.

ESG data for real estate and infrastructure

The GRESB Assessments capture the most important ESG data related to the sustainability performance of real estate and infrastructure companies and assets. Taken together, these metrics are used to assess an organization’s exposure to various risks and highlight opportunities to invest in strong-performing companies.

With data points covering everything from greenhouse gas emissions to the percentage of employees that complete a satisfaction survey, each GRESB Assessment is split into components. Each component is then divided into aspects, which comprise several related and individually scored and weighted indicators. The methodology is consistent across regions, investment vehicles, and property types and aligns with international reporting frameworks, such as TCFD, GRI, and PRI.

Each indicator relates to one of the three ESG dimensions (E, environmental; S, social; and G, governance):

- E – environmental indicators relate to actions and efficiency measures undertaken in order to monitor and decrease the environmental footprint of a portfolio

- S – indicators relate to an entity’s relationship with and impact on its stakeholders and the direct social impact of its activities

- G – indicators relate to the governance of ESG, policies, and procedures as well as the approach to ESG at the entity level

Overarching metrics

We provide detailed aspect-level and individual indicator-level assessments of performance. For an in-depth breakdown of every performance indicator score included in the GRESB Real Estate and Infrastructure Assessments, please review the respective scoring documents, which can be found in GRESB Documents.

While indicators vary across assessments, components, and asset classes, GRESB has identified three key overarching metrics, among others, that have gained prominence across real assets:

- Greenhouse gas (GHG) emissions: GHG emissions are the primary driver of anthropogenic climate change and a critical source of local, regional, and global environmental impacts. Its accounting has developed significantly in recent years. Many countries have introduced mandatory GHG emissions reporting, in addition to entities often setting their own voluntary GHG emission targets. Evaluating emissions within participants’ portfolios has become standard practice, and entities are increasingly looking at emissions throughout their value chains.

- Energy: Energy consumption accounts for a large share of real assets’ environmental footprint. The use of energy is both a direct cost and a critical source of local, regional, and global environmental impacts. Data measurement and consistent reporting of energy consumption help entities conceptualize overall energy consumption, increase the energy efficiency of their portfolio, and reduce economic and environmental impacts associated with fossil fuel energy use.

- Water: Consistent collection of water consumption data provides property companies, assets, and fund managers the information to monitor their environmental impact, reduce the burden on potable water consumption and wastewater systems, assess exposure to risks of disruptions in water supplies, and reduce water expenditures. The inflow/withdrawal of water can have significant impacts on the environment and communities. Relatively high levels of water withdrawals can potentially create liabilities or regulatory risks.

ESG metrics for real estate

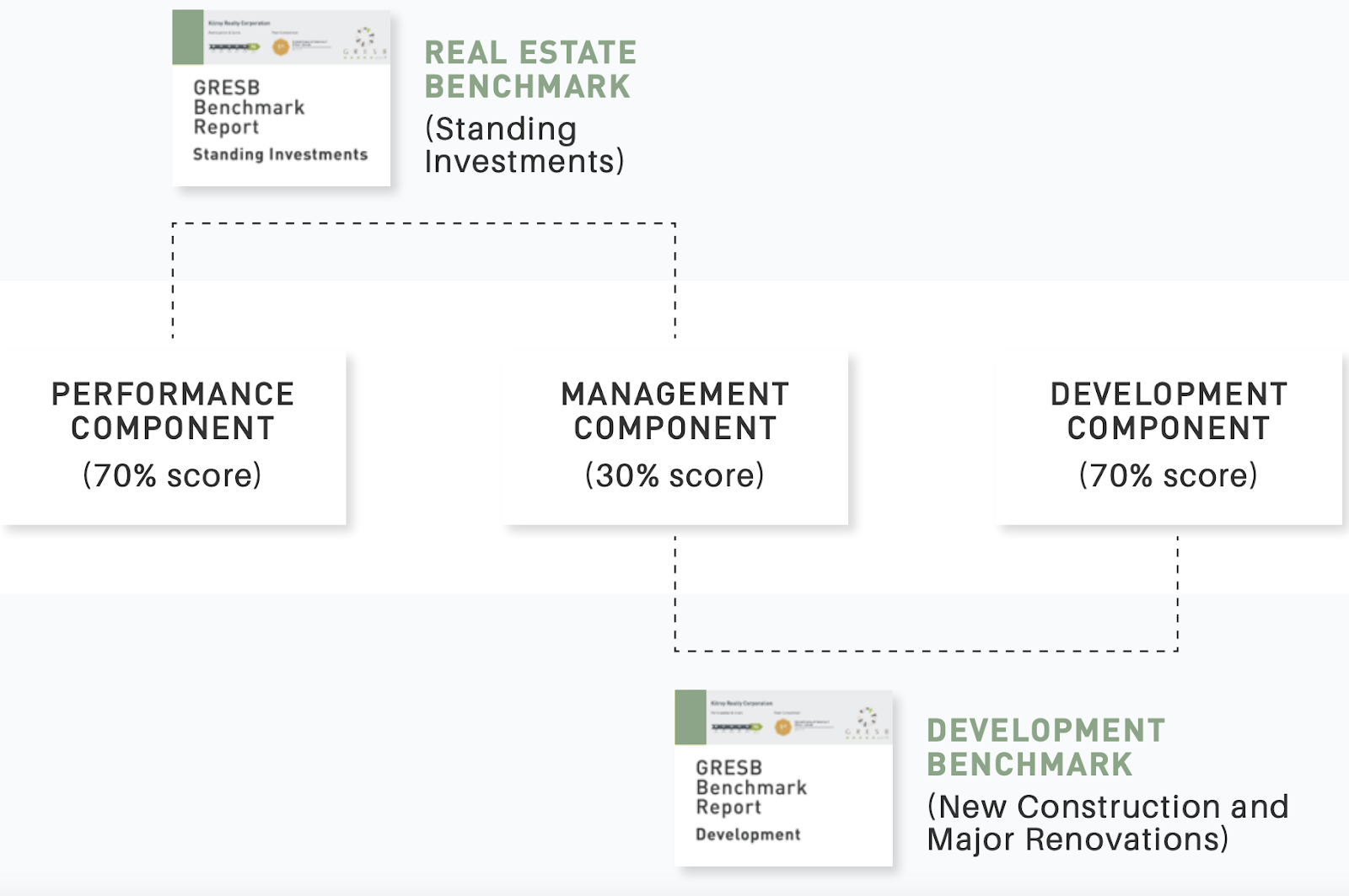

The GRESB Real Estate Assessment looks at data covering a number of ESG issues and generates two benchmarks: The GRESB Standing Investment Benchmark and the GRESB Development Benchmark.

The assessment can help several real estate stakeholders – such as listed property companies, private property funds, developers, and investors that invest directly in real estate – by providing actionable information and tools to monitor and manage the ESG risks and opportunities of their investments and to prepare for increasingly rigorous ESG obligations.

Members, investors, and participants can decide whether they would like to report on specific, individual components, or report on all the components. These will provide access to different reports, with all reports including a GRESB Score and a GRESB Rating. Please refer to the table on the right for an overview of the results available after reporting on each component of Real Estate.

Components, aspects & performance indicators

Management Component

The Management Component measures the entity’s strategy and leadership management, policies and processes, risk management, and stakeholder engagement approach, with information collected at the entity level. The Management Component comprises five aspects, each of which contains two or more performance indicators.

Performance Component

The Performance Component measures the entity’s asset portfolio performance, composed of information collected at the asset portfolio level. It is suitable for any real estate company or fund with operational assets. The Performance Component comprises ten aspects, each of which contains one or more performance indicators. Aspects include Risk Assessment, Targets, Tenants & Community, Energy, GHG, Water, Waste, Data Monitoring & Review, and Building Certifications.

Development Component

The Development Component measures the entity’s efforts to address ESG issues during the design, construction, and renovation of buildings. This component is suitable for entities involved in new construction (building design, site selection, and/or construction) and/or major renovation projects, with ongoing projects or completed projects during the reporting year. The Development Component comprises eight aspects, each of which contains two or more performance indicators. Aspects include ESG Requirements, Materials, Building Certifications, Energy, Water, Waste, and Stakeholder Engagement.

You can learn more about the assessment and how each component is divided on our Real Estate Assessment page.

Scoring Model

The sum of the scores for each indicator adds up to a maximum of 100 points. The maximum score for each aspect is a weighted element of the overall GRESB Score. GRESB takes into account the unique characteristics of different property types, not only in benchmarking absolute scores but also in the scoring of a selection of indicators. A selection of indicators is scored based on each portfolio’s main property types – this holds specifically for the Energy, GHG, Water, Waste, and Building Certifications indicators. Please refer to the chart on the left for score breakdown across components.

Aggregation rules handbook

To provide clarity on the calculations taking place in the GRESB Portal when aggregating asset-level data to property sub-type level data, we have created an aggregation rules handbook. This is one of the insightful documents you will find under GRESB Resources.

ESG metrics for infrastructure

At GRESB, we offer two complementary Infrastructure Assessments: the Infrastructure Fund Assessment and the Infrastructure Asset Assessment.

Both address critical aspects of ESG performance through a globally applicable and standardized reporting and benchmarking framework. The Fund Assessment is intended for infrastructure funds and portfolios of assets, while the Asset Assessment is meant to be completed by the individual underlying assets (portfolio companies). Both Assessments cover the full breadth of infrastructure sectors, including:

- Data infrastructure

- Energy and water resources

- Environmental services

- Network Utilities

- Power generation x‑renewables

- Renewable power

- Social infrastructure

- Transport

The GRESB Infrastructure Assessment provides investors with actionable information and tools to monitor and manage the ESG risks and opportunities of their investments and to prepare for increasingly rigorous ESG obligations. In turn, GRESB Infrastructure Assessment participants receive comparative business intelligence on where they stand against their peers, a roadmap with actions they can take to improve their ESG performance, and a communication platform to engage with investors.

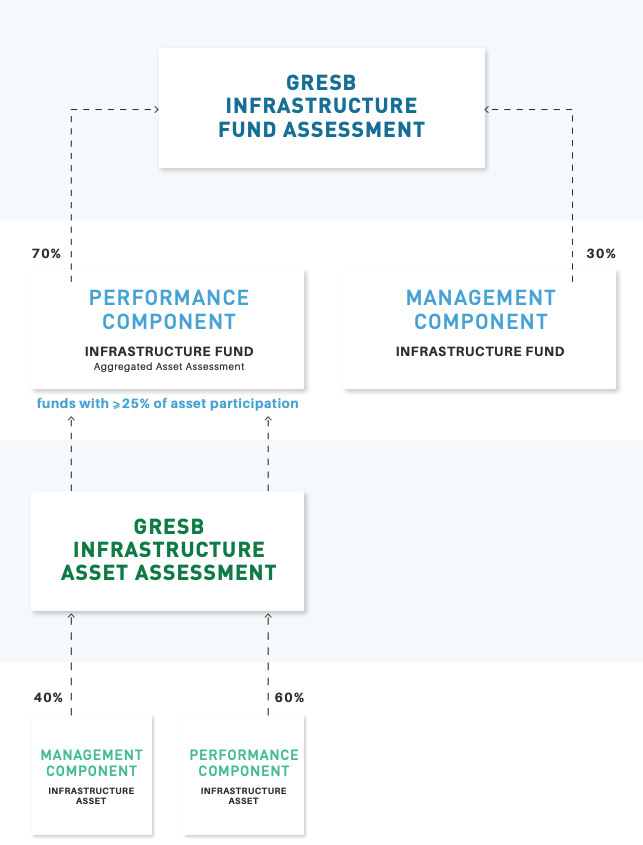

The Infrastructure Fund Assessment is split into separate Management and Performance Components. This structure allows entities to complete either or both components. Entities starting off on their sustainability journey are thus able to first develop their data collection processes before reporting performance data.

Infrastructure funds, portfolios, and companies can participate in the Fund Assessment. Common examples of infrastructure funds include:

- A sector-focused fund with investments in renewable energy

- A geographic-focused fund with investments in a specific region, such as North America or Oceania

- A segregated account that is globally diversified offering exposure to several sectors

Components, aspects & performance indicators – Infrastructure Fund Assessment

Management Component

All funds must complete the Management Component – Infrastructure Fund. The Management Component focuses on management and processes and is pitched at the organizational/fund level. The Management Component is suitable for any type of fund. Funds completing the Management Component will obtain a Management Score – Infrastructure Fund.

The 2022 Management Component – Infrastructure Fund consists of 22 indicators across five aspects:

- Leadership

- Policies

- Reporting

- Risk Management

- Stakeholder Engagement

Performance Component

Funds do not complete a Performance Component themselves. Instead, the underlying assets of the fund complete it. If 25% or more of the fund’s underlying assets complete the Infrastructure Asset Assessment, the scores of these assets are averaged and the fund will obtain a Performance Score – Infrastructure Fund.

GRESB Score

Importantly, the premier measurement of ESG performance for investors is the full GRESB Score – Infrastructure Fund (i.e. Management plus Performance Components). You can learn more about the assessment and how each component is divided on our Infrastructure Fund Assessment page.

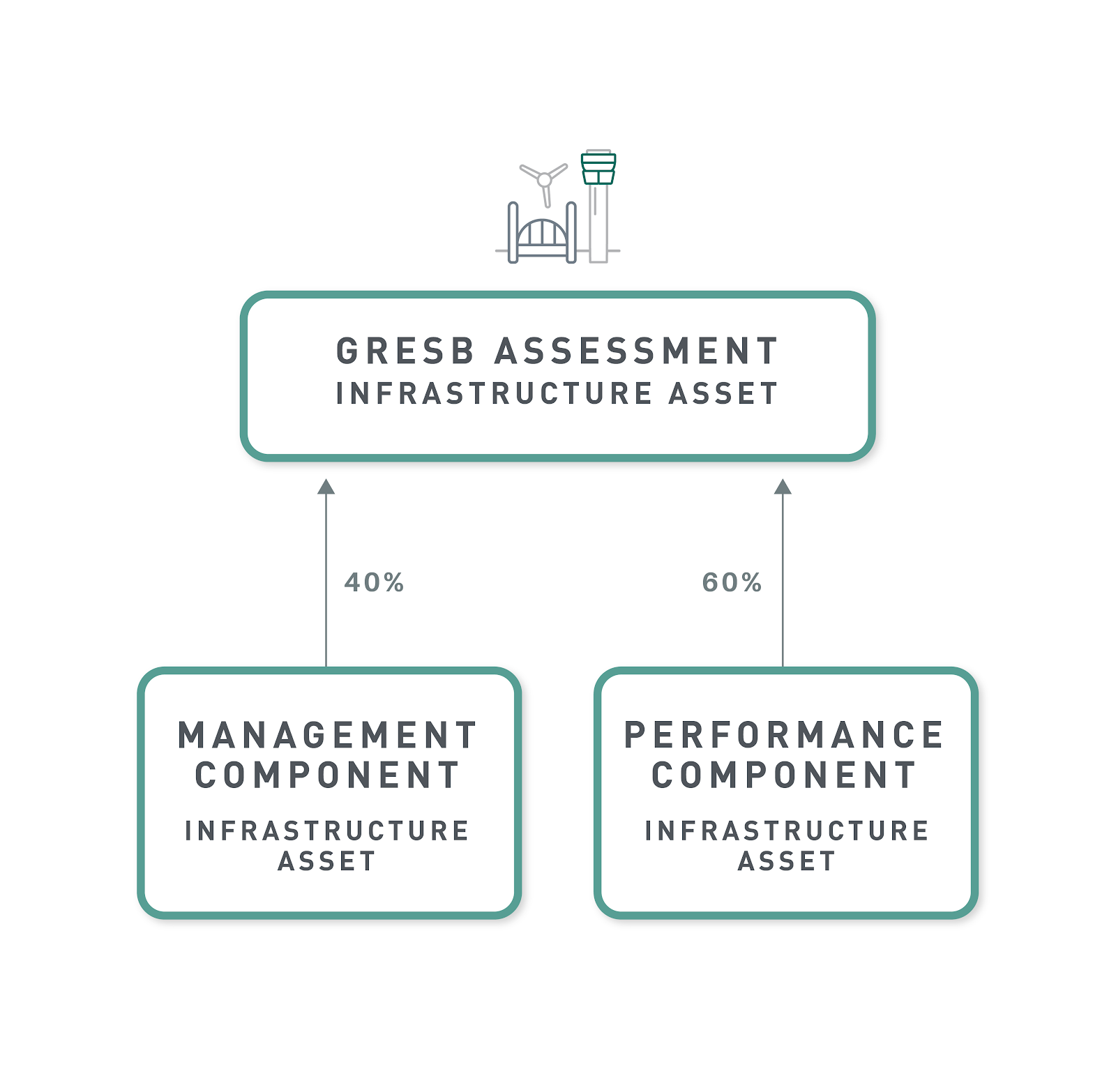

Scoring Model

The GRESB Infrastructure Asset Assessment is split into two components: the Management Component and the Performance Component. The overall GRESB Score – Infrastructure Asset is the sum of the Management Score – Infrastructure Asset and the Performance Score – Infrastructure Asset. The sum of the scores for each indicator adds up to a maximum of 100 points. The maximum score for each aspect is a weighted element of the overall GRESB Score. Please refer to the chart on the left for score breakdown across components.

Components, aspects & performance indicators – Infrastructure Asset Assessment

Management Component

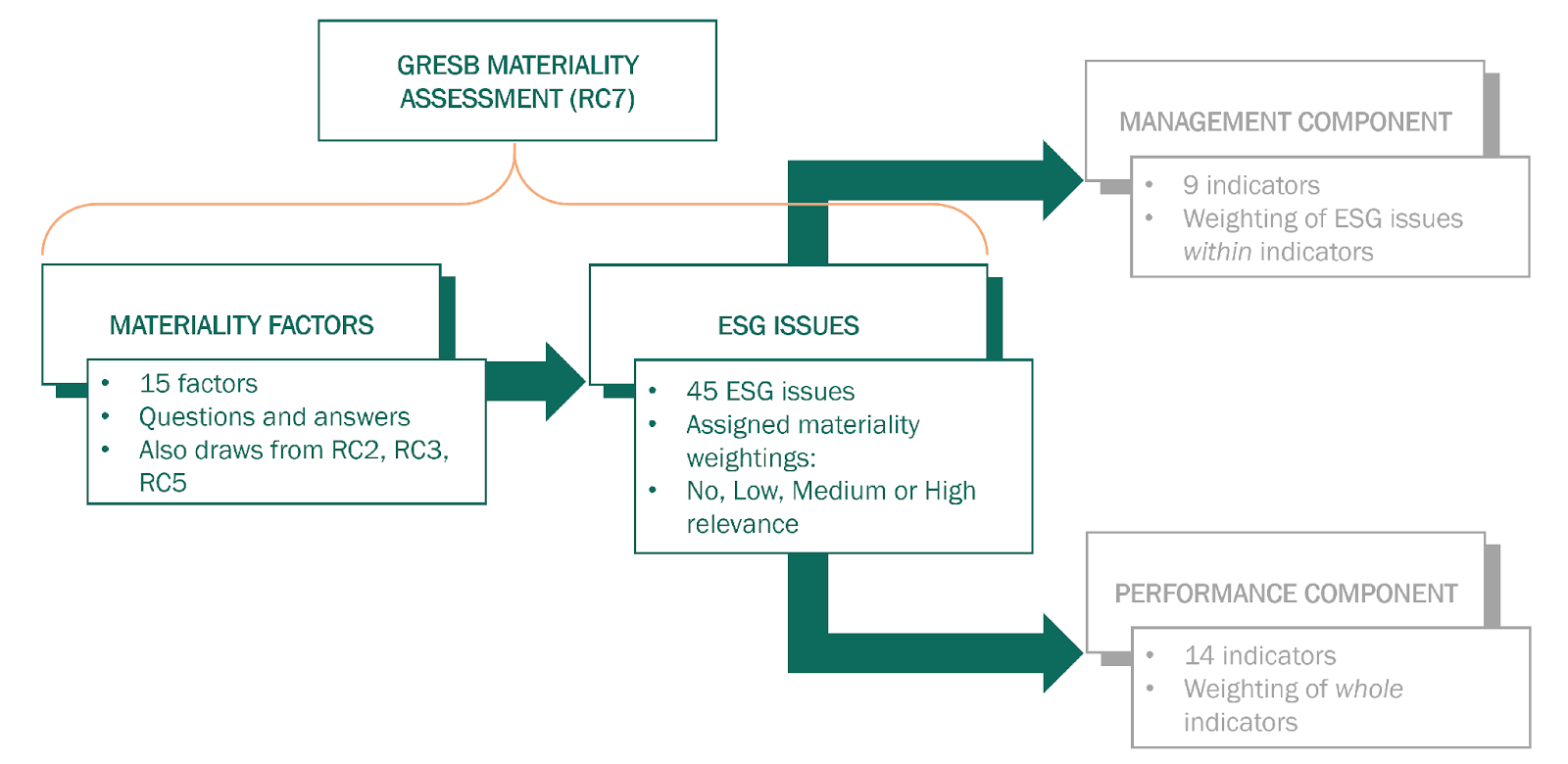

For the Management Component, the indicators in the aspect “Policies” and six indicators in the aspect “Risk management” are subject to materiality-based scoring. These indicators cover the standard list of (45) ESG issues and are scored based on how many of the material issues are addressed. Consider, for example, the indicator “Policies on environmental issues (PO1)”. Each of the 13 standard Environmental issues will receive a materiality weighting from the GRESB Materiality Assessment.

Performance Component

For the Performance Component, most indicators are subject to materiality-based scoring (only Implementation, Output & Impact, and Certification & Awards aspects are not). Each indicator addresses a specific ESG issue, so the materiality weightings from the GRESB Materiality Assessment apply directly to the weighting of each whole indicator.

Indicators relating to ESG issues of high relevance are weighted highly, and those of medium relevance moderately. Indicators relating to issues of no or low relevance are not scored. The weighting of the material (scored) indicators is automatically redistributed to ensure that the Performance Component retains its overall weighting of 60% of the Asset Assessment. For example, for an Asset with “Renewable power: Solar power generation” as its primary sector, the indicator “Air pollution” will not be scored and more weight will be given to other material indicators (like “Energy”). This means that materiality-based scoring brings the focus only on material ESG issues, minimizing the reporting burden for participants.

You can learn more about the assessment and how each component is divided on our Infrastructure Asset Assessment page.

The Materiality Tool

While the GRESB Materiality Assessment and the whole materiality-based scoring process are straightforward to understand and apply, some participants may want to understand them, and how they apply to their situation, in more detail. GRESB provides an Excel-based GRESB Materiality & Scoring Tool for this purpose.

.

ESG frameworks and stakeholder engagement

When crafting the GRESB Assessments, we count on different resources to be able to decide what is the most relevant and appropriate data to collect. Our Foundation is one of them.

The GRESB Foundation engages with the industry to arrive at a consensus on the GRESB Standards. These standards are a set of guidelines to assess and benchmark ESG and related performance of real and other assets. They are aligned with the Sustainable Development Goals, the Paris Climate Agreement, and major international reporting frameworks.

The ESG frameworks that GRESB engages most with include:

- Principles for Responsible Investment (PRI)

- The Global Reporting Initiative (GRI)

- The Sustainability Accounting Standards Board (SASB)

- The International <IR> Framework

- EU Sustainable Finance Disclosure Regulation (SFDR)

- Task Force on Climate-related Financial Disclosures (TCFD)

- CDP

You can learn more about which ESG initiatives we work closely with on our frameworks and stakeholders page.

The future of GRESB Assessments

In September 2021, GRESB launched an 18-month stakeholder engagement process to create a shared vision for future GRESB Standards and Assessments and to develop a strategic roadmap with all GRESB Members and Partners for implementation. Being an industry-led organization, we put the voice and priorities of our members and partners at the forefront of our work. This means that we have tailored our assessments to analyze the most relevant aspects and indicators for the industry.

Creating and following this roadmap will help ensure that GRESB Standards and Assessments continue to provide value as they evolve into the future while remaining globally relevant for all our members and partners. In other words, the metrics used in our analysis frameworks might eventually change to some degree in order to keep up with the market advancements and legislative requirements. Please see 2023 GRESB Standards page for more information.

Would you like to learn more about how we analyze ESG metrics?

Our validated ESG performance data and peer benchmarks can be quite complex and granular. Feel free to reach out to us with your inquiry. Our team would be happy to take you through the assessments and reports.