Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Andrea Palmer and Stan Bertram describe five reasons how the new EU Directive could transform real estate

You would be forgiven to admit if you never heard of the Energy Performance of Buildings Directive (EPBD). With SFDR and the EU Taxonomy fully consuming the financial sector in recent years, the real estate industry almost lost track of the EU’s building-level ambitions. It is our view that the EU’s EPBD 2025 re-cast will be a game changer for European real estate.

Updating a legacy legislation

The EPBD isn’t new; in fact, it has been around for more than twenty years. It was the legislation that launched the Energy Performance Certificate (EPC) and that first put ESG on the map in European real estate markets. Earlier this year, the European Parliament voted to implement a more ambitious EPBD to nudge buildings down to zero-emissions (ZEB) by 2050.

Most European real estate investors by now are aware that the current EPC scheme is far from perfect. For one, EPCs and actual energy intensities are almost fully non-correlated, and, second, current EPC schemes are fragmented across Europe, applying different criteria and scoring methods.

The new EPBD re-cast proposal seeks to address these challenges. Below we summarize the five reasons why we believe the legislation will be a game changer.

1. Harmonized EU EPCs

The EPBD re-cast calls for one harmonized EPC scheme to be used by all EU countries. Further, it is to be largely based on actual energy intensities as opposed to theoretical measurements as it stands today. In the proposal, A-ratings will be reserved for zero-emissions buildings and G-ratings are for the 15% worst performing buildings in a given market. The remaining buildings are distributed proportionately between these two letter ratings.

Main takeaways: There will be one EU-wide EPC scheme, with ratings based on actual energy usage instead of theoretical measurements.

2. Minimum Energy Performance Standards (MEPS)

The EPBD re-cast introduces EU-wide “minimum energy performance standards”. These MEPS outline the minimum EPC rating that a building can earn to be considered in-compliance with legislation. It is up to individual member state governments to define appropriate regulatory “sticks and carrots” to mobilize real estate owners in their country.

Buildings owned by public bodies, non-residential and commercial:

- After 1 January 2027, at least EPC E; and

- After 1 January 2030, at least EPC D.

Residential buildings and units:

- After 1 January 2030, at EPC E; and

- After 1 January 2033, at EPC D.

Main takeaway: Minimum EPC requirements across the EU could mean situations where landlords are no longer able to rent space that does not comply (e.g. like is currently the case for offices in The Netherlands) or receive fines. This will vary by country.

3. Carbon Border Adjustment Mechanism (CBAM)

The CBAM is a tariff on carbon intensive products, such as steel, that are imported into the EU. This is a rather protectionist economic policy that aims to make EU manufacturing more competitive against foreign produced goods that are not subject to meaningful carbon taxations.

We expect the CBAM to change dynamics of decisions to build new or re-develop existing buildings. Because the most carbon intensive materials are in properties’ foundation and frames, re-developments that keep a building’s existing infrastructure will become more interesting to pursue. We anticipate real estate companies that know how to effectively reposition buildings by re-using existing carbon intensive materials to be the winners under the CBAM.

Main takeaway: CBAM will increase the cost of new real estate developments and make embodied carbon more financially material.

4. National building energy databases

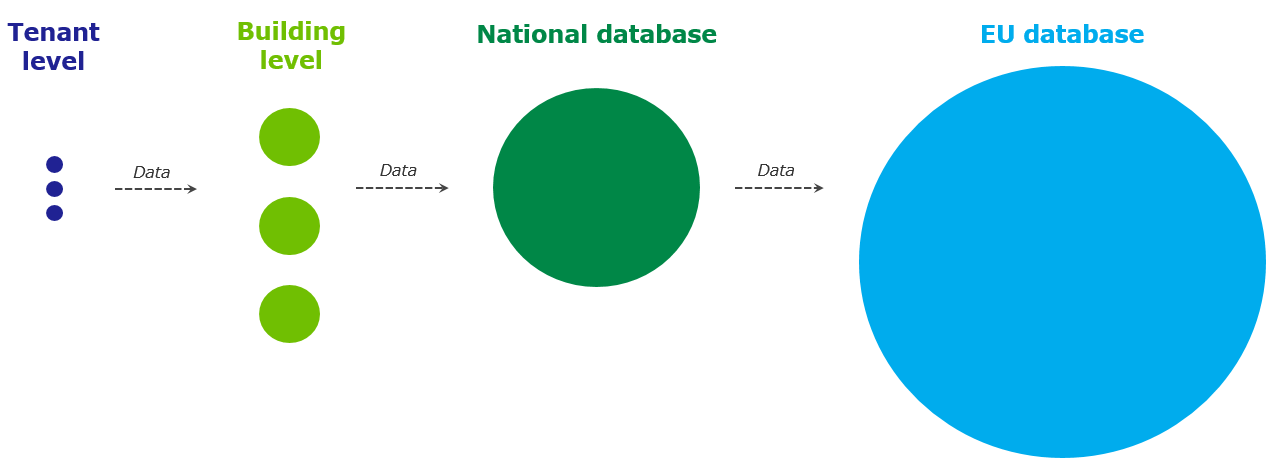

The EPBD re-cast calls for public national databases for building energy performance to be stored. This database is to include information on buildings’ EPC ratings, building renovation passport content (explained below) and calculated/metered energy consumption. Eventually, member states shall enable transfer of this data to the EU level ‘Building Stock Observatory’, which will be used to generate denominators for the consumption-based EPC scheme (explained above).

Main takeaway: Our expectation is that these databases will unlock greater transparency across the real estate value chain and will enable an energy consumption based EPC system, specifically for defining the bottom 15% of real estate stock as required for EPC G.

5. Building renovation passport

The EPBD re-cast also calls for increased visibility of sustainability through what is called a ‘building renovation passport’. These passports should entail specific renovations that need to be implemented for a building to reach net zero, including associated costs. Based on input from site-visits and energy audits, passports outline an optimal sequence of project implementation (i.e., renovation measures) to avoid energy/carbon ‘lock-ins’.

Main takeaway: Building renovation passports improve visibility on future costs for investors, valuers and lenders. We expect this level of information to help ‘burst’ the carbon bubble by allowing investors to appropriately price upgrades to net zero.

By Andrea Palmer and Stan Bertram, PGGM