What’s new in April

The 2025 GRESB Assessments are officially underway! If you haven’t started your submission yet, head over to the GRESB Portal to begin. The GRESB Member Success Team is here to support you throughout the process—get in touch with us if you have any questions.

In this month’s newsletter, we share key updates and resources to help you navigate the assessment season and strengthen your performance, including:

- New building certification and energy rating insights as part of Score Contribution

- GRESB services to make the most of your GRESB participation

- Navigating data center sustainability with GRESB

- Reflections from the Foundation meetings in London

- Catching up with Asset Impact

Read more below.

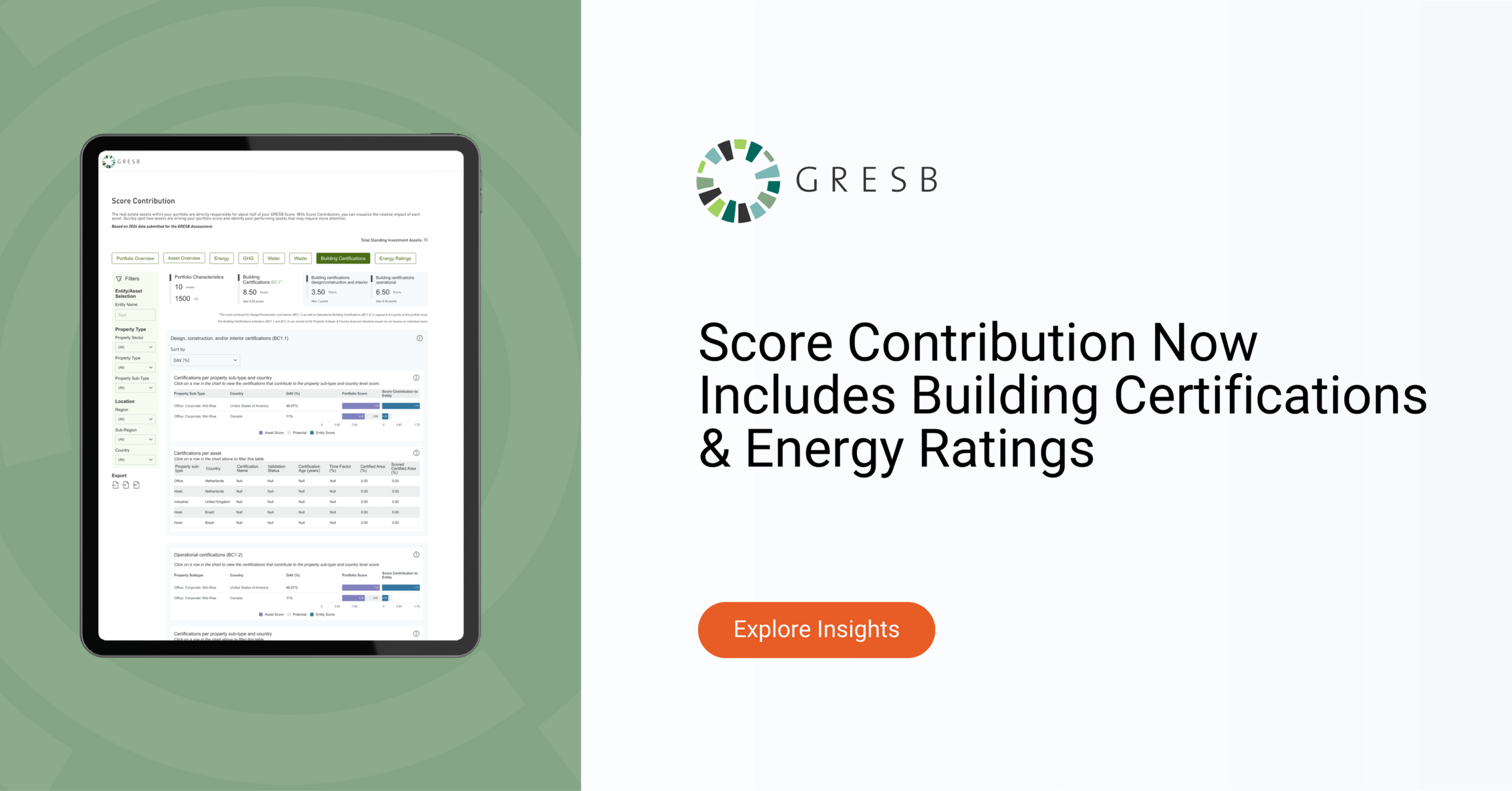

Score Contribution now includes certifications & energy ratings

GRESB has expanded its new Score Contribution feature to include building certifications and energy ratings, giving Real Estate Participants deeper insights into asset-level performance. This update provides Real Estate Participants with deeper, more actionable insights into how individual assets influence their GRESB Score across key performance metrics.

With these new additions, Score Contribution now delivers a more comprehensive view of what drives performance at the asset level, enabling real estate managers to focus their efforts where they matter most, make informed, targeted improvements, and communicate more effectively with their assets and stakeholders.

Since its launch in March, more than 1,300 real estate portfolios have already explored the tool to access asset-level insights and unlock new opportunities for performance improvement.

Score Contribution is available at no additional cost to all GRESB Real Estate Participants. Learn more about the Score Contribution update on the GRESB website.

Make the Most of Your GRESB Participation

Looking for help in navigating the GRESB Assessments and making the most of your participation? Learn more about GRESB’s QuickStart and the Pre-Submission Check and watch a recording of our recent Assessments Q&A sessions below.

GRESB QuickStart

In 2025, GRESB introduced QuickStart, a service designed to help new participants familiarize themselves with GRESB quickly so they can better navigate the assessment process. QuickStart will give you the opportunity to get one-on-one time with the GRESB Member Success team to ask your most pressing questions and receive tailored advice.

The service will cover the most important aspects of getting started, including:

- Understanding the GRESB timeline

- Navigating resources like the Reference Guides and Scoring Documents

- Seeing important tools in action through a live demo

- Receiving customized tips and tricks for reporting

QuickStart is available through May. Learn more here.

Pre-Submission Check

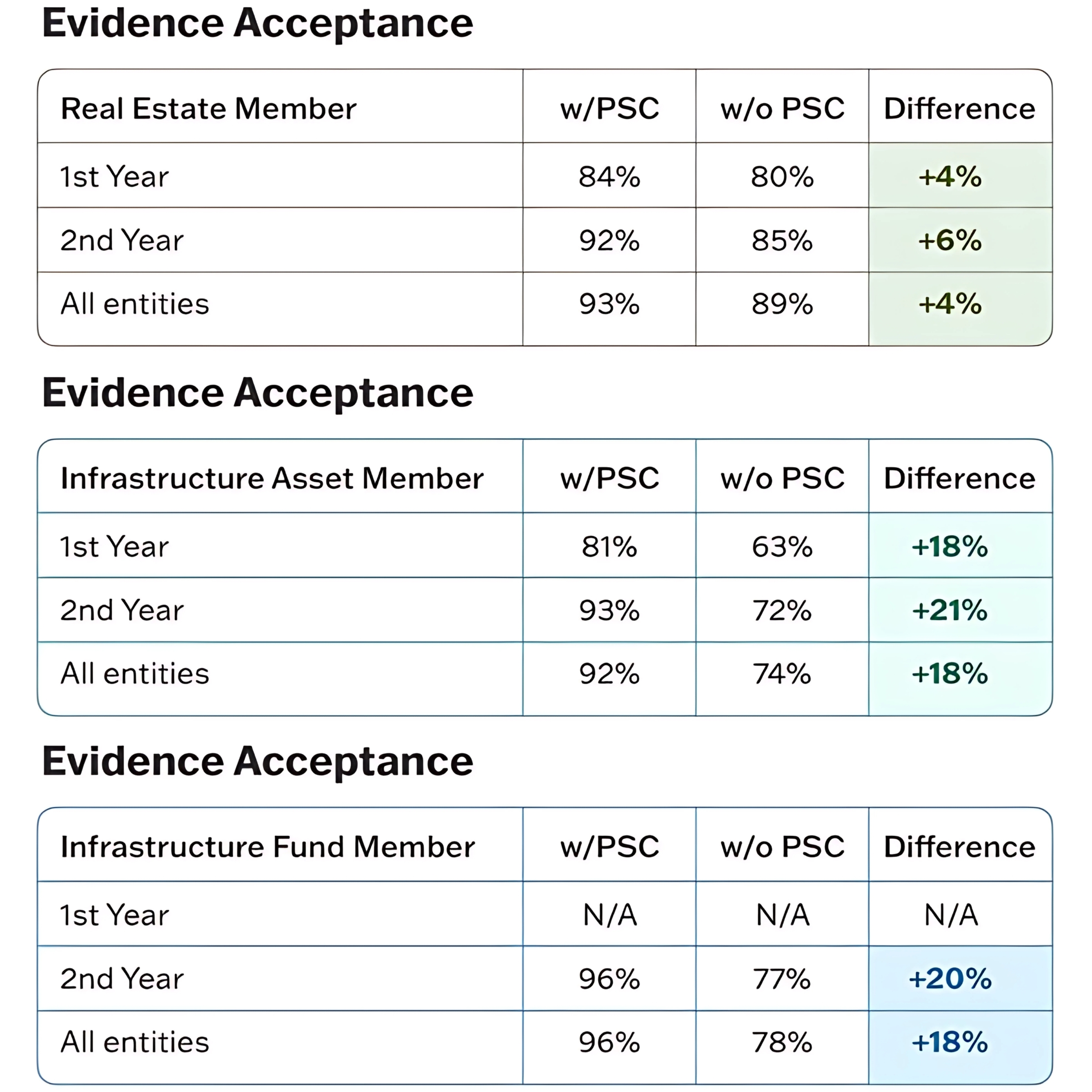

A Pre-Submission Check is a high-level check of your Assessment response prior to final submission. It not only helps to reduce errors that may adversely impact your Assessment results but also ensures that your submission is as complete as possible.

In 2024, the acceptance rate of submitted evidence by new GRESB Participants across all Assessments was 4–18% higher on average for those who used a Pre-Submission Check than for those who did not.

Pre-Submission Checks can be requested until June 20, with Pre-Submission Checks scheduled from May 1 until June 27. Learn more here.

You can learn more about all GRESB Assessment services on the GRESB website.

GRESB Assessments Q&As

Last week, GRESB hosted a series of live Q&A sessions to answer the most pressing questions about the 2025 GRESB Real Estate & Infrastructure Assessments. If you missed them, you can watch recordings of the sessions below:

Navigating data center sustainability with GRESB

Data centers are among the most rapidly expanding real asset investments, facing unique sustainability challenges that can significantly impact long-term performance.

GRESB’s latest white paper, “Navigating Data Center Sustainability with GRESB: Trends and Recommendations for 2025 GRESB Participants,” offers practical guidance and insights on:

- The growth and impact of data centers

- The latest trends in GRESB participation—and how data centers are engaging with the assessments

- Energy consumption data for data centers

- Key considerations for choosing between the GRESB Real Estate and Infrastructure Assessments in 2025

- What to expect from GRESB’s evolving approach in 2026 and beyond

Foundation update

Foundation Members In-Person Meeting

Members of the GRESB Foundation, including the Board, the Real Estate and Infrastructure Standards Committees, and the Data Center and Change Management Working Groups convened for the Foundation’s second annual in-person meetings in London. The Foundation was delighted to have nearly all the Standards Committee members in attendance, as well as many of the Foundation Board and several Data Center and Change Management Working Group members. Some members traveled from Hong Kong, Sydney, and Mexico City!

In addition to the Real Estate and Infrastructure Standards Committees, the Data Center and Change Management Working Groups hosted productive meetings, and the entire Foundation was offered a lecture by Massachusetts Institute of Technology researchers, Juan Francisco Palacios and Bram van der Kroft, as well as a tour of AXA Investment Managers’ iconic Dolphin Square(re)development. To read more about the week, take a look at the recent GRESB insights article.

Data Center Working Group

Data Center Working Group members were invited to join the rest of the Foundation members in London. To capitalize on their time together, they hosted an all-day working session, hosted by SMBC. The in-person work session has brought them closer to developing new guidelines for data centers and will ultimately produce a new, fit-for-purpose standard for data centers. To read more about GRESB’s focus on data centers, check out the recently published whitepaper on Navigating Data Center Sustainability with GRESB in 2025.

Change Management Working Group

The Change Management Working Group—comprised of members of the Foundation Board, RESC, ISC, and ERG—also hosted its fourth meeting during the Foundation’s time in London. Their productive meeting resulted in soon-to-be published Principles for Governing the Standards Development Process, which will be presented to the Foundation Board during their next meeting. The Foundation is hopeful these governing principles will provide an additional level of transparency into how the Foundation manages incremental, annual changes to the Standards.

GRESB’s Growing Toolkit: Spotlight on Asset Impact

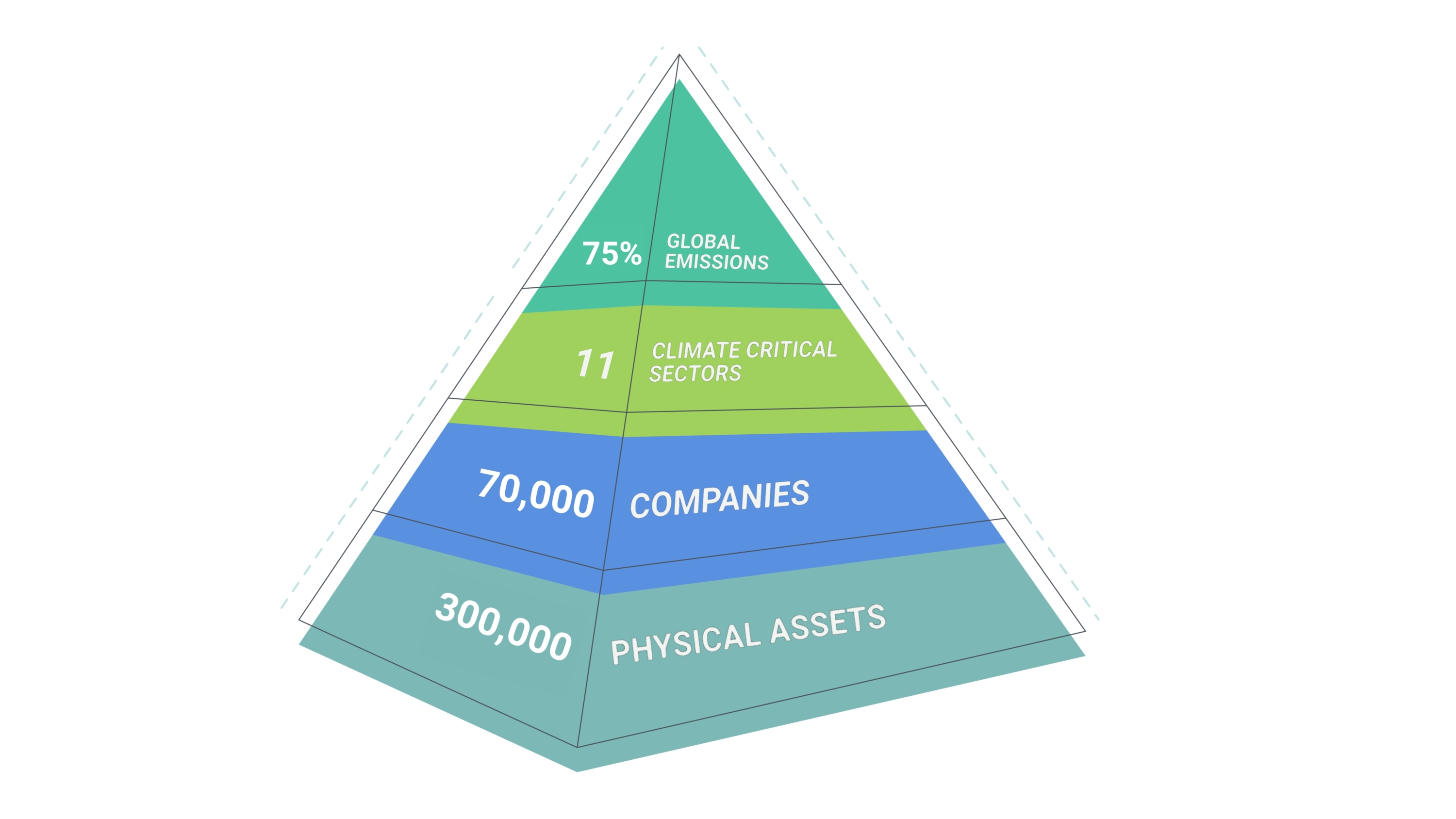

Understanding emissions and operational performance from the asset to the companies who run and own them is key to setting priorities and making informed investment decisions. Asset Impact is a core part of GRESB’s platform, supporting financial institutions in decarbonizing not just infrastructure and real estate but other climate-critical industries. A GRESB product line, Asset Impact delivers granular asset-based emissions and activity intelligence across a growing range of sectors—oil & gas, automotive, cement, chemicals, power generation, steel, and more—that are critical to the low-carbon transition.

Asset Impact’s innovative approach to data and analytics tackles a core challenge lenders and investors worldwide face: how to access detailed, forward-looking, independent data required for assessing physical and transition risks, aligning investments with evolving market expectations, and meeting growing regulatory requirements.

Explore the latest insights from Asset impact:

- A new practical guide to EBA Pillar 3 Disclosures

A step-by-step guide for banks on how to improve climate risk reporting using structured and asset-based data, created in collaboration with ESG Book. - Assessing the credibility of claims with examples from the automotive sector

An on-demand webinar examining the credibility of climate claims and a sector deep dive into the forward-looking outlook for car manufacturers worldwide. - What is asset-based data?

A concise explainer on how granular climate data is reshaping risk management and driving sustainable finance.

Learn more about Asset Impact and explore how your team can leverage asset-based data on energy, transport, and industry—pass this on to colleagues in risk, climate, or portfolio strategy.

GRESB events

Beyond Compliance: Leveraging Sustainability for Real Impact in Residential Real Estate

Residential real estate has become the largest sector in the GRESB Real Estate Benchmark, now representing more than one-third of reported assets.

Join GRESB and Conservice on April 29 to dive into residential—we will be looking at sustainability-related trends, regulatory developments, and the many ways companies can leverage environmental and social strategies as a tool to drive positive change across the residential.

Setting the Standard: A New Approach to Energy Efficiency

As the real estate industry transitions towards more rigorous energy efficiency standards, the shift from relative to absolute performance benchmarks is becoming a critical factor in sustainability strategies.

This webinar will explore the evolving energy efficiency landscape, focusing on the alignment between GRESB’s updated methodology and the ASHRAE Standard 100:2024.

GRESB insights

The Pulse by GRESB

The Pulse by GRESB is an informative content series featuring the GRESB team, partners, GRESB Foundation members, and other experts, published on Spotify, Apple Podcasts, and YouTube. Listen to the latest episodes below:

GRESB’s energy efficiency playbook: Key updates for 2025

In this insightful episode, Charles van Thiel, Director of the Real Estate Standard, Ben Thomas, RESC Member, and Parag Cameron-Rastogi, Director of Real Asset Analytics, unpack the latest updates to the GRESB Real Estate Standard. Together, they explore how GRESB is now recognizing both top-performing energy-efficient assets and those actively improving.

The case for clean energy: Unlocking incentives & opportunities for on-site renewables

Join host Reid Morgan, Manager, Member Relations, in conversation with Peter Light, CEO and Co-Founder of Lumen Energy, as they dive into the exciting opportunities and real-world challenges of bringing on-site renewable energy to commercial real estate.

Listen to the episode or read the transcript.

GRESB case studies

GRESB’s latest Participant Q&A highlights LCOR’s strategic approach to sustainability in the residential multifamily real estate sector. With nearly 50 years of experience, LCOR is a fully integrated development, investment, and operating company focused on core urban areas across the eastern United States.

Since 2022, LCOR has participated in the GRESB Real Estate Assessment with guidance from GRESB Partner breea, improving its funds’ average GRESB Scores by 15 points, enhancing investor engagement, and taking major strides in deploying property technologies that boost operational efficiency, lower costs, and support resilient, connected communities.

“GRESB has helped us better understand where to allocate resources most effectively to improve environmental performance, climate resiliency, and boost the bottom line,” shared Mike Hogentogler, Chief Operating Officer at LCOR.

See more GRESB manager and investor case studies.

Industry Insights from our Partners and Members

Industry insights from our partners and members into “Data Quality, Coverage & Comparability” and other rolling topics:

The Power of Data: A Real Estate Game Changer | Utopi Ltd

Data is transforming real estate by enabling better decisions, improving building performance, and protecting asset value. This article explains why high-quality data is essential—not just for efficiency, but for staying competitive and compliant.

From fragmented to unified: How real estate can achieve 100% energy data coverage | Noda

Real estate portfolios often struggle with fragmented energy data due to outdated collection methods and lack of tenant-level submetering. Overcoming these barriers through real-time monitoring and unified data systems is essential for effective energy management and sustainability initiatives.

How fund and asset managers can effectively tackle ESG data and reporting challenges | Catalyst

Fund and asset managers face increasing pressure to enhance reporting. Implementing standardized frameworks, leveraging third-party data assurance, and integrating advanced technologies are key strategies to improve data accuracy and meet investor expectations.

Data coverage and quality: An industry wide challenge | JLL

In commercial real estate, robust performance hinges on comprehensive, high-quality data. Challenges like inconsistent data collection and limited tenant-level insights can impede sustainability efforts. Addressing these issues is crucial for informed decision-making and aligning with evolving industry standards.

Measured or made up? Why not all sustainability data should be treated the same | EVORA

In real estate, not all energy data is equal. Mixing true meter readings with estimates or manual entries undermines reporting and decisions. Trust comes from traceable, automated data—not guesswork.

Interested in contributing? Check out the 2025 GRESB Editorial Calendar for fixed monthly topics and submission guidelines. The topic for May is “Data Centers (Real estate & Infrastructure).”

Upcoming Industry Events

8th Sustainable Investor Summit | May 13 – May 14 | Frankfurt

Discover the latest sustainability investment trends and strategies at SIS 8. Institutional investors, asset managers, companies, and experts will meet in Frankfurt on May 13 to discuss the latest developments in sustainable finance. Alexander Roznowski, Business Development Manager at GRESB, will be speaking at the event.

CFA Chicago Live 2025 | May 5 – May 7 | Chicago, USA

Engage with industry leaders and a global network of peers to explore the themes shaping the future of investment. Paul Vozzella, Sales Director – Eastern Region, will be attending the event, representing both GRESB and Asset Impact.

SuperReturn Climate & Energy Transition | June 2 – June 4

Join us at SuperReturn Climate & Energy Transition, where sustainability, infrastructure, and innovation take center stage. Don’t miss Roxana Isaiu and Giulio Comellini leading an LP-only roundtable focused on the financial risks and opportunities of sustainability in real assets, and Cathy Granneman speaking on AI-driven energy demand.

LPs attend for free; GPs get 10% off with code FKR3593GRESB.

Careers

GRESB is growing and looking for new people! Please feel free to share with your network. Our most recently added open positions:

- QA Engineer (2-3 years experience) | Amsterdam

- Events Internship (Sustainability) | Amsterdam

- Client Relationship Manager, Asset Impact | Amsterdam | Paris | London | Berlin

- Working Student – Finance and Business Support | Amsterdam

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletter.