Key takeaways

- The participation of value-added and opportunistic funds in the GRESB Real Estate Benchmark has tripled since 2019

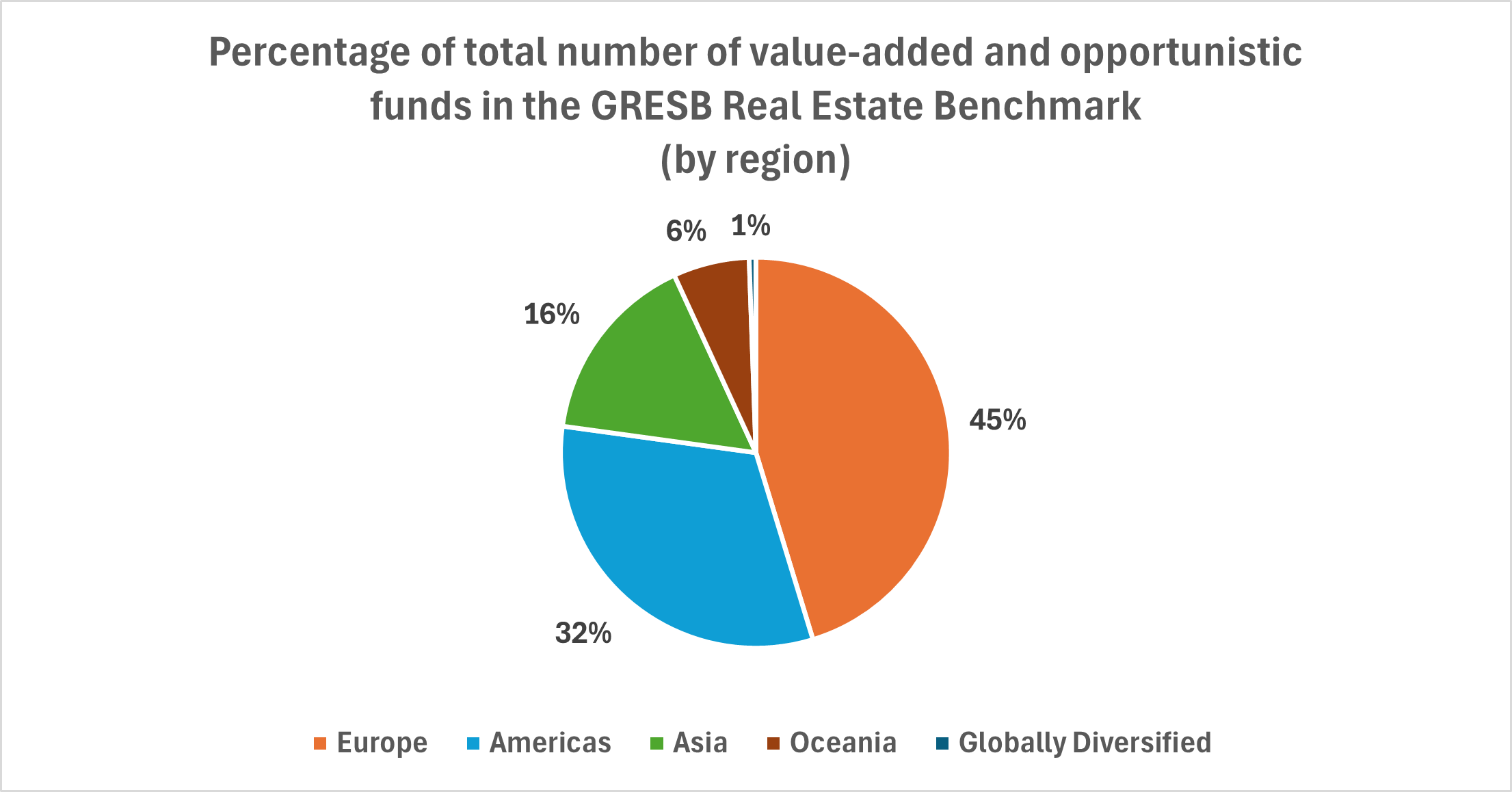

- In 2023, value-added and opportunistic funds participating in GRESB mainly originated from Europe (45 percent), followed by the Americas (31 percent), and Asia (16 percent)

- Value-added and opportunistic funds tend to progress at a faster pace than the rest of the GRESB universe in terms of year-over-year score increases over a five-year period

Value-added and opportunistic funds are key investment vehicles in the real estate investment landscape, offering distinct strategies that foster growth and dynamism within the industry. Value-added funds specialize in identifying properties with untapped potential and strategically enhancing them to maximize returns. This may involve renovations, repositioning, or operational optimizations, ultimately boosting property value and investor yields. Meanwhile, opportunistic funds embrace higher-risk ventures, pursuing projects with significant upside potential through redevelopment or ground-up developments.

With a specific focus on retrofitting buildings and creating long-term value through new developments, these types of funds have a significant role in the transition of the real estate industry toward more sustainable practices. These funds actively contribute to the transition to a low-carbon economy by enhancing the efficiency of buildings through their investments. By targeting properties with untapped potential, they facilitate the implementation of energy-efficient upgrades, sustainable design features, and advanced technology integration (e.g., smart meters).

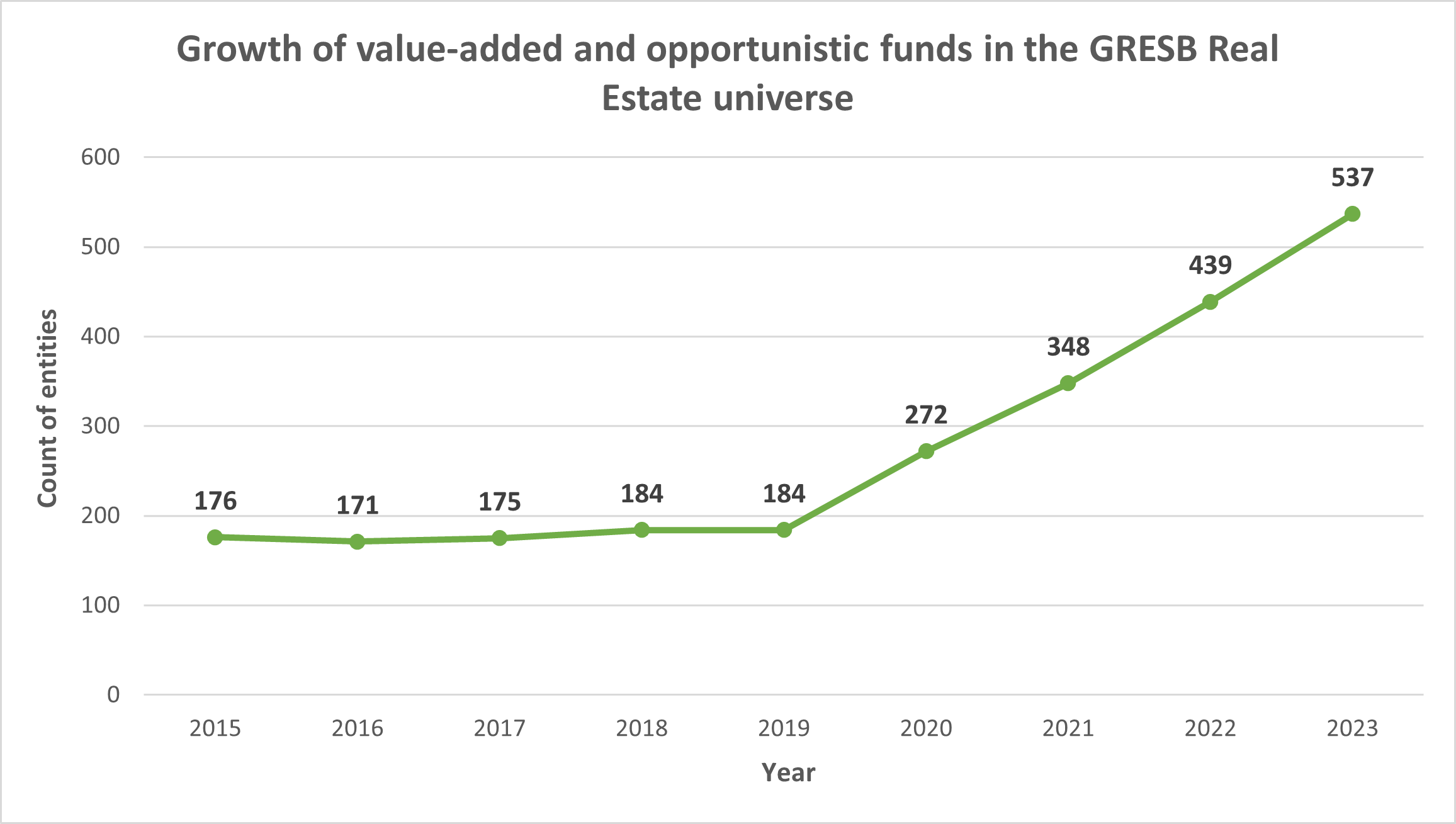

In recent years, GRESB has seen a significant surge in the participation of value-added and opportunistic funds in its Real Estate Assessment. While the participation of funds within these strategies remained relatively stable from 2015 until 2018, their numbers tripled between 2019 and 2023, growing from 184 funds to 537. In comparison, the total number of entities that comprise the GRESB universe grew by 116 percent, from 964 reporting entities to 2,084 entities during the same period.

To contextualize this data within the broader benchmark, the share of value-added and opportunistic funds has grown from approximately 19 percent in 2019 to 26 percent in 2023.

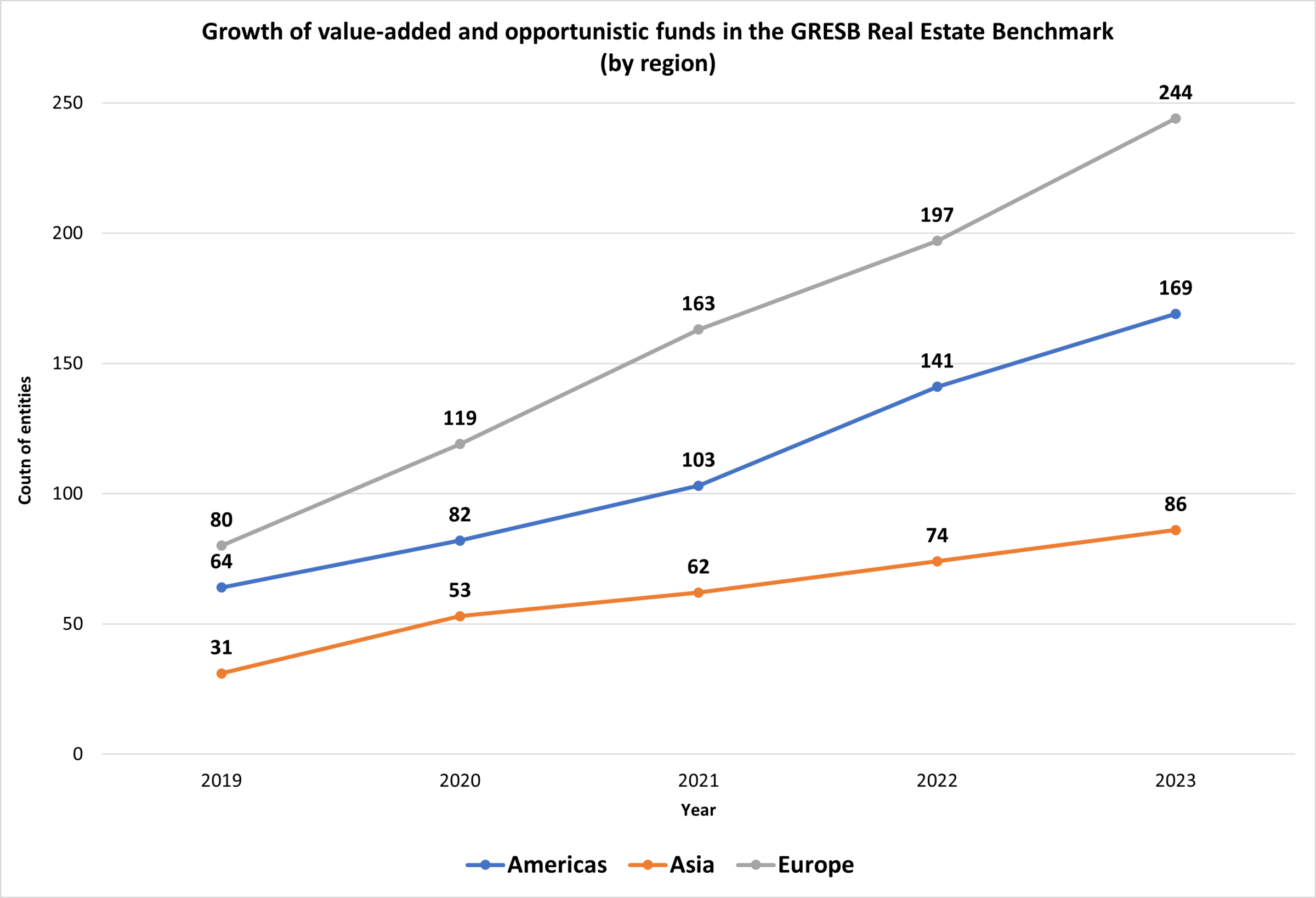

In terms of geographic distribution, the top two regions with the highest number of value-added and opportunistic funds in the GRESB Real Estate Benchmark are Europe (45 percent) and the Americas (31 percent), followed by Asia (16 percent). Since 2019, these regions have recorded sharp increases in participation for funds within these strategies, with Europe registering an average increase of 205 percent, while the Americas and Asia saw an average growth of 164 percent and 177 percent, respectively.

This trend points to a global landscape increasingly focused on ESG considerations, where a brown-to-green approach provides a strategic avenue for investors to align their portfolios with sustainability goals. By supporting the transformation of properties into greener assets, these funds contribute to improved environmental outcomes and enhance the long-term viability and value of real estate investments within the value-added and opportunistic sectors.

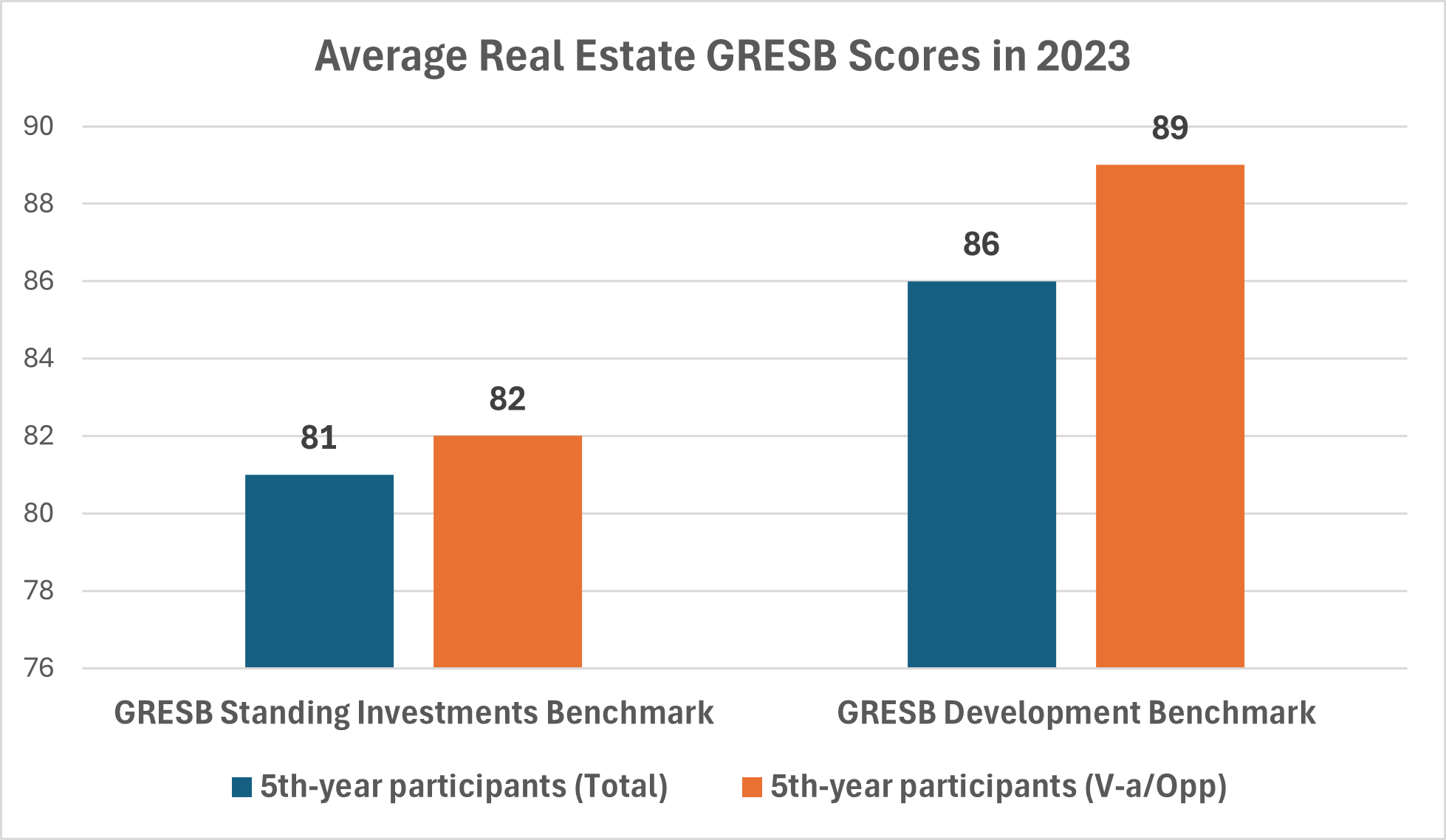

Turning our attention to first-year participant scores, we note that the performance of value-added and opportunistic funds is mostly in line with that of the overall GRESB universe. In the 2023 GRESB Real Estate Assessment, the average GRESB score for first-year participants was 59.6 percent, while the average GRESB score for value-added and opportunistic funds sat slightly below it at 55 percent. However, when looking at the progression of GRESB scores for value-added and opportunistic funds after five years of reporting, we observe that funds within these strategies tend to progress faster on average compared to the rest of the GRESB universe. The average number of points obtained by value-added and opportunistic funds after five years of participation in the Standing Investment Benchmark is 82, compared to 81 for all entities. When looking at entities reporting to the Development Benchmark, this difference is even more apparent, with value-added and opportunistic funds presenting an average score of 89, while the rest of the benchmark scores 86 points on average.

In conclusion, the increasing participation of value-added and opportunistic funds in the GRESB Real Estate Assessment signals a growing commitment to transparency and establishing ESG best practices within these investment strategies. Increased participation offers investors a comprehensive view of fund performance and fosters a benchmark for sustainable practices in the sector, highlighting a positive stride toward a more responsible and accountable landscape for real estate investments.

Want to know more?

For insights on real estate fund performance, explore our 2023 Benchmark data.