Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Following the hottest summer on record for certain areas of Europe, drought warnings, and unprecedented wildfires, climate change is at the forefront of our minds. Collectively, we are grappling with agreeing the right terms and definitions to structure our societal response. It may seem the reserve of a limited few, but increasingly these concepts are being debated in communities and boardrooms across the world. Both consensus and clarity are important.

Carbon neutrality and net-zero carbon are two of the most frequently used terms to define the requirements of action to mitigate climate change, however there is a significant lack of clarity around what they actually mean. Many frameworks have been developed in the last few years to try to help. In real estate alone, there are a variety of routes that investors are pursuing in defining and delivering their net-zero targets. The scope of these commitments ranges from the corporate level to asset level, with varying boundaries on the emissions sources encompassed by the targets.

The complex landscape is causing confusion for many market actors. This risks the misalignment of climate ambitions, detracting from what must be a focus on creating a zero-carbon economy and avoiding the worst ravages of climate change.

Carbon Neutrality vs Net-Zero Carbon

Carbon Neutrality is the action of mitigating greenhouse gas emissions through offsetting and, in the UK, this has the backing of the international standard PAS2060. This approach balances the emissions released with those avoided (through purchasing of third-party carbon reduction schemes), or those extracted from the atmosphere (through carbon removal schemes). In principle, this is a good position to take, reducing current emissions outside of an organization’s direct control and value chain, and removing historic emissions.

However, any offsets purchased and retired must be “high quality” and additional. Without the highest levels of integrity, and without an accompanying reduction strategy, organizations not only open themselves up to claims of “greenwashing,” which can damage brand and reputations, but also do active harm to the climate.

There is also a much more fundamental issue, that the forecast scale of the voluntary offset market is nowhere near the volume of emissions released each year. On a purely commercial basis offset costs are forecasted to rise and, without reducing emissions, any organization that holds this stance in the long-term will be committing to increasing costs outside of their control. This means that carbon neutrality is a fair short-term tactical position to take, but does not address the underlying issue of man-made climate change, nor the long-term challenges facing the real estate sector.

Net-zero carbon is also about balancing emissions, with the additional core component of minimizing emissions over time, treating offsets as a last resort. As net zero is an interim stage to zero carbon, offsetting is necessary for emissions from sources which cannot yet be completely reduced to zero – this is relevant to real estate particularly via the embodied carbon associated with development and refurbishment projects. However, minimizing emissions before relying on offsets addresses the issue of globally constrained carbon offset schemes. In both practice and theory, therefore, net zero is a much more challenging term to define than carbon neutral.

It is a constantly shifting target within the current environmental landscape; which emissions sources should be targeted for reductions? How much should emissions be reduced before relying on offsetting? How will these requirements change with time as the industry transitions?

Net-zero carbon is very dependent on the entity’s scope of emissions and with which framework they are aligned. The lack of uniformity in approach and definitions is the main source of confusion in the real estate market, as the reduction requirements and the emissions boundaries of such reduction targets are highly variable.

Increasingly, leaders in the real estate industry are aligned around removal of fossil fuels, prioritizing energy efficiency improvements and reducing embodied carbon. These will all support the drivers from regulators, investors, and tenants of operationally efficient and low-carbon assets, with the push of risk management and avoiding “asset stranding.”

Going beyond zero carbon with carbon negative and carbon positive is a risky strategy. Other terms such as “carbon negative” and “carbon positive” are sometimes used by organizations. Confusingly, these terms are often used to mean the same thing, where an organization believes that they can go beyond zero carbon by further contributing to carbon removals beyond their value chain. These are not terms that are recognized by any standards, and therefore risk criticism of greenwashing. This is particularly risky for real estate as there is no consensus that we can achieve a zero embodied carbon built environment, and that most carbon accounting principles prevent an entity from reducing their overall footprint beyond zero.

Whichever approach an organization takes, the first fundamental task is quantifying emissions; “you cannot manage what you do not measure.” While the question of what to measure is relatively straight forward, it is often a lot harder than it sounds to actually gather the required data due to the variety of lease types and different actors paying utility bills and owning data. From our experience of working across thousands of real estate assets, we find reported energy data for operational assets can vary from below 25% to 80% coverage of a portfolio, and anything over 60% is generally considered good.

Market Evolution

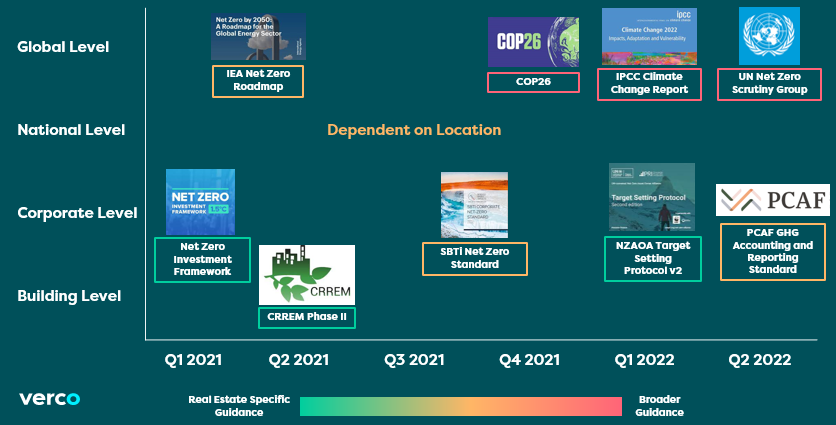

Net-zero definitions are constantly evolving. In 2019 and 2020, a wave of net-zero commitments were made by many prominent real estate investors and asset managers3. Since then, a variety of publications and frameworks have arisen to redefine net zero and further call organizations to action in reducing their climate impact. These publications range in their levels of applicability to real estate investors but all provide insight into the shifting requirements of a low-carbon strategy. The below diagram provides an overview of this furtherance to the net-zero agenda and how different publications may be more, or less, relevant to real estate organizations. Various national-level publications have arisen in the timeline of the diagram (such as the UK net zero strategy) but the relevance of these will be dependent on the operating and marketing countries of the organization.

Further notable publications anticipated to be released in the next year include:

- SBTi FLAG guidance, which will be relevant to organizations with holdings in rural estates and arable land.

- International Organisation for Standardisation (ISO) standard for carbon neutral buildings.

- CRREM / SBTi collaboration, which we anticipate will feed into the SBTi Buildings guidance, due to be released Q4 2023.

- UK Net Zero Carbon Buildings Standard, which will be a collaboration of a range of market actors (including GRESB) and should therefore be of use to other nations in developing equivalent standards.

- PCAF / CRREM / GRESB joint Technical Guidance on accounting and reporting of financed emissions from real estate operations, expected to be published later this year.

Continuous evolution of net-zero requirements and definitions requires organizations to take a dynamic approach to their net-zero commitments. Many of those that made commitments in 2019/20 now have to revise these commitments, particularly in light of the stringent but widely accepted 90% reduction requirement of the SBTi Net Zero Standard. This challenge will only continue as real estate transitions to low-carbon operations, and commitments, where strategies and communications will have to reflect these ongoing developments.

A further example of this requirement for a dynamic approach is due to the carbon mitigation focuses of net-zero targets and the lack of complementary climate adaptation strategies. As we approach 2050, the impacts of climate change will only worsen, even as carbon reductions are made.[1] Approaches to mitigation will therefore continue evolving to account for changes in climate conditions. Real estate organizations will need to manage their ambitions and communications around this in order to maintain alignment with current best practice.

While net-zero targets and frameworks provide useful guidance and starting points for communicating ambition, targets are meaningless without action – both direct emissions reductions, partnering with tenants and supply chain, collaboration with peers and political advocacy. A set of consistent principles which are followed could often be more meaningful in defining a strategic response to climate change, than the particulars of statuses regarding “net zero” and “carbon neutrality.”

However, robust and recognizable statuses like net zero will also support the transition as they help reflect value and differentiate competitors, and thus drive the market toward lower-carbon approaches.

Despite the built environment being one of the largest contributors to global carbon emissions, there is a significant lack of alignment within real estate as to the definition and requirements of a net-zero strategy and status. If the industry is to effectively transition to a low-carbon future, definitions must align to provide market actors with credible, consistent guidance. However, market actors must also retain dynamic strategies if they are to continue aligning with best practice as science-based recommendations evolve.

This article was written by Ben Ross, Head of Aim for Zero, and Luke Riseborough, Consultant, at Verco.