Our industry is engaged in an important dialogue to improve the efficiency and resilience of real assets through transparency and industry collaboration. This guest article contributes to that conversation and does not necessarily reflect GRESB’s views or position, nor does it represent an endorsement. The GRESB Insights blog is designed to share diverse industry perspectives and foster informed discussion on key topics for real assets investments.

In the current reporting environment, it’s easy to feel compliance fatigue—the unsurprising result of multiple frameworks, conflicting emphases, and stretched resources. But if you’re among the thousands of UK companies for whom ESOS reporting is obligatory, and you’re wondering how to get extra value out of the time you put into it, there is good news: ESOS and GRESB have plenty of synergies, to the extent that ESOS audits and action plans, done right, can materially contribute to improved GRESB performance. Consider them your government-mandated GRESB accelerator.

Experts from Verco have analyzed the latest ESOS data to show you exactly how leading real estate organizations are turning regulatory compliance into real-world energy savings of the type that might just nudge you into performance improvement. In this article, we’ll look at a few highlights from that data, then at their links to GRESB results, and finally we’ll discuss some practical recommendations to turn compliance into a competitive advantage.

What the ESOS data reveals

Recently released government data shows that 7,738 participants have reported energy-saving opportunities to ESOS, with 5,905 of those having submitted an Action Plan. Among these action plans, 87% submitted at least one concrete energy efficiency measure. These organizations had a total energy consumption of 750 billion kWh in the reference year, of which 200 billion kWh comes from real estate organizations, as categorized based on SIC codes and manual review.

In the rest of this article, we’ll focus on the real estate organizations, but you can take a deeper dive into the ESOS data here.

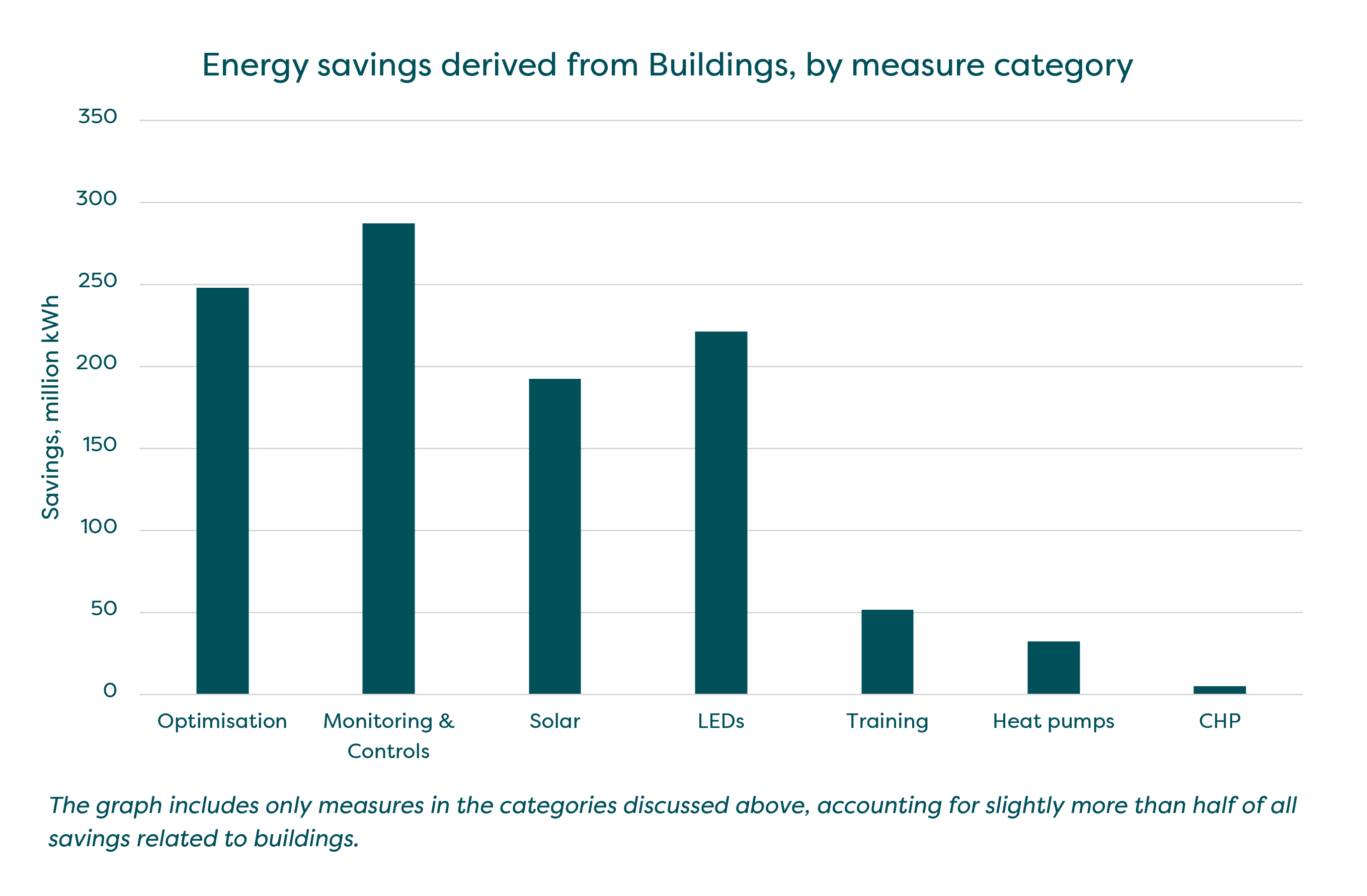

We categorized measures based on the occurrence of key terms. These categories were solar, LEDs, heat pumps, optimization, combined heat and power, monitoring & controls, and training. Of these categories, optimization and monitoring & controls were the two clear front-runners among real estate organizations, being the most frequently mentioned efficiency measure types and accounting for about 410 and 480 million kWh of potential savings, respectively, by year-end 2027. Solar and LEDs formed our second category cluster, with savings of approximately 220 and 240 million kWh, respectively. Bringing up the rear were CHP and heat pumps, with savings of 5 million kWh and 43 million kWh, respectively. Lastly, training-based solutions formed an intriguingly isolated datapoint, separate from any of the aforementioned clusters, with 98 million kWh of potential savings—more than twice as much as from CHP and heat pumps combined.

Focusing on savings derived just from buildings—as opposed to, e.g., transport or industrial processes—we see a similar distribution, though the gap between the top two clusters is not as large. This is illustrated in the graph below. Note that the graph includes only measures in the categories discussed above, accounting for slightly more than half of all savings related to buildings.

As ESOS savings are measured over a four-year period, the data also shows a clear trend where organizations with ambitious savings are taking early action and implementing the majority of measures in 2024 and 2025.

Getting more out of ESOS

The main question we need to be asking is: how can this kind of engagement with ESOS turn into real-world net-zero progress and, more specifically, the kind of improvements that are reflected in GRESB results?

Let’s explore a few key GRESB indicators where ESOS actions can contribute directly, potentially enabling improved results and conserving resources.

- SE1: Employee Training. When one thinks of “Energy Savings Opportunities,” the types of measures that first spring to mind tend to be on-site renewables, re-lamping with LEDs, and so on. However, we’ve also seen that nearly 100 million kWh of savings are projected to come from staff training measures—far ahead of some hard-tech solutions like CHP or heat pumps. SE1 makes specific mention of the percentage of employees who received ESG-specific training during the reporting year, so appropriate training measures may well qualify for inclusion in both GRESB and ESOS.

- T1.1: “Portfolio improvement targets: Has the entity set long-term performance improvement targets? The end year must be 2025 or later and must be at least three years later than the baseline year.” Given the four-year ESOS cycle and the three-year expiry on GRESB evidence, there are opportunities for real estate organizations to loosely align their ESOS runs with GRESB timelines. Additionally, ESOS’s four-year periodicity favors a cycle of audit-plan-implement-repeat, encouraging organizations to review what has or hasn’t worked and to target continuous improvement and reductions.

- EN1: Within EN1, “Like-for-like energy improvement,” “Renewable energy: on-site,” “Renewable energy: performance,” and “Energy efficiency” account for 7 out of 14 points. Correctly implemented and evidenced, ESOS measures could contribute to obtaining these points.

- RA3: Efficiency Measures. GRESB categories specify measures such as “Automation system upgrades / replacements,” “Management systems upgrades / replacements,” “Informational technologies,” and “Installation of on-site renewable energy.” An average of 19% of measures reported to ESOS by real estate organizations relate to monitoring & controls, while a further 9% relate to solar installations.

Alongside the above direct contribution from ESOS, your GRESB submission can further benefit from indirect contributions. Elements of the ESOS evidence pack, such as reports and energy audits, may be used as evidence for GRESB. Moreover, audits carried out for ESOS can help in the creation of an Environmental Management System for the entity, scored in indicator RM1. The indicator, with a maximum score of 1.25 points, only has a benchmark average of 0.77 points for Europe, indicating an area of potential improvement for many reporting entities.

Turning compliance into competitive advantage

When it comes to creating a competitive advantage, there are two points to consider as you look to maximize the benefits of ESOS reporting.

First is the implementation gap: The ESOS data shows that real estate organizations have made great plans, but execution is where GRESB points are won and where impact is made. It’s therefore crucial to think ahead about how your ESOS Action Plan will be implemented and how you can track that implementation to ensure that ESOS commitments translate into GRESB performance improvements year-on-year.

Secondly, some organizations struggle to create synergies as they simply jump from one compliance report to the next. It can help to take a strategic approach here so ESOS and GRESB submissions are aligned from the start. For example, an energy efficiency measure that seems costly in terms of ESOS may be much more justifiable if it could win the extra EN1 points that push you to results improvement.

Practical recommendations

Concrete actions your organisation may be able to take now are:

- Mining your ESOS action plans and reviewing your previous GRESB submissions to establish where further points can be achieved. Trained specialists like the Verco team, with experience of GRESB and ESOS, can help provide further insights.

- Structuring future action plans that are in line with GRESB indicators as we approach ESOS phase 4.

- Creating integrated reporting and implementation calendars that ensure synergies between your GRESB, ESOS, and other compliance reporting timelines.

You’ve already taken the first step by being compliant. As the future of sustainability continues to evolve, and compliance reporting becomes more interlinked, the need to shift our perspective to a more synergistic approach is imminent. This will elevate your ESG roadmap from a compliance-driven approach to one that actively drives progress towards net-zero ambitions.

This article was written by PK Flemming, Consultant at Verco. Learn more about Verco here.

Read more from our partners.