CSRD and its associated European Sustainability Reporting Standards (ESRS) comprise a central pillar of the EU’s sustainability reporting framework. Although this ambitious legislation applied to the first wave of in-scope companies in 2024, it was then subject to significant controversy throughout 2025 as the EU Commission sought to recalibrate the sustainability reporting ecosystem with the Omnibus Package.

In early 2025, the CSRD was delayed through a “stop-the-clock” directive, with a slew of additional proposals making their way through the legislative funnel. These included proposals to substantially decrease the CSRD’s scope by over 80%, to significantly revise the ESRS’s list of datapoints, and to cancel the adoption of any future sectoral standards.

This recalibration has introduced further uncertainty into a reporting ecosystem that was already struggling with complexity. Moreover, the proposal to drastically reduce the scope of companies subject to CSRD has raised concerns amongst investors who will no longer be guaranteed access to sustainability data via annual CSRD reports.

The rolling back of sustainability reporting reduces the availability of sustainability data for EU investors, hindering their ability to thoroughly assess the non-financial information necessary for effective risk management and informed decision-making. Furthermore, the combination of legislative delays and scope reductions prevents the market from being able to fully contextualize sustainability outcomes, compare disclosures, and benchmark sustainability performance as there will now be limited CSRD reports available.

Going beyond compliance with GRESB

As EU markets grapple with the legal uncertainty and reductions in data caused by the CSRD’s ongoing revisions, the GRESB Assessments continue to provide stability, comparability, and universal applicability for investors and managers in the region. As a strategic partner for resilient and high-performing investments across real assets and climate-critical industries, GRESB offers a global, standardized, annually updated, industry-aligned, and materially relevant framework that equips the industry with high-quality, validated, asset-level data to track improvements and drive measurable outcomes.

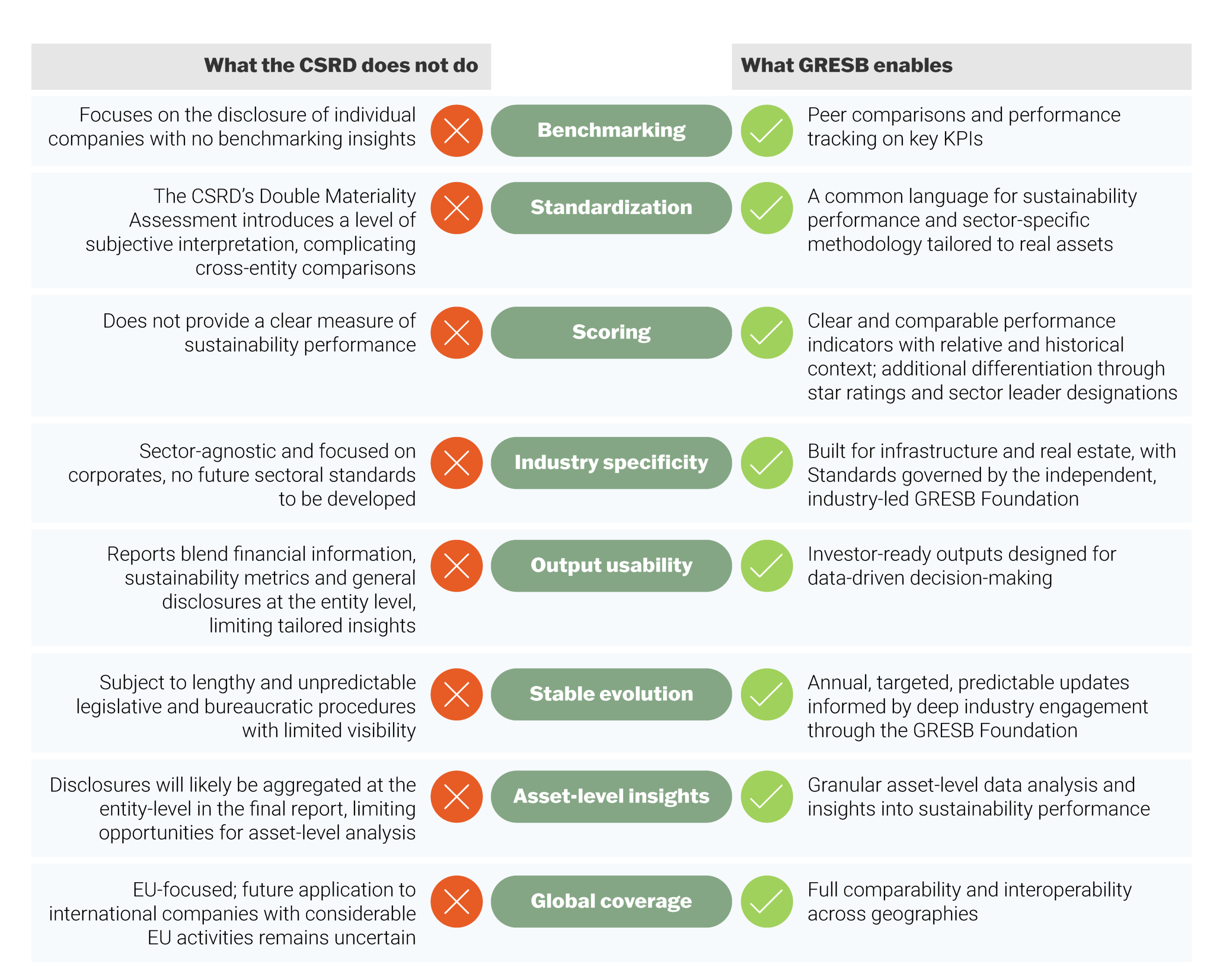

While the CSRD is a step forward in advancing transparency across the EU, it was not designed to offer benchmarking, facilitate comparability, or generate real-asset-specific insights in and of itself By focusing on asset level data, sector-specific benchmarking, and measurable performance indicators, GRESB empowers stakeholders to go beyond compliance—identifying areas of opportunity and risk with greater clarity.

How GRESB and CSRD differ: