As the importance of sustainability continues to shape financial markets, reporting regulations are rapidly evolving around the world. However, this regulatory landscape remains in flux and is marked by shifting priorities, delays, and, in some cases, rollbacks. For managers and investors, this results in an environment that is increasingly complex, fragmented, and unpredictable—making it challenging to plan, act, and compare performance with confidence.

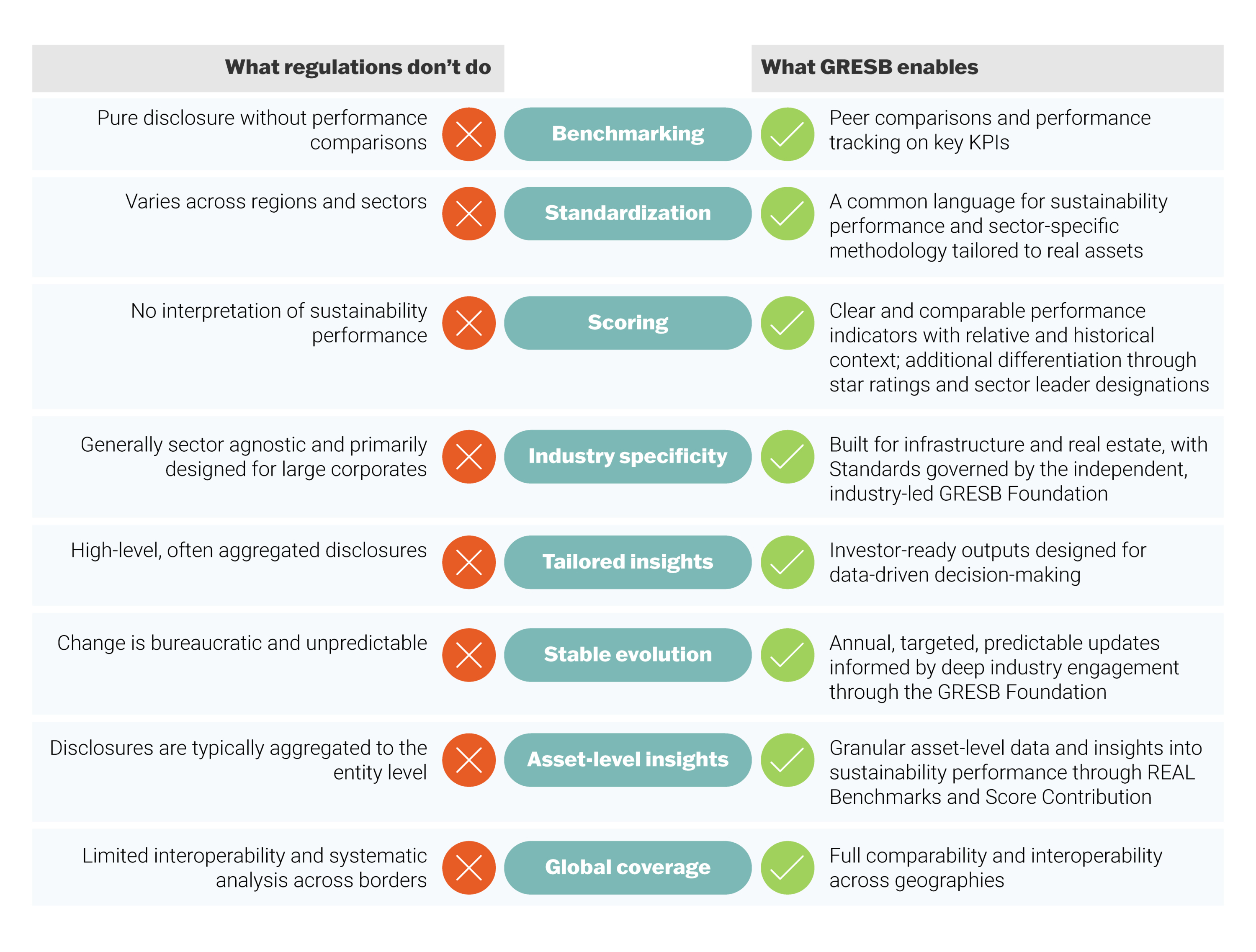

As a trusted partner in fostering sustainable decision-making, GRESB brings stability to this environment as it is purpose-built to meet the real-world needs of asset managers and investors who are striving to go beyond compliance. As an industry-led organization, GRESB offers an independent, structured, and globally comparable framework that complements—and extends beyond—sustainability regulations.

By delivering tailored insights, sector-specific benchmarks, and decision-useful performance analytics, GRESB empowers real asset stakeholders to turn fragmented disclosures into meaningful strategies that enhance resilience, efficiency, and financial value.

Where regulations often mandate transparency, GRESB enables action.

What makes the regulatory environment challenging?

Complex

Sustainability regulations are often densely convoluted with layers of complexity that can require the assistance of legal consultants to unravel. Moreover, these regulations are primarily sector-agnostic, mostly comprising generalized disclosures in a one-size-fits-all approach that can make them difficult to interpret through the lens of certain asset classes.

Fragmented

There is little consistency across jurisdictions, resulting in many regulations differing in terms of their applicability, scope, timelines, definitions of materiality, requirements, assurance, and ultimately the type of data needed to comply.

Unpredictable

Regulatory frameworks are frequently revised, delayed, or rescinded. Examples include the ultimately abandoned SEC Climate Disclosure Rule in the US, and the Omnibus Package overhauling the sustainability reporting framework in the EU.

With these trends expected to continue, the accompanying volatility reinforces the need for a steady, reliable source of performance insights—one that evolves methodically and predictably.

What makes GRESB purpose-built for real assets?

GRESB offers a set of annually updated, global standards that create a common language specifically tailored to the nuances and needs of real assets. It complements regulatory disclosure frameworks with actionable tools that drive performance and long-term success. GRESB’s core foundation of consistency, comparability, industry-specificity, and global applicability results in the GRESB Assessment offering a stable, universal framework that regulations have not been able to successfully facilitate.

Sector-specific

The GRESB Standards are carefully developed through deep industry engagement by the Infrastructure and Real Estate Standard Committees and are overseen by the GRESB Foundation. This ensures alignment with the realities of real assets, in contrast to sector-agnostic regulatory disclosures.

Harmonized

GRESB has developed a centralized system for capturing, validating, assessing, benchmarking, and scoring sustainability data which enables investors to compare assets and funds regardless of where they are located in the world.

Stable

GRESB operates on an annual cycle with transparent timelines and standards changes driven by the industry through the GRESB Foundation and communicated in advance of implementation. In turn, the stability of the GRESB Assessment provides year-over-year traceability and enables measurable improvements over time through high-quality validated data and actionable insights.

While sustainability compliance legislation largely focuses on disclosure, GRESB is a strategic partner for resilient and high-performing investments across real assets offering a global, standardized, stable, sectoral, materially relevant benchmark that drills down into asset-level data and provides actionable insights that are trackable over time and relevant anywhere in the world.

GRESB & major sustainability regulations

Read more insights on how GRESB interacts with major sustainability regulations below.