Our industry is engaged in an important dialogue to improve the efficiency and resilience of real assets through transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

In recent times, ESG has drawn a lot of attention, facing significant political and legal challenges as debates intensify over its impacts, usefulness, and even relevance. Despite this situation, the ESG & sustainability disclosures have become more widespread and are demanded by stakeholders. The emphasis is shifting from simply reporting data to ensuring its credibility and reliability.

Assurance & verification enhances the data quality and offers stakeholders confidence that the data and claims being made are aligned with global standards and undergo robust systems to remain consistent. It helps organizations move beyond compliance, building genuine trust and reinforcing their commitment to transparent and sustainable business practices.

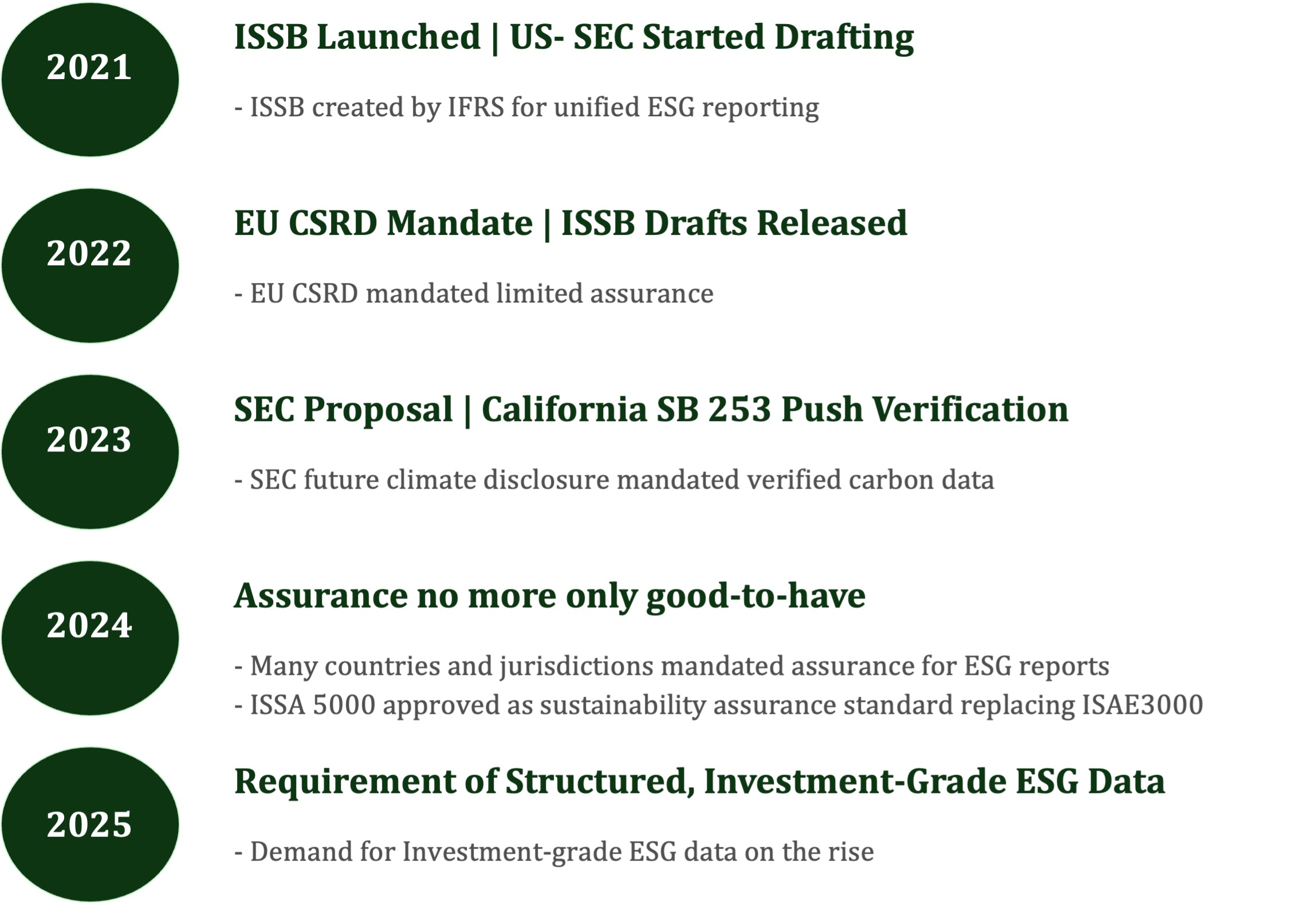

The growing importance of ESG assurance in the last half decade

Voluntary key drivers—Investors, scores, and ratings

The ask for better quality and third-party-assured ESG data has been driven by various stakeholders, and investors’ demands and ratings have been some of the prominent ones, and more recently, the regulations themselves. The ESG reporting forums used by investors and various ESG ratings and scores take into account the assurance and verification.

GRESB (Global Real Estate Sustainability Benchmark)

GRESB places significant scoring weightage on the quality of ESG data and third-party assurance.

- Real Estate Assessment: 5.5% points are assigned to assurance and verification of energy, GHG, water, and waste data under real estate assessment by GRESB.

- Infrastructure: In the beginning of 2025, the GRESB Infrastructure Assessment awarded additional points for assured GHG data ranging between 0 and 5.7 points based on materiality weighting of the entity.

CDP

The reporting entities cannot achieve an “A” score under CDP without having third-party assurance in place.

CDP assigns leadership points and hence an “A” score if:

- Scope 1 & 2 Emissions are 100% assured and verified

- Scope 3 Emissions are at least 70% assured and verified

Dispelling common myths about ESG assurance

Myths

“Assurance is too expensive and complex”

“Only large companies need assurance”

“It’s just for regulatory purposes”

“ESG data is too difficult to verify”

“ESG assurance is a pass or fail exercise”

Fact

→Assurance program can be customized, and with proper planning, it simplifies reporting and reduces long-term compliance costs.

→Organizations of all sizes gain value through improved credibility and investor trust, and regulations have provided a roadmap to include mid-size and small-size companies under ESG assurance.

→Assurance enhances sustainability strategy, risk management, and overall ESG performance.

→Standardized methodologies make ESG assurance practical and effective.

→Assurance is conducted to provide conclusions on the accuracy of the data as well as the robustness of the systems used, along with the observations for improvement.

Steps for a smooth assurance process

- Engage early, zero down on the scope

Engage with the assurance providers early to discuss the requirements and consider suggestions on the scope of the assurance based on the materiality, feasibility, and practicality rather than going for full ESG reports in the first assurance cycle. - Selecting an independent third-party assuror versus consultant

There could be an inclination to engage the ESG consultants already working with the company to also conduct assurance. This could help in getting detailed advisory but might lack formal verification capabilities and may also lead to conflicts of interest. Engaging an independent third-party assuror ensures unbiased verification and adds credibility to sustainability reporting, which is required for complying with the assurance requirements. - Budget appropriate time for assurance

Collecting the internally validated data set does not mean that it is automatically assured, and the assurance process should be appropriately incorporated in the whole reporting time plan. - Complete the Assurance Process

The provider conducts their independent assessment, including data verification, stakeholder interviews, and process reviews. They identify gaps and provide recommendations. - Communicate findings and actions

Integrate the assurance results into your ESG submissions, sustainability report, or public disclosures. Highlight improvements made based on findings and maintain transparency with stakeholders.

This article was written by Vishal Goel, Director ESG at Earthood. Learn more about Earthood here.