2017 has been an outstanding year for GRESB. From collaborating with some of the most influential institutional investors in the world to achieving record participation levels in our Assessments, here are some of the biggest highlights of the year:

Growing Market Coverage

- We grew our Investor Membership to over 70 institutional and retail investors, collectively representing USD 17 trillion in institutional capital.

- We achieved double-digit percentage growth rates across all our Assessments – Real Estate, Infrastructure, and Debt – underlining our position as the global ESG benchmark for the sector.

- For the first time, we collected ESG Disclosure data for all REITs and listed property companies, not only those that participate in the GRESB Real Estate Assessment.

Improving Data Analytics

- We rolled out new features and enhancement to the Assessment Portal including new asset level graphs in the Real Estate Benchmark Report, more granular validation tracking and improved performance indicator reporting.

- We further enhanced our quantitative outlier detection system and introduced more precise reporting requirements at the front end to ensure more accurate, more comparable and more actionable data.

- We launched the Real Estate Pre-Assessment – a new ESG evaluation specifically for real estate companies and funds that are raising capital, undergoing due-diligence or have a short hold strategy, as well as those that have recently started to incorporate ESG into their operations.

Deepening Industry Engagement

- We held 11 Industry Working Group meetings, 12 Benchmark Committee meetings, 10 Advisory Board meetings and 3 Board meetings in 2017.

- We published 14 Public Results Snapshots, 12 newsletters and, together with our partners, published over 80 posts on GRESB Insights.

- We held 61 events and training sessions attracting an audience of 3,435 attendees and held our first annual GRESB Spring conference in London on May 2nd, hosted by our Global Partner Siemens.

- We answered over 2,300 helpdesk tickets, responding to 86% of the tickets within 12 hours.

- We hired 8 new employees in 2017 bringing our staff numbers to 20 and moved to new offices in Zuidas, Amsterdam’s financial district, to support our growing team.

Take a look at the infographic below capturing the highlights of the year.

[icon name=”arrow-circle-down” class=”” unprefixed_class=””] Download the 2017 Year in Review infographic

What it all means for sustainability performance

Not only is our market coverage growing but the sector is moving towards higher levels of sustainability performance. Looking at the global results from the 2017 Real Estate Assessment we can see that the sector:

- Reduced like-for-like energy consumption by 1.1% – equivalent to 79,827 U.S. homes,

- Reduced like-for-like carbon emissions by 2.2% – equivalent to 113,000 passenger cars,

- Reduced like-for-like water consumption by 0.5% – equivalent to 999 Olympic swimming pools, and

- Diverted 52.9% of landfill waste – equivalent to 399,008 truck loads.

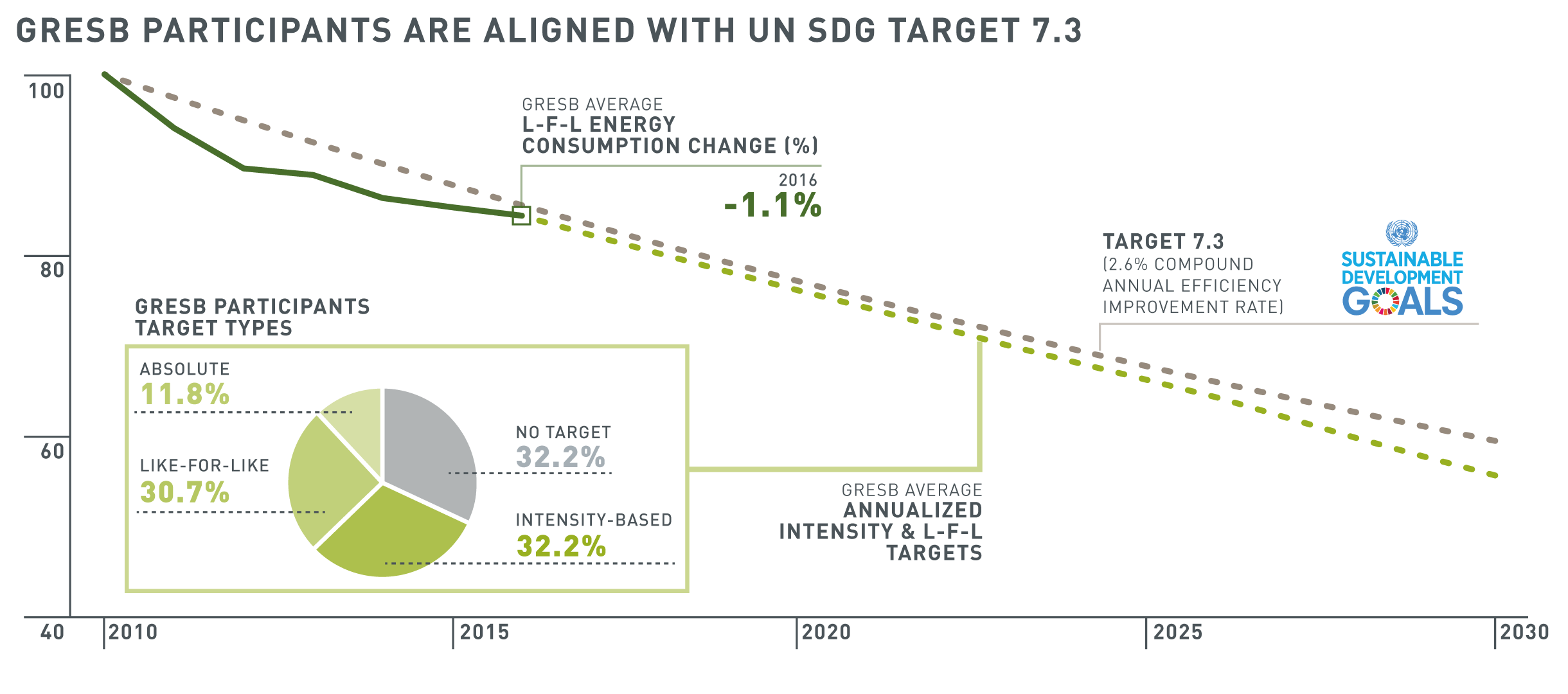

To determine how these reductions stack up against key national and policy goals, we tracked the performance of the GRESB real estate universe against target 7.3 of the United Nations Sustainable Development Goals (UN SDGs). Target 7.3 aspires to double the energy efficiency rate of improvement by 2030, which requires a 2.6% compounded improvement rate to achieve it. By tracking like-for-like portfolio energy consumption change as a determinant to measure energy efficiency improvement, the results show that GRESB participants that submitted data have stayed ahead of the target between 2010 and 2016.

Not surprisingly, these tangible improvements in ESG performance are reflected in improved GRESB scores year-on-year. The chart below plots the distribution of scores since 2012. It shows how investor demand on companies and funds to report to GRESB is powering a global market transformation towards higher levels of sustainability performance.

Here’s to 2018

We thank you for the time and attention you’ve given to our work over the past year. Our shared vision of “Sustainable Real Assets” is too large for one organization to tackle alone. It can only be achieved if we collaborate to solve the tough sustainability challenges facing our sector together. We’re all on this journey together and, in line with the call to partnership and cooperation set out Goal 17 of the UN SDGs, we invite you to continue along the journey with us in 2018.

Right now GRESB analysts are working closely with our Advisory Boards, Benchmark Committees and Industry Working Groups on the 2018 Assessments and we will be publishing the Pre-Release materials in March 2018. At the beginning of 2018 we will be releasing the details of our “Sustainable Real Assets 2018” Spring conferences, establishing a new Debt Advisory Board, holding our first Industry Working Group for the new GRESB Resilience Module and announcing a new strategic partnership in Asia.

If you’re not already a subscriber, please sign up for our newsletter to stay up to date.

Here’s to a happy and productive 2018.

Sander Paul van Tongeren

Co-Founder and Managing Director

GRESB