Over the last year, the real estate and infrastructure industries navigated an unprecedented combination of conditions:

- Slower capital flows, “higher for longer” interest rates, and rising construction and labor costs. The Urban Land Institute and PwC reported a nearly 50% reduction in real estate capital flows between 2022 and 2024 (the year reported to GRESB in 2025).

- Exceptionally high levels of uncertainty about policy and regulation. The World Economic Forum found that 82% of decision-makers expressed very high levels of political and economic uncertainty—levels potentially rivaling the height of the COVID pandemic.

- Growing regional differences in sustainability sentiment. GlobalScan, ERM, and Volans documented a strong divergence in experience with the so-called “sustainability backlash:” 91% of North American professionals reported significant backlash, compared with 71% in Europe and 38% in Asia-Pacific.

Despite these conditions, the global GRESB community showed resilience. Leading companies and funds stayed the course with their sustainability efforts, often even expanding or accelerating their work. This is reflected in the state of the real estate and infrastructure benchmarks:

- Steady participation. Company and fund participation mirrored the record levels achieved in 2024 with more than 100 new managers joining.

- More education. More than 1,300 industry professionals in 57 countries used the GRESB education platform to learn and grow, with more than 500 earning a GRESB AP credential for the first time.

- Better performance. Most important, the industry continued to make real-world performance gains, improving energy efficiency, reducing greenhouse gas emissions, and mitigating critical risks to people and asset value.

GRESB supported these outcomes through the steady execution of the GRESB Foundation Roadmap and a focus on streamlining the end-to-end participant experience.

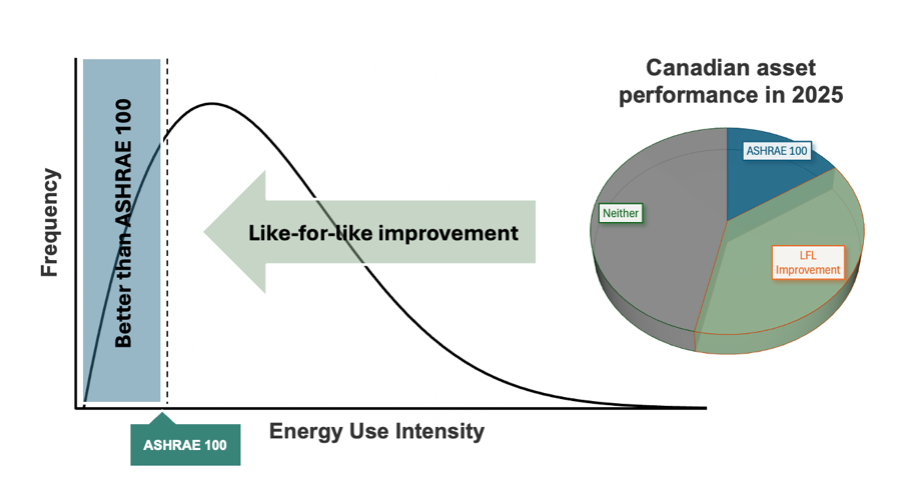

One highlight: New recognition for operationally efficient real estate. GRESB referenced a new, global energy efficiency standard (ASHRAE 100) to provide recognition for currently efficient real estate. This provided the opportunity to recognize both high performance and year-over-year improvement. As an example, Canada-based GRESB Participants reported 7,700 investor-owned assets, 11% of them were recognized as efficient relative to ASHRAE 100 and another 37% were recognized for superior year-over-year improvement.

Looking Forward

Looking ahead to 2026, five priorities will shape the GRESB experience and, we hope, accelerate our work promoting more sustainable real assets:

- Streamlining and predictability

- Asset performance

- Specificity

- Advanced ratings

- Road to performance

Streamlining and Predictability

GRESB remains focused on providing a streamlined, predictable assessment process. This means that participants have timely, forward-looking information about Standards changes, combined with active, targeted efforts to reduce reporting burden. In 2026, this will include automating the pre-submission of 17 fundamental real estate indicators, clarifying guidance, and continued emphasis on validation consistency.

Asset Performance

In 2025, GRESB introduced new tools to help participants understand the relationship between asset and entity performance. This will continue in 2026. Participants will continue to have access to score contribution and score impact analysis. They will also have the option to upgrade to more advanced and comprehensive asset analytics, including score simulation.

Specificity

GRESB exists to provide a dedicated Standard for real assets. Investors and managers increasingly request even more specificity. They want tools that recognize sector- and strategy-specific circumstances. This means adapting indicators and performance metrics to the realities facing residential real estate, data centers, industrial property, and more. In 2026, this will be reflected in incremental improvements to the Residential Assessment, full availability of the Lender Assessment, an all-new Data Center Assessment, and the new GRESB Ready label for early-stage companies and funds.

Advanced Ratings

The GRESB Star Ratings were introduced nearly a decade ago as a tool to understand and communicate relative market position. A Five Star rating indicated top quintile practices and performance across all participants. At the time, this concept aligned with investor applications and the relatively broad distribution of participant scores. Since then, both participant performance and investor applications have evolved. Participants’ scores have increased, accompanied by rising concentration among market leaders. Many investors are using Star Ratings as an indicator of quality, not only market position. In the New Year, GRESB will conduct an industry consultation to explore new, additional ratings that can be used to better reflect current participation patterns and support a broad range of investor applications. The consultation will inform GRESB’s plan to develop and deploy new ratings in the future.

Road to Performance

Finally, and perhaps most important, the GRESB Foundation clearly expressed a vision of a multi-year transition to a performance-centric Standard and assessment. This means reinterpreting current information to increase emphasis on measured, operational performance and performance-related practices. This will include changes in the recognition of widely achieved “fundamental” indicators and increases in points allocated to energy, GHG emissions, water, and waste. The Foundation Secretariate will focus on energy and GHG emissions metrics in 2026. These updates will be available to review in the 2027 cycle and become the primary scoring system in 2028. This timeline is aligned with the Foundation’s change management principles published earlier this year.

Engagement

These priorities will be overseen by a growing GRESB Foundation. The Foundation is the non-profit organization responsible for governing the GRESB Standards. In 2025, the Foundation engaged more than 130 leaders in its work. There are more opportunities in 2026, including new groups providing input from partners and regional leaders. The result will be an even more active and representative organization.

Bottomline

GRESB is excited about the road ahead. We are deeply committed to our mission and our work driving positive change through constructive engagement between investors and managers. We passionately believe that sustainable real assets are more valuable and less risky for both investors and managers.

The year ahead will see the most streamlined GRESB Assessment ever. We will provide new tools that make GRESB relevant and accessible for more investment strategies in more real asset sectors. You will see GRESB asking for your feedback throughout the year, providing opportunities to shape the future of the benchmark.

We look forward to working with you in the year ahead. For now, we wish you and your families a happy holiday season—recharging for an impactful New Year ahead.