GRESB Infrastructure Asset assessment for renewable energy

The GRESB Infrastructure Asset assessments provides asset managers and asset operators in the renewable energy sector with a globally recognized and standardized framework to assess, improve, and derive value from their sustainability performance. The infrastructure assessments evaluate key performance indicators that investors deem most material, including energy production, emissions intensity, biodiversity management, and community engagement. Participation in an assessment allows you to:

- Stand out from peers with sector- and region-specific insights

- Engage investors and lenders for access to capital

- Benchmark your operational performance against your peers

- Identify areas of risks, opportunities, and impact in your operations and facilities

- Streamline your sustainability data collection and progress monitoring

- Prepare for regulatory requirements in your market

- Integrate best-in-class sustainability practices into your operational and investment mandates

The GRESB Assessment is evolving and Ventient is pursuing an ambitious growth strategy, requiring us to regularly re-baseline our metrics and targets and update our materiality assessment.

Ventient Energy

GRESB Infrastructure Asset Assessment Participant

The GRESB Assessment is evolving and Ventient is pursuing an ambitious growth strategy, requiring us to regularly re-baseline our metrics and targets and update our materiality assessment.

Ventient Energy

GRESB Infrastructure Asset Assessment Participant

Key benefits of GRESB for renewable energy infrastructure

Attract and retain capital with validated and benchmarked performance data

Investors often seek out and prioritize renewable energy assets to meet their sustainability and net-zero commitments. By participating in GRESB, you can deliver credible, validated sustainability data, rankings, and ratings that investors can trust, making it easier to secure funding and maintain strong investor relationships. GRESB performance showcases your leadership and helps set you apart in a competitive market.

Improve operational resilience and efficiency

GRESB gives you clear benchmarks to measure performance against peers, enabling you to identify opportunities to improve asset efficiency, resource use, and climate resilience. By acting on these insights, you can optimize operations, reduce costs, and ensure your assets are future proofed against environmental and regulatory risks.

Enhance your reputation as a sustainability leader

Participating in GRESB demonstrates your commitment to transparency and best-in-class sustainability practices. It strengthens your position as a leader in the energy transition, helping you build trust with stakeholders- whether they’re investors, regulators, or local communities who increasingly expect renewable energy operators to deliver measurable environmental and social impact.

Benchmarking sustainability in renewable energy infrastructure

Leading sustainability benchmark for renewable energy infrastructure

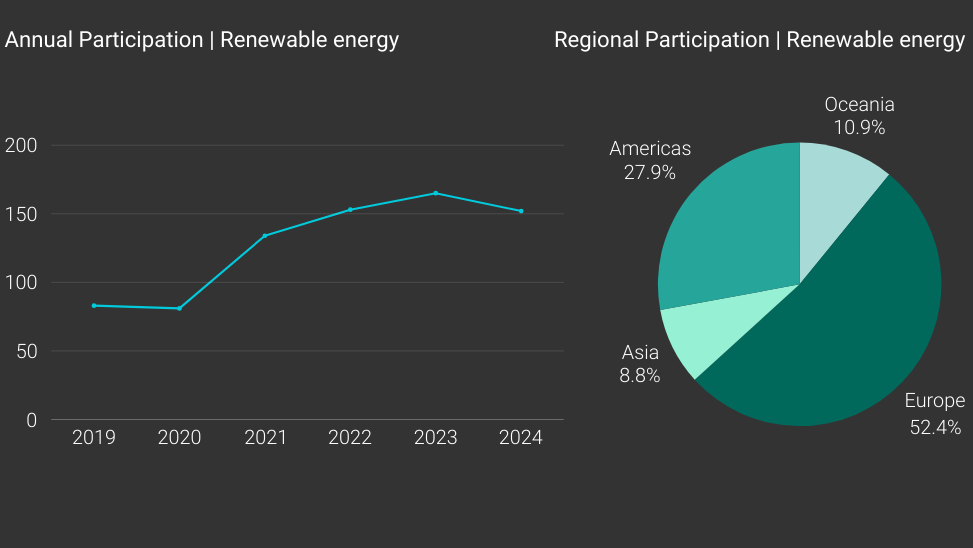

GRESB is the leading benchmark for infrastructure investments, encompassing 167 funds and 720 assets operating in 80 global markets. For the 2024 benchmark year, GRESB collected operational data from more than 150 renewable energy assets in its infrastructure asset assessment.

Renewable energy assets are a key part of GRESB’s Infrastructure Asset Benchmark and represent 22% of the benchmark.

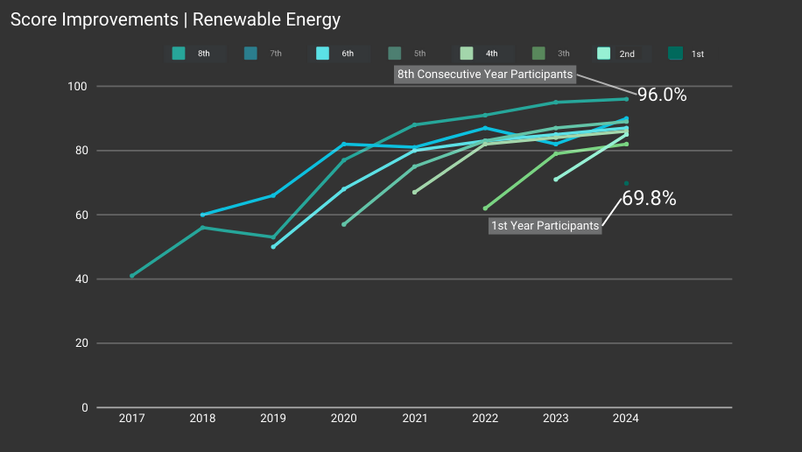

Gaining an early upper hand

Early participation in GRESB carries with it a significant benefit as scores substantially improve for most entities after the first two years of reporting. Assets can quickly build momentum by identifying gaps, implementing targeted improvements, and adapting to the GRESB framework. On average, renewable energy assets typically see 21 points increase in their GRESB Score by their third reporting year.

By starting early, participants gain a competitive edge and can enhance their sustainability performance. They can position themselves as industry leaders by the time standardized sustainability reporting becomes a universal expectation for renewable energy centers.

Driving performance through comprehensive metrics

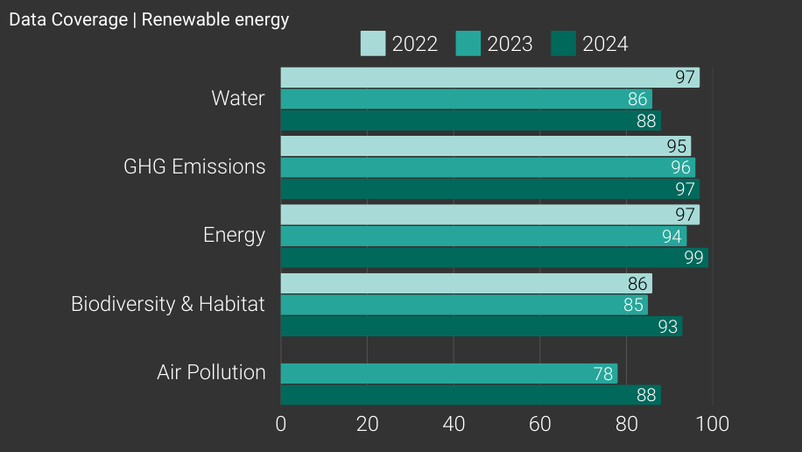

Renewable energy projects operate across diverse geographies with varying environmental conditions. GRESB’s framework ensures granularity across key sustainability indicators like energy production efficiency, greenhouse gas emissions (including Scope 3), land use, and biodiversity impacts.

In 2024, renewable energy assets recorded nearly 100% coverage on average for energy, 97% for greenhouse gas (GHG) emissions, and 93% for biodiversity and habitat metrics. This high data coverage allows renewable energy projects to efficiently track and take targeted action to reduce their environmental footprint.

Track your net-zero efforts

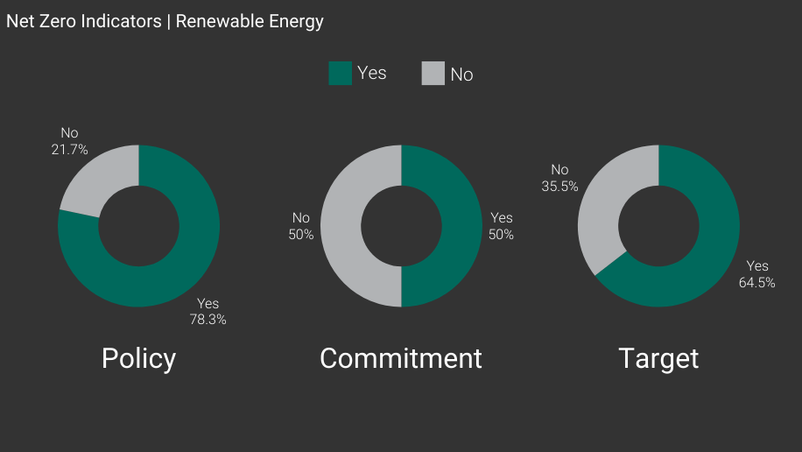

Achieving net-zero emissions is central to renewable energy infrastructure. Net-zero goals require accountability across all emission scopes, including direct (Scope 1), energy-related (Scope 2), and value-chain emissions (Scope 3).

GRESB’s globally recognized framework supports participants in systematically tracking and reporting emissions across all three scopes addressing complexities like supply chain emissions and operational efficiency. This empowers renewable energy operators to easily establish targets, measure progress, identify areas for improvement, and align operations with global net-zero goals.

Since last year, there has been an 8% increase in the adoption of net-zero targets among renewable energy infrastructure participants in GRESB, reflecting growing commitment to sustainability and alignment with global climate goals in the sector.

Join industry leaders driving change across infrastructure

Ready to learn more about the benefits and process of participating in GRESB?

Have questions? Get answers.

"*" indicates required fields