empowering your investment strategies with transparent, actionable data and deeper insights to help you build more resilient, efficient, and successful real assets portfolios.

Real estate

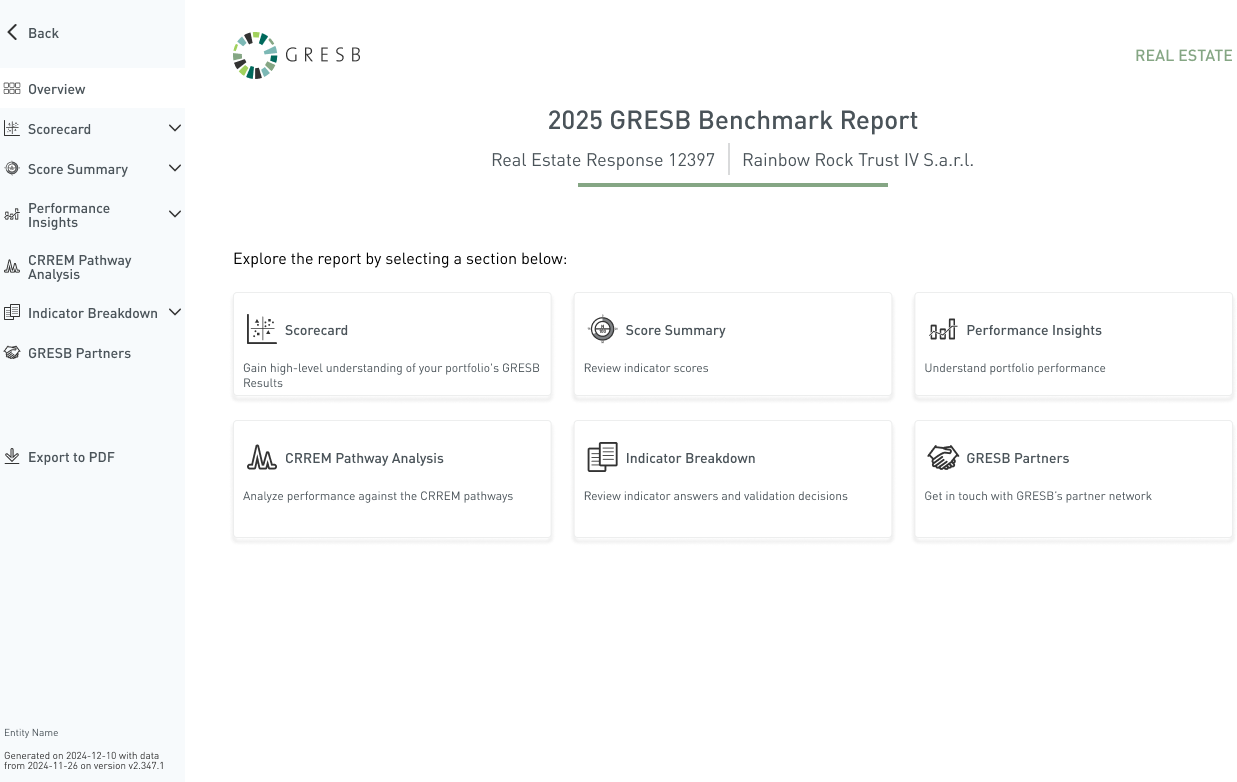

The flagship GRESB Benchmark Report is undergoing significant updates and structural changes in response to member feedback. These updates aim to deliver a more intuitive, visually-driven experience—making it easier to navigate the report, spot trends, identify strengths, and strategize improvements.

As of 2025, the Benchmark Report will be organized into clearly defined sections, enabling more targeted analysis of both portfolio performance, asset performance, and scoring. Designed to meet the diverse needs of different users, the updated report will also feature enhanced, user-friendly navigation to help users explore content more efficiently and gain deeper analytical insights.

- Scorecard:

- High-level summary of ratings, rankings, scores, and portfolio performance

- Current and previous year aspect strength and opportunity analysis

- Overall portfolio impact, including insight into portfolio-level consumption, data coverage, like-for-like performance, and targets

- Score summary:

- Detailed breakdown of aspect and indicator scores as well as benchmark insights

- Performance insights:

- Sector and country-level analysis of portfolio performance

- Sector and country-level intensities

- CRREM Pathway alignment:

- CRREM alignment and trajectory performance insights

- Indicator breakdown:

- Peer group comparisons at the indicator-response level

To enhance usability, individual sections as well as the full report will be printable. More information, including a walkthrough of the updated Benchmark Report, will be made available in the near future.

New Residential Component

In 2025, GRESB introduced a new voluntary Residential Component for real estate participants whose portfolios consist of more than 75% residential assets by GAV. Developed in response to industry feedback and guided by the Real Estate Standard Committee and the GRESB Foundation, the Residential Component introduces a more tailored and actionable framework for assessing residential asset performance.

Participants who opt for the Residential Component complete it alongside the main Real Estate Assessment. It features sector-specific indicators that reflect the unique performance drivers of residential assets, ensuring greater relevance and value.

By completing the Residential Component, participants will continue to receive the GRESB Benchmark Report and will gain access to the new standalone Sector Insight: Residential Report.

The new standalone report contains:

- A residential-specific benchmark and peer group for management, performance, and new residential indicators

- Benchmark distribution and scoring for new residential indicators

- Adjusted scoring weights for existing indicators to reflect performance drivers in the residential sector

The introduction of the Residential Component reflects GRESB’s broader shift toward sector-specific insights, enabling greater relevance and strategic value for residential real estate participants and investors.

Infrastructure:

The GRESB Infrastructure Benchmark Report has been enhanced to improve usability and enable deeper analysis. Key updates include:

- Location-based vs. market-based emissions views:

The Portfolio Impact section and Asset Impact section of the Infrastructure Fund and Asset Benchmark Reports now clearly distinguish between location- and market-based GHG emissions—offering more accurate performance context based on the methods used by the entity. - Net-zero target setting visualization:

Available for infrastructure assets, this new visualization shows the entity’s emissions trajectory against its stated net-zero targets, including:- The current year’s emissions vs. the target line

- Data coverage for the current year’s emissions for Scope 1, 2, and 3, if applicable

- The percentage of offsets used in targets

- The Scopes included in the targets (Scopes 1 and 2, or 1, 2, and 3)

- Scope 2 accounting method (location vs. market-based)

- Embedded report guidance:

New guidance elements are now integrated directly into the Benchmark Report to help users interpret each section more easily—streamlining navigation and understanding

With these updates, GRESB aims to continue to support your journey toward operational efficiency, resilient asset performance, and superior long-term returns.

If you have any questions about the GRESB Benchmark Report or any of the GRESB products and services, please contact us.