Our industry is engaged in an important dialogue to improve the efficiency and resilience of real assets through transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

As ESG performance becomes a defining factor in real estate investment and operations, green building certifications have become more than just a badge of honor. When leveraged during development and ongoing asset management and supported by strong data practices, certifications become essential tools for maximizing value, improving sustainability metrics, and achieving higher GRESB scores.

Integrating green certifications during development & asset management

Green certifications such as LEED, WELL, Fitwel, ENERGY STAR, IREM, and BREEAM are most impactful when integrated early. During development, design and material choices made with certification goals in mind help shape a building that performs sustainably from day one. Energy-efficient HVAC systems, low-flow water fixtures, and environmentally responsible construction materials aren’t just checkboxes—they’re long-term investments that pay off operationally and reputationally.

In asset management, certifications guide ongoing performance. Operational certifications like ENERGY STAR or BREEAM In-Use help benchmark performance and identify opportunities for improvement. Operational certifications also promote best practices for maintenance, management, and sustainable policies. Re-certifications also reinforce sustainability over a building’s lifecycle and ensure performance does not degrade.

GRESB rewards certifications in both new developments and operational assets. The 2024 standard updates even differentiate certification types and age, encouraging ongoing sustainability performance, not just design-time compliance. Looking ahead, GRESB is also carrying out a building certification evaluation process against revised building certification criteria, which were developed through industry engagement in 2024. As such, early and continuous certification strategies contribute positively to GRESB asset-level and portfolio-level indicators.

Data collection during due diligence

The foundation of any certification or ESG strategy is robust data. During acquisition due diligence, capturing ESG-relevant data is no longer optional—it’s a competitive advantage. From utility bills and system specifications to IAQ metrics and tenant satisfaction, due diligence should integrate environmental, social, and governance checkpoints.

Certifications depend on this information. ENERGY STAR, for example, requires 12 months of operational data; LEED O+M assesses energy, water, waste, and indoor environmental quality; and WELL requires health-related operational data. Missing data can delay or derail certification efforts.

Beyond compliance, this early data helps asset managers understand where a building stands and where to invest. Is the HVAC nearing end-of-life? Are tenant complaints suggesting poor air quality? These insights support informed decision-making and risk mitigation, both of which GRESB rewards.

Screening tool & readiness assessment for certifications

Choosing the right certification isn’t one-size-fits-all. A 30-story urban office tower may be a prime candidate for LEED or WELL Core, while a suburban multifamily complex might find Fitwel or ENERGY STAR more aligned to its budget and goals.

Starting at the portfolio level, properties can be screened based on available data and performance metrics to determine which assets may be likely candidates for certification and/or which certification rating system may be the best fit for the asset. From there, a green certification feasibility study is recommended, which includes a gap analysis: what’s already in place, what’s missing, and what’s realistically achievable. This analysis helps inform both CAPEX strategy and ESG targets. If a building is 70% of the way to LEED Silver, modest investments in lighting or water systems might unlock a certification—and with it, a value premium.

Certification frameworks themselves function as benchmarks and third-party verifications of performance. They establish consistent expectations across geographies and asset types. By using the rating systems as internal scoring tools, owners can compare buildings within a portfolio, even before formal submission.

GRESB integrates this logic: the presence of certifications, particularly at the asset level, contributes to scoring under Management, Performance, and Asset-level indicators. Leveraging them as screening tools helps ensure buildings are not only eligible for submission but also positioned competitively.

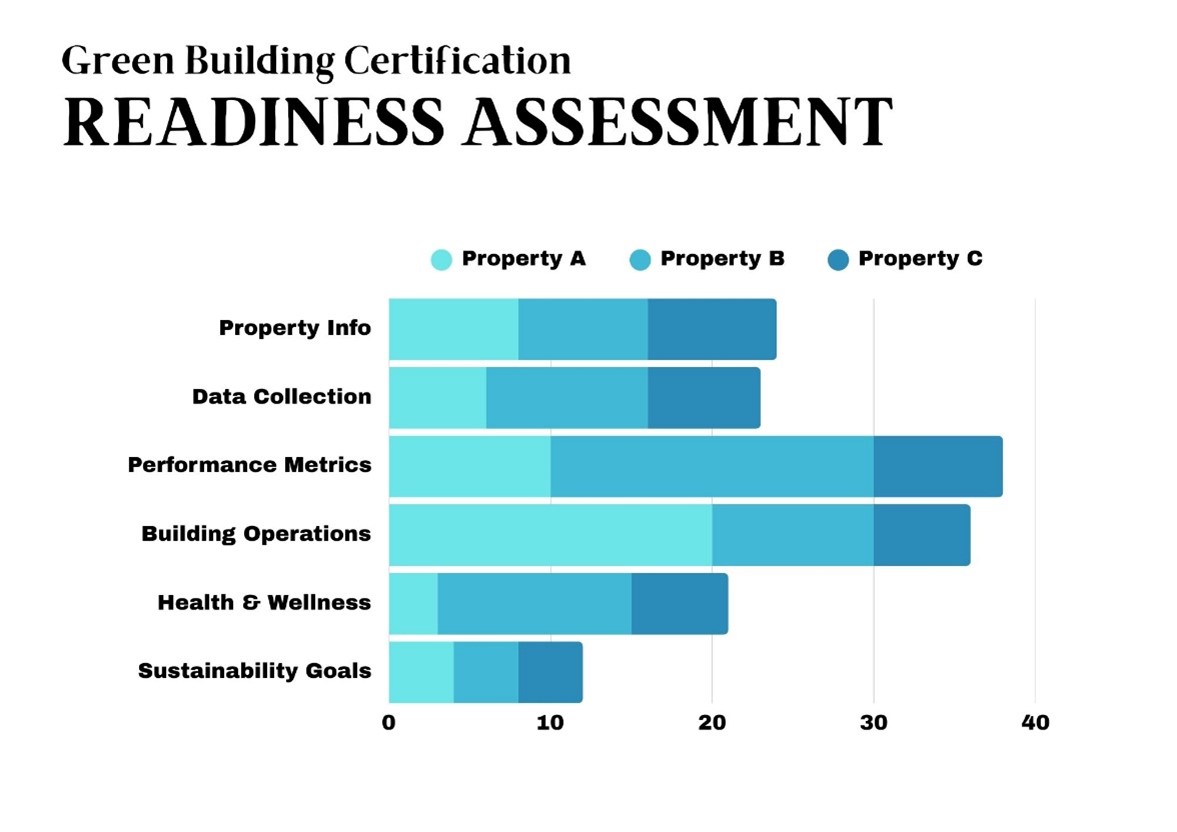

Graph: Example of a portfolio-level view of how multiple buildings are performing in the various categories, which allows clients to focus on improvements to prepare for certification.

Process & best practices for certification success

A successful certification strategy starts with an integrated team: asset managers, engineers, ESG consultants, and on-the-ground property teams. Clear roles and timelines are essential. Certifications should be mapped to construction or renovation schedules to avoid rework or missed opportunities.

Best practices include:

- Early feasibility review: Conduct a certification screening during pre-acquisition, capital planning, or project kickoff.

- Benchmarking: Use ENERGY STAR Portfolio Manager or similar tools to establish baseline performance.

- Stakeholder alignment: Ensure ownership, facilities, and tenants understand the certification goals.

- Documentation systems: Create a centralized repository for design specs, utility data, and inspection records.

- Maintenance planning: Include recertification timelines in asset management plans.

Certifications are documentation-heavy, detail-oriented, and require the participation of all the stakeholders in the property. Investing in project management tools and experienced consultants can accelerate timelines and reduce administrative burden.

ROI & the power of proactive ESG strategy

There’s a growing body of evidence that certifications drive ROI:

- LEED-certified buildings have shown a 3.7% rent premium over non-certified counterparts.

- Certified Class A urban offices can see up to a 25.3% sales premium per square foot.

- Operational savings from efficient systems reduce overhead over the long term.

- Higher tenant retention and satisfaction are linked to WELL and Fitwel certified spaces.

But the return isn’t just financial. Certifications support a proactive ESG strategy. Instead of responding to investor or regulatory pressure after the fact, certified buildings offer documented, third-party verified performance. This reduces exposure to greenwashing accusations and ensures resilience against changing regulations.

GRESB, investors, and regulators increasingly expect not just goals, but evidence. Green building certifications, backed by clean, timely, and transparent data, are a tangible way to prove commitment and performance.

When data is gathered continuously—not just for annual reporting—it becomes a strategic asset. It enables predictive maintenance, anticipates compliance risks, and supports agile capital planning. This is the foundation of a proactive, rather than reactive, ESG strategy.

Conclusion

Green building certifications are not just a final stamp of approval; they are roadmaps for better buildings. When embedded in development and asset management practices—and powered by quality data—they inform smarter decisions, reduce risk, and enhance asset value.

For real estate owners and managers, the path forward is clear: use certifications as strategic tools, collect actionable data from day one, and align efforts with investor expectations and frameworks like GRESB. In doing so, sustainability becomes more than a goal—it becomes a driver of long-term performance and resilience.

This article was written by Lance Collins and Brady Mills, Directors at Partner Energy. Learn more about Partner Energy here.