Reflecting on the CREtech Climate Leadership Summit Workshop

At the annual CREtech Climate Leadership Summit, leaders from climate venture capital, proptech, architecture firms, real estate owners, and carbon accounting companies gathered to connect and chart out the future of leadership in commercial real estate. The workshop this year took the form of a game.

The goal was clear: teams of five were tasked with selecting from a list of energy efficiency, building electrification, and grid-interactivity measures to help reduce system-wide emissions corresponding to a portfolio of operational buildings.

The challenges were also clear:

- Each player represented a different set of stakeholder interests.

- The teams had a set budget.

- The teams were required to adapt their strategies to the local grid context provided to them.

For 30 minutes, the teams engaged in a fierce race to understand, negotiate, collaborate, and ultimately learn about the value that commercial real estate can provide to grid decarbonization.

Background: Challenges and opportunities of an evolving grid

The electric grid of the 20th century was characterized by a mono-directional flow of electricity, with power generated at centralized facilities and distributed to consumers. This model served its purpose effectively for decades, offering a reliable energy supply. However, the 21st century has ushered in a new era of challenges for grid decarbonization.

First, there is a significant shift from dispatchable to non-dispatchable energy sources. The rise of renewable energy, such as wind and solar, has introduced variability and intermittency into the grid. Unlike traditional power plants that can be controlled and dispatched as needed, renewable energy production is subject to weather conditions, making grid management more complex.

Second, while there is a growing emphasis on reducing the carbon intensity of the grid, this reduction is not uniform throughout the day or across regions. As a result, the carbon emissions associated with electricity generation can vary widely by time and location. This introduces challenges in aligning energy supply with fluctuating demand, especially as the grid transitions to a cleaner energy mix.

Third, the integration of renewable energy sources and the evolving energy landscape have led to a rise in price variability. Fluctuating energy prices can impact grid stability and the economics of energy production, affecting both consumers and grid operators.

Amidst these challenges, real estate can play a pivotal role in helping the grid transform. While it’s often noted that operational real estate accounts for around 40% of global emissions, it’s essential to recognize that most of these emissions arise from energy use within those buildings. As consumers of a substantial portion of electricity generated on any grid, the built environment is in the perfect position to facilitate a more rapid low-carbon grid transformation.

Enter, Grid-interactive Efficient Buildings (GEBs)

The concept of GEBs holds immense promise in addressing the challenges of grid decarbonization. GEBs are designed to be highly energy-efficient and equipped with advanced technologies that enable them to interact with the grid in an intelligent and dynamic manner. By optimizing their energy consumption to align with periods of cleaner energy generation, GEBs help reduce carbon emissions associated with electricity production.

The value that GEBs can provide to the grid is multi-faceted. Firstly, they enhance grid resilience by offering demand flexibility. GEBs can reduce their energy demand during periods of high stress on the grid, such as during heatwaves or peak electricity demand, thus helping to avert blackouts. Secondly, GEBs contribute to the integration of renewable energy sources by storing excess energy during times of surplus and releasing it when needed. This capability aids in grid balancing and ensures a stable supply of electricity, even when renewables are generating inconsistently.

Furthermore, GEBs have the potential to reduce energy costs for building owners and occupants. By leveraging smart technology and adjusting energy usage in response to real-time pricing signals, GEBs can save money for consumers while also relieving grid congestion during peak hours, which can lead to lower electricity prices overall.

Now back to the game

Participants of the 2023 CREtech Climate Leadership Summit are in deep play, scattered around tables in the main conference hall of the Grand Hotel in Stockholm.

Each table represents a different grid context:

- California Independent System Operator

- South Australia

- Western India

At each table, there are individuals tasked with playing the role of various stakeholders along the combined built environment and grid value chain:

- Property owners

- Facilities managers

- Electric utilities

- Tenants

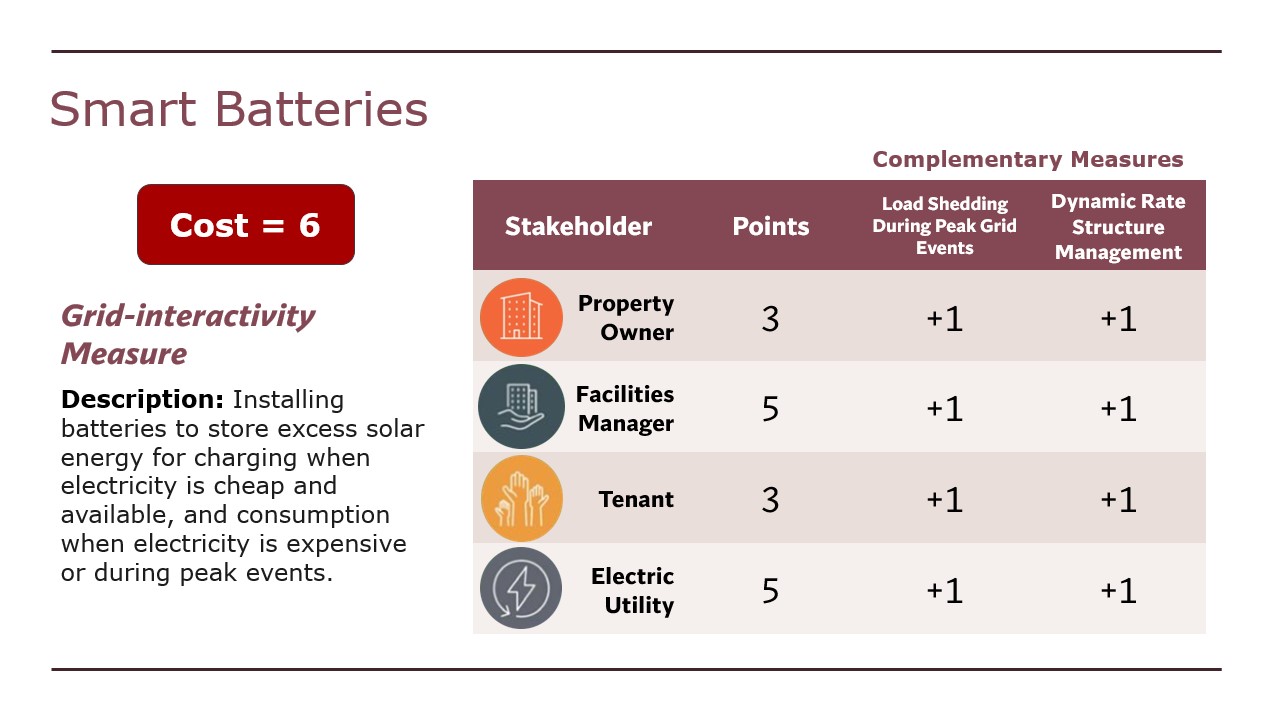

The players are attempting to choose a set of energy efficiency measures, building electrification measures, and grid-interactivity measures to update their fictional stock of operational real estate assets. Each measure has a cost, a different benefit for each stakeholder (conceptualized as points), and bonus points for harmonizing with other compatible measures.

As if by design, each table begins taking a different approach. One table began by choosing an optimal set of complementary measures, and then went about trading out measures in order to get their costs below the set cost ceiling. Another table took a very collaborative approach, attempting to maximize the value of the table’s stakeholders as a whole. Another table took a very stakeholder-centric approach, with each stakeholder fighting to maximize their individual benefit.

By the end, it was clear that maximizing value for the entire system often generally ended up with greater benefit to all stakeholders involved. Furthermore, what worked well in one grid context, could not work in others. For example, in Western India, electrification measures were disincentivized while energy efficiency measures were incentivized. This is the case because electrifying buildings increases emissions, given the fact that about 98% of energy is supplied by coal. On the other hand, electrification and grid-interactivity measures were incentivized in South Australia, where almost all the energy is supplied by intermittent wind and solar, and enhanced inter-operability with the utility is needed to match demand to the variable supply.

It’s time that the real estate sector shifts from contributing to the problem by simply consuming energy, to being part of the solution by enabling a global low-carbon and resilient grid transformation.

Key takeaways

As a major consumer of energy on any grid network, commercial real estate is in a position to help increase the amount of renewable energy on the grid, thus driving system-wide decarbonization.

There are many stakeholders involved in the real estate value chain, each with different mandates. It is important to recognize and appreciate their roles within the greater system in order to devise solutions that provide enough value to everyone such that they can be financed and implemented.

Local grid conditions matter. Over-simplified heuristics like “energy efficiency first” do not necessarily provide the greatest system-wide emissions reduction in all cases. The building/grid system needs to be approached holistically in order to drive the greatest emissions reductions.