Today marks the end of the GRESB Health & Well-being week. This didn’t mean that we all got to work from our respective oases of inspiration for the past 5 days (although the Amsterdam office does a very good job at keeping us alert and creative), but that our internal “to do” list was driven by research and development of Health & Well-being indicators in the context of the 2018 Real Estate Assessment. Plus, our Insights page was filled with a series of diverse blog posts from our partners – click here for your weekend reading list.

Following the submission deadline for the 2017 assessments, the GRESB team is not only preparing the summer validation and analysis period but also laying the groundwork for the 2018 assessment cycle. And to do so, we have selected a number of topics for focused research and engagement in order to refine existing indicators and evolve towards a more efficient data reporting structure in 2018.

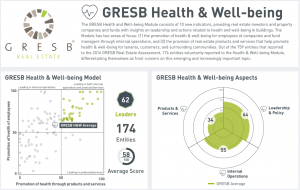

Not coincidentally, the first of a series of three Industry Working Groups (IWG), was dedicated to the topic of health and well-being. This came in response to the notable increase in the level of acknowledgment of the topic, coupled with a widespread market interest in tracking and benchmarking health and well-being indicators. We observe a transition from energy and carbon as traditional metrics of real estate performance to a more encompassing set of indicators including tenant welfare and healthy buildings.

Takeaways from the Industry Working Group

This is why, after two years of collecting health and well-being data on a voluntary basis, we believe that the topic should become an integral part of the Real Estate Assessment, as a holistic set of indicators used for market differentiation. The 60-minute sessions proved to too short for everything we wanted to cover, but here are a few takeaways. These will inform how health and well-being will be covered by GRESB Real Estate in 2018.

- The participation in the 2017 voluntary Health & Well-being Module showed a strong increase (join us for one of our September results launch events for more insights). The drivers for participation vary – from wanting to be recognized as a health and well-being front runner to increasing tenant retention.

- We have seen an incredible demand for metrics and strategies for incorporating health and well-being. People understand there is an opportunity for using health for market differentiation.

- Health and well-being is becoming an important selling point for tenants but is yet to be properly incorporated into metrics of the core business and investor preferences.

- There is a need for direct translation of health and well-being concepts into measures of productivity, tenant retention, reduction in the rate of complaints, attracting investor capital.

- There is a good general understanding of how individual strategies impact productivity, but not how they collectively contribute to better spaces. This is why building certifications on health are important – they research and test the holistic approach to a level that can be explained and potentially replicated.

- It is important to differentiate between health and safety (which often refers to traditional occupational safety issues such as slip and falls, workplace hazards and toxic exposures) and health and well-being (which introduces a broad range of activities that address the determinants of health or the conditions that lead to health outcomes).

- GRESB is uniquely positioned to facilitate conversations between groups of people that wouldn’t otherwise connect – health and well-being can touch on various divisions of a company and it can mean totally different things to different people. It doesn’t necessarily matter who spearheads health and well-being initiatives, but rather who is involved in developing them.

Many questions are still looking for an answer, of which some of the most important ones remain:

- How to measure impact? – Quantifying impact is an important topic for sustainability measures in general.

- How can health and well-being effectively translate into metrics of productivity and quality investments?

- What is the business case for health & well-being?

The same questions were asked not so long ago about good (read – innovative) sustainability practices. An increasing body of research, coupled with an impressive number of asset and portfolio level examples of value creating strategies, helped answer them and caught the attention of capital providers. It is only a matter of time until we observe the same trend here.

In the end, happy and loyal tenants = happy investors.

This article is written by Roxana Isaiu, Director, ESG & Real Estate.