What’s New in May

The 2025 GRESB Assessments are well underway, and the season is picking up momentum. If you haven’t already, now is the ideal time to request a Pre-Submission Check to ensure your submission is as complete and accurate as possible.

In this month’s newsletter, we’re sharing key updates and tools to support your GRESB journey and drive stronger performance, including:

- Early access to 2025 Submitted Data for infrastructure

- Improved Benchmark Reports and a new Residential Component

- Insights from GRESB’s Erik Landry on net zero in real assets

Expanded Data Exporter for Infrastructure

GRESB recently announced the expansion of the Data Exporter for infrastructure with the launch of 2025 Submitted Data, a new feature designed to give infrastructure investors and members earlier access to submitted GRESB Infrastructure Assessment data.

Now available via the GRESB Data Exporter, the new functionality allows you to download assessment data as soon as it’s submitted through the GRESB Portal—no need to wait for the final results to be released in October.

This new capability is part of GRESB’s ongoing efforts to deliver actionable, real-time insights that support:

- Proactive performance improvement, enabling you to take earlier, data-driven action to manage risk and strengthen portfolio resilience

- Efficient data management and reduced reporting burden, allowing you to ingest information directly into your internal systems, reducing manual effort

- Timely reporting and compliance, helping you stay ahead of internal, corporate, and regulatory disclosure requirement

The new 2025 Submitted Data feature is available for all GRESB Infrastructure Assessments. Head over to the GRESB Portal and access the Data Exporter to explore this new functionality.

You can learn more about the new feature and access step-by-step guidance and FAQs on the GRESB website.

Improved Benchmark Reports & Deeper Insights

We are pleased to share a series of important improvements to the GRESB Benchmark Report across real estate and infrastructure as part of GRESB’s commitment to empowering your investment strategies with transparent, actionable data and deeper insights to help you build more resilient, efficient, and successful real assets portfolios.

Real Estate

The redesigned Benchmark Report now offers a more intuitive, visually driven experience through a new section-based structure, improved visuals, and user-friendly navigation. Designed to meet the diverse needs of different users, the improved Benchmark Report enables more targeted analysis of portfolio performance, asset performance, and scoring.

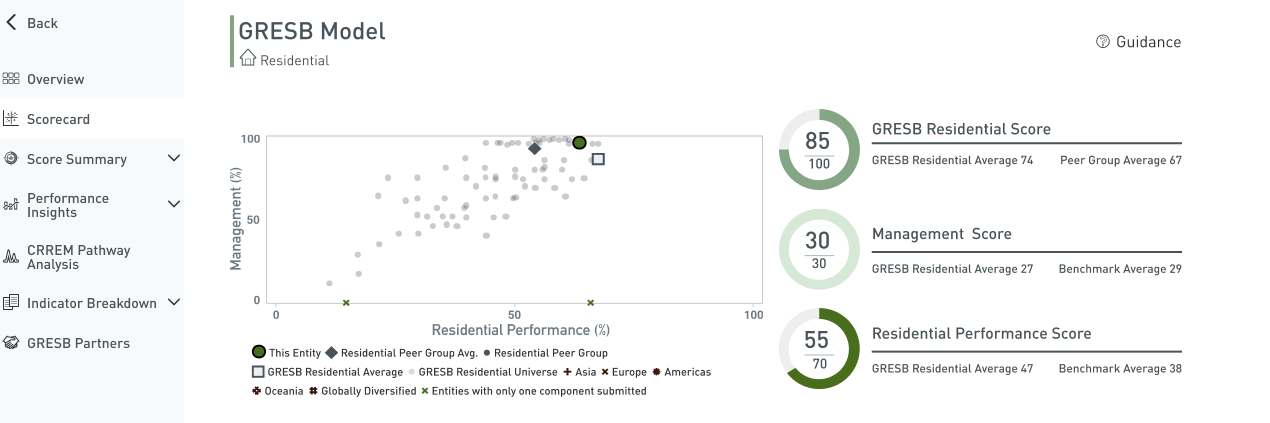

New Residential Component

As of 2025, GRESB also offers a new Residential Component to participants whose portfolios consist of more than 75% residential assets by GAV. It features sector-specific indicators that reflect the unique performance drivers of residential assets, ensuring greater relevance and value.

By completing the Residential Component, participants will continue to receive the GRESB Benchmark Report and will gain access to the new standalone Sector Insight: Residential Report.

Infrastructure

The Infrastructure Benchmark Report has been enhanced to improve usability and enable deeper analysis through clearer location-based and market-based GHG emissions breakdowns, net-zero setting visualizations, and embedded guidance.

The updates to the Benchmark Reports reflect GRESB’s commitment to delivering intuitive, decision-useful insights that help members achieve real-world outcomes.

GRESB and the Net-Zero Challenge

The global push toward net zero is reshaping the future of real assets—and GRESB is at the forefront. As a trusted partner for resilient and high-performing investments across real assets and high-impact industries, we equip the real estate and infrastructure sectors with the data, tools, and insights needed to drive meaningful carbon reduction and build climate-resilient portfolios.

Our latest net-zero content—authored by Erik Landry, Director, Climate Change at GRESB—explores target-setting, emissions data, and tailored approaches that address the unique challenges facing both real estate and infrastructure stakeholders. Dive into GRESB’s role in advancing transparency, standardization, and climate-aligned action across the sector.

Explore our net-zero resources:

- GRESB and the Net-Zero Challenge

Discover how GRESB drives climate impact through its industry-specific framework and tools, partnerships like the Net Zero Financial Services Provider Alliance, and our role within General Atlantic’s Beyond Net Zero Fund. - Net Zero in Real Estate

Explore 2024 Real Estate Benchmark insights and core aspects of net-zero strategies—from energy efficiency and embodied carbon to renewable energy procurement. - Net Zero in Infrastructure

Delve into 2024 Infrastructure Benchmarks findings and learn more about net-zero target setting, Scope 1–3 emissions, and pathways to system-level transformation.

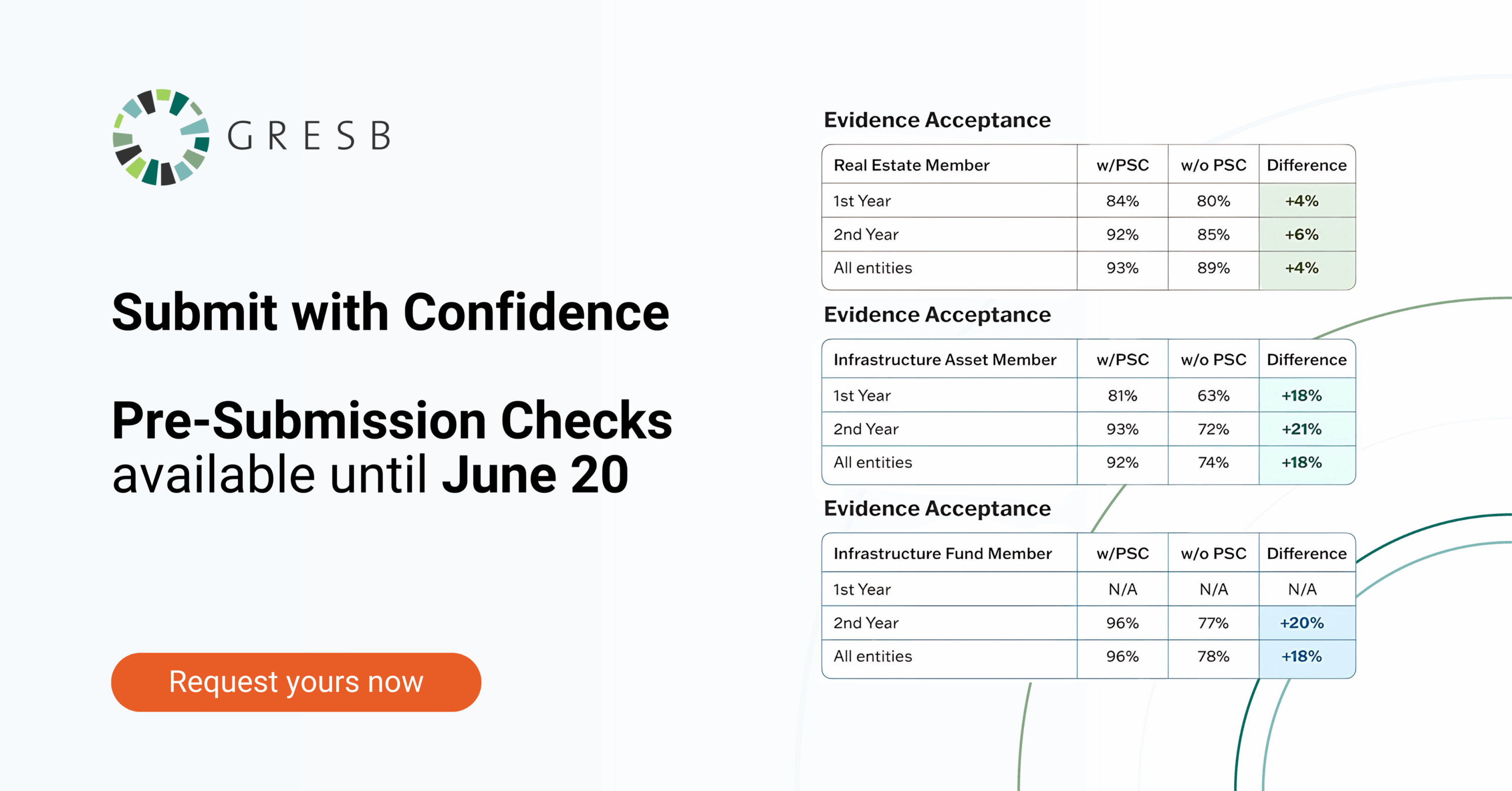

Request a Pre-Submission Check

With the assessments well underway and capacity filling quickly, now is the ideal time to request a Pre-Submission Check.

A Pre-Submission Check offers a high-level review of your assessment response before final submission. It helps identify potential issues, reduce errors that could impact your results, and ensure your submission is as complete and accurate as possible.

In 2024, new GRESB Participants who used a Pre-Submission Check saw an average 4–18% higher evidence acceptance rate across all Assessments compared to those who did not.

Pre-Submission Checks can be requested until June 20, with Pre-Submission Checks scheduled from May 1 until June 27.

Chris Pyke on Nasdaq Trade Talks

GRESB’s Chief Innovation Officer Chris Pyke recently joined Nasdaq TradeTalks to discuss the evolving role of climate tech financing, energy efficiency, and the growing demand for actionable sustainability data in investment decision-making.

Hosted by Jill Malandrino, the conversation featured insights on risk reduction, resilience, and the importance of material non-financial information in real asset strategies.

GRESB Events

Join GRESB and Longevity Partners on July 17 to dive into how biodiversity is reshaping sustainability and risk management in real estate.

This webinar will explore how new biodiversity indicators in GRESB’s assessments are driving structured disclosure and integration of nature-related risks. From regulation to regeneration, this session connects the dots between climate, nature, social impact, and capital for the built environment.

Foundation Update

Urban Land Institute (ULI)

Sarah Welton, Director of the GRESB Foundation was recently appointed to ULI’s Responsible Property Investment Council (RPIC) and she participated in the RPIC Council Day during the ULI Spring Meeting in Denver, Colorado. The council meeting was hosted in the History Colorado Center and was followed by a tour of Denver’s Union Station. During the meeting, Sarah moderated a panel of Katie Cappola, Lori Mabardi and Brooke Pottish on the current state of sustainability in the United States, which included a robust discussion about the effects of sustainability regulations and targets on project due diligent and investment decisions. Please reach out to [email protected] if you will attend the ULI fall meeting in San Franciso and would like to connect.

MIT Research Support

The GRESB Foundation is supporting MIT researchers, Bram van der Kroft, Juan Palacios, Roberto Rigobon and Siqi Zheng to understand the extent to which retrofitting real estate has become a central issue for evaluating profitability, tenant satisfaction, and regulatory compliance impacts real estate retrofitting decisions. The team has developed an engaging 10-minute retrofitting simulation and survey designed to capture how real estate professionals think about trade-offs in sustainability investments. To participate in their research project, please complete the 10-minute survey and game. Following the project, participants will receive an invitation to an exclusive MIT-hosted webinar to discuss the results and explore the future of sustainable real estate strategy.

Standards Committees Call for Applicants

The Foundation Board will begin to review applications for the Standards Committee members and is looking forward to welcoming several new members! We encourage new applicants to review the Standards Committee Terms of Reference and then complete this nomination form for either (or both) the Real Estate and Infrastructure Standards Committees as we will be looking for new members later this year.

The Foundation also welcomes GRESB Members to apply to join one of the Expert Resource Groups for which we accept new members on a rolling basis.

GRESB Insights

The Pulse by GRESB

The Pulse by GRESB is an informative content series featuring the GRESB team, partners, GRESB Foundation members, and other experts, published on Spotify, Apple Podcasts, and YouTube. Listen to the latest episodes below:

Raising the bar: Key updates to the GRESB building certification evaluation process

Host Charles van Thiel, Director of the Real Estate Standard, and Karl Desai, Senior Associate, Real Estate, dive into the evolving landscape of building certifications. Hear from our speakers as they explore the importance of these certifications, the GRESB Foundation’s efforts to revise recognition criteria in line with industry progress, and the implications for both certification organizations and GRESB Participants.

GRESB’s energy efficiency playbook: Key updates for 2025

Join our speakers Charles van Thiel, Director of the Real Estate Standard, Ben Thomas, RESC Member, and Parag Cameron-Rastogi, Director of Real Asset Analytics, as they explain how GRESB is now recognizing both top-performing energy-efficient assets and those actively improving.

Contribute to GRESB Insights

Industry insights from our partners and members into “Data Centers (Real estate & Infrastructure)” and other rolling topics:

- Build trust and improve data quality through ESG assurance | Earthood

This Insight explores how third-party sustainability assurance builds stakeholder trust and improves data quality. With increasing expectations from investors and frameworks like GRESB and CDP, assurance is becoming a key component of credible sustainability reporting. - Sustainable data centers: ESG, compliance, and futureproofing for success | Catalyst

EU regulations, including the Energy Efficiency Directive and Taxonomy, are shaping sustainability strategies. The article covers key compliance KPIs, the role of LEED and BREEAM certifications, and practical steps to enhance sustainability performance and prepare for evolving standards. - Understanding embodied and operational carbon in data centers | BranchPattern

Data centers face rising scrutiny for both operational and embodied carbon. MEP systems, structural components, and material choices significantly impact total emissions. Lifecycle carbon assessments are becoming essential for meeting efficiency expectations. - The data center boom: Navigating growth and sustainability | JLL

The EMEA data center market is expanding rapidly, driven by AI and cloud computing, with a projected 25% CAGR through 2027. Germany is setting a new regulatory benchmark with its Energy Efficiency Act, mandating 100% renewable energy use by 2027. JLL explores how investors are adapting new frameworks and KPIs to meet sustainability and compliance demands. - Cooling data centers: Managing water use in the age of AI and ESG | HydroPoint

Water use is emerging as a major environmental concern for data centers. Smart water management, real-time monitoring, and water replenishment programs can help reduce risk and improve performance, especially in water-stressed regions. - Climate resilience: Three essential questions for compliance and enhancing value | ClimateFirst

ClimateFirst presents a framework to assess climate risk using three key questions: What are the risks? What is the financial impact? And what actions are needed? CVaR assessments help translate climate hazards into actionable insights, supporting resilience planning and GRESB compliance.

Interested in contributing? Check out the 2025 GRESB Editorial Calendar for fixed monthly topics and submission guidelines. The topic for June is “Biodiversity”.

Upcoming Industry Events

SuperReturn Climate & Energy Transition

June 2–4 | Berlin, Germany

Join us at SuperReturn Climate & Energy Transition, where sustainability, infrastructure, and innovation take center stage. Don’t miss Roxana Isaiu and Giulio Comellini leading an LP-only roundtable focused on the financial risks and opportunities of sustainability in real assets, and Cathy Granneman speaking on AI-driven energy demand.

LPs attend for free; GPs get 10% off with code FKR3593GRESB.

RIA Conference Toronto 2025

June 3–4 | Toronto, Canada

As the leading event for responsible investment professionals in Canada, the conference attracts the most influential leaders in sustainable finance, providing a dynamic forum for learning, dialogue, and cutting-edge insights. Jonathan Kaufman, Director, Real Estate, Americas, will be attending.

GRESB Members get 10% off with code GRESB10.

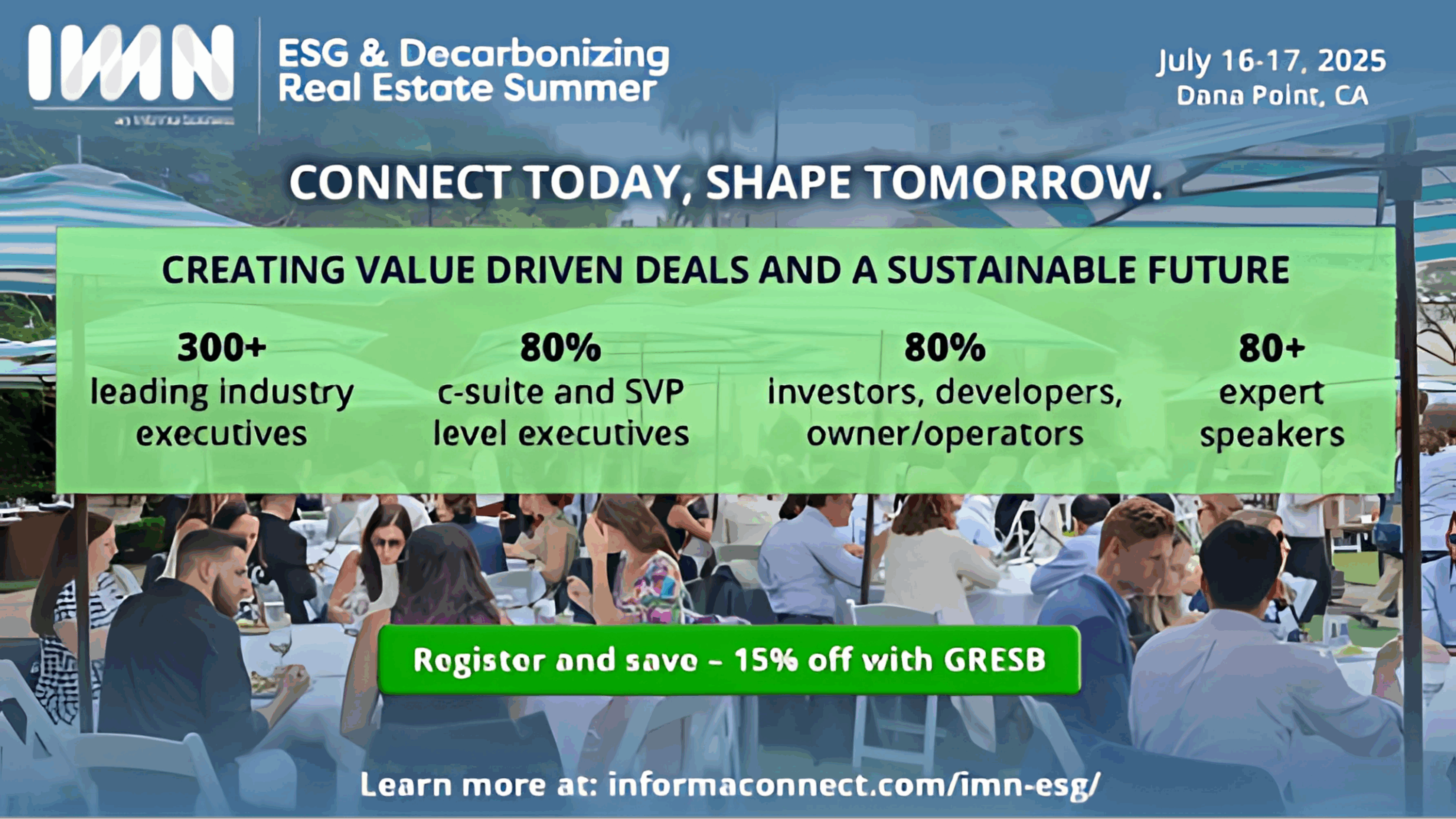

ESG & Decarbonizing Real Estate Summer

July 16–17 | Dana Point, USA

This premier event brings together 300+ senior industry leaders to explore actionable strategies for integrating sustainability principles into real estate investment and operations. Reid Morgan, Manager Member Relations, Americas, will be speaking at the event.

GRESB Members receive 15% off with code REU2258GRESB.

PERE Network Europe Forum

June 10–11 | London, UK

PERE Network’s 20th annual Europe Forum brings together 200+ of the region’s most influential institutional investors, fund and asset managers, developers, and strategic partners to prepare for the next generation of real estate investment.

Responsible Investor Europe 2025

June 11–12 | London, UK

Join leaders in sustainable finance at Responsible Investor’s 18th annual RI Europe conference. Connect, collaborate, and explore the latest ESG innovations and best practices to stay ahead in a rapidly changing financial landscape.

Careers

GRESB is growing and looking for new people! Our most recently added open positions:

- QA Engineer (2-3 years experience) | Amsterdam

- Client Relationship Manager, Asset Impact | Amsterdam | Paris | London | Berlin

- Working Student – Finance and Business Support | Amsterdam

- M&A and Special Projects Internship | Paris

What are we reading

The importance of actively managing real estate assets | PERE

Building a greener tomorrow: Green technology has transitioned from a niche innovation to a fundamental pillar of the real estate industry | Institutional Real Estate Inc.

Strengthening investor engagement with banks to help decarbonise the built environment | IIGCC

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletter.