Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Reporting Environmental, Social, and Governance (ESG) metrics and progress is an increasingly common requirement for companies in the real estate industry. Today, company stakeholders—investors, employees, residents, philanthropic partners, vendors, community leaders, and government officials—demand action and accountability around matters related to ESG. Successful ESG reporting is critical when a company seeks to track its ESG program advancement and set benchmarks, as well as communicate accomplishments in a meaningful, well-organized, and easily digestible format. Yet, amidst an evolving regulatory environment, multiple frameworks and protocol options, and shifting investor expectations, even well-intentioned efforts to establish an ESG program and articulate its progress can fall short.

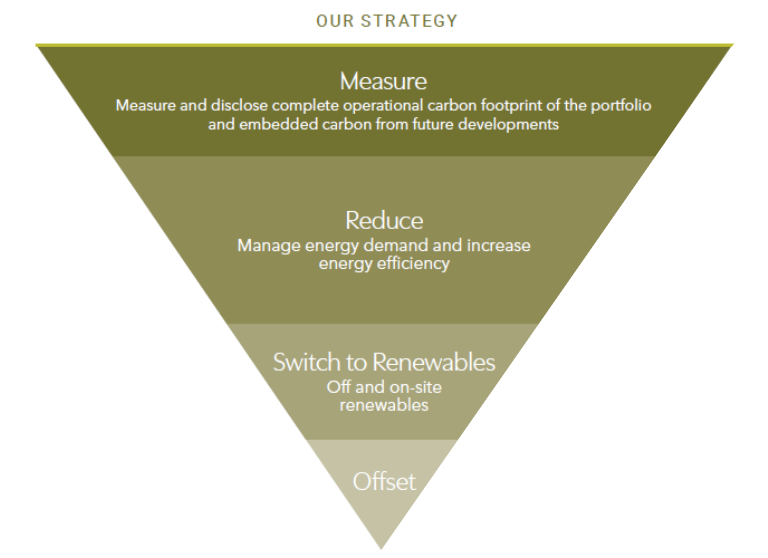

Developing and installing an effective ESG program that meets the needs of all company stakeholders requires that a company follows an environmentally and socially responsible integrated business strategy, one with clearly defined and measurable ESG goals, reporting metrics, and standards.

Reporting frameworks

Understanding the appropriate industry standards, national legislative requirements, voluntary standards, benchmarks, and assessments against which progress will be measured is the first step in crafting any effective ESG program. While in Europe there are mandatory disclosures for both listed and unlisted companies, the U.S. still relies on voluntary ESG reporting. This, however, may change soon. In 2021 the Securities and Exchange Commission (SEC) proposed amendments to enhance its guidelines on disclosures, which should be available this fall.

Today, companies in the U.S. use various frameworks to enhance transparency, including the Global Reporting Initiative (GRI) standards as a basis for disclosure, as well as standards from the:

- Task Force on Climate-Related Financial Disclosures (TCFD)

- Sustainability Accounting Standards Board (SASB)

- United Nations Sustainable Development Goals (UNSDGs)

Companies can also leverage the GHG Protocol, a worldwide standard for reporting greenhouse gas emissions. This detailed framework provides tools for companies to inventory, quantify, and report their greenhouse gas emissions in ways that support their missions and goals.

These guidelines are incredibly useful, yet the plethora of quantitative and qualitative frameworks available (often referred to as the “alphabet soup” of ESG) can confuse rather than clarify. It is my hope that, in the future, there will be a universal, international framework for disclosures. The International Sustainability Standards Board (ISSB) provides the framework that could most easily become a global baseline for sustainability disclosures. Not only would this provide easy comparisons but it would also simplify the daunting task of beginning an ESG program.

Use ratings to shape your ESG program

In addition to the frameworks described above, various ESG ratings are useful when shaping policies and initiatives. These ratings provide detailed guidelines about the ESG-related programs, initiatives and achievements that warrant a positive score, allowing companies to easily identify their next steps. Just a few of the ratings that companies use include:

- GRESB Rating: Measures overall ESG performance, including management and building performance, and provides a rating based on the comparative performance of participating companies

- CDP ESG Risk Rating: Measures environmental transparency, actions and performance

- Sustainalytics ESG Risk Rating: Measures financially material ESG risks in a portfolio

- ISS ESG Quality Score & Corporate Rating: Measures sustainability performance using a sector-specific and materiality-focused approach across industries

Beyond these ratings (and the many others available), some investors even create their own rating systems based on whichever ESG matters concern them most.

Measure from the get-go

Measuring a company’s ESG standing against that of its industry peers is a useful guidepost. That said, it’s also important to look closely for internal progress. When launching an ESG program, recognizing the company’s starting point, even if unflattering, provides a clearly defined baseline against which to measure all future progress. Collecting, managing, and analyzing internal data is paramount for any ESG program to effectively foster change and shape future actions. As such, assessing progress against both internal and external ESG metrics can help a company assess its year-over-year individualized progress, broader industry standing, and opportunities for future ESG advancement.

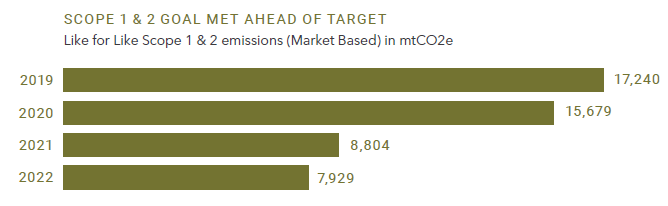

Set targets

Too often, a company sets targets for its ESG program that are too lofty, vague, or ambitious, causing the program to fall short of delivering its desired outcomes. Long-term goals are impossible to achieve without first identifying and executing small, more easily achieved steps toward overall improvement. Setting measurable, time-bound targets ensures a program structure that naturally encourages regular reporting, increasing the likelihood of success. While a company may have a 10- or 20-year plan for reducing Scope 1 & 2 emissions, it is best that the company also has regular, more frequent reporting requirements. Such reporting requirements provide a framework for a company to track its progress, ensuring longer-term accountability as these requirements may force a company to address poor progress in early on in its program’s evolution

Benefits of timely reporting

Despite recent anti-ESG sentiments, regular ESG reporting has proven itself to be a good business practice. It provides investors with a transparent view of an organization’s multifaceted impact on all stakeholders, serving as a form of risk management by regularly informing investors about a company’s ESG accomplishments and progress.

Benefits of consistent and timely ESG reporting include:

Attracting and retaining new and existing investors: Historically, investors have looked almost solely at financial data to determine a company’s worth. Today, however, investors often also analyze ESG metrics to assess the long-term prospects of a company’s non-financial and financially linked risks and opportunities.

In the real estate industry, we have seen transparent ESG reporting encourage accountability and drive value for investors. In the multifamily sector specifically, housing that is climate resilient and operationally optimized is poised to meet higher resident standards and adapt to changing regulations. In fact, research has shown that REITs with strong ESG initiatives may have better operational performance than those without such initiatives. For example, companies with sustainable building practices are better prepared for changes in building code law or government incentives for green buildings, and they often have lower operating expenses and higher rental income. Additionally, strong ESG practices are more attractive to residents, which can lead to higher occupancy rates and more stable cash flows, in turn maximizing value for shareholders over time. In fact, studies have shown that between 2013 and 2020, companies with high ESG performance tended to score 2.6x higher on total shareholder return than medium ESG performers.

Ensuring a culture of stakeholder transparency and engagement: ESG reporting is a valuable tool for informed data management that also ensures ongoing and transparent engagement with company stakeholders—both inside and outside of the organization. Consistent and proactive ESG reporting provides stakeholders with a view into its current ESG performance, as well as the opportunity for the company to set or reexamine future strategic plans and goals to benefit stakeholders.

To start, let’s look at an organization’s internal factors. Employee morale can greatly benefit from a strong ESG reporting program. By demonstrating their care for the well-being of their employees and residents, companies can establish an otherwise difficult-to-create sense of purpose and engagement. This makes it easier to attract new talent; retain and motivate existing employees; and connect them to a company’s overall brand mission. Altogether, ESG achievements are often viewed by employees as a source of pride and a major factor in overall job satisfaction.

Turning to the world outside of the walls of an organization, resident feedback provides an opportunity to anecdotally measure public opinion of a company’s broader ESG program. This starts with encouraging residents to voice their opinions on ESG and share where the company can improve. Such encouragement makes residents feel heard and valued.

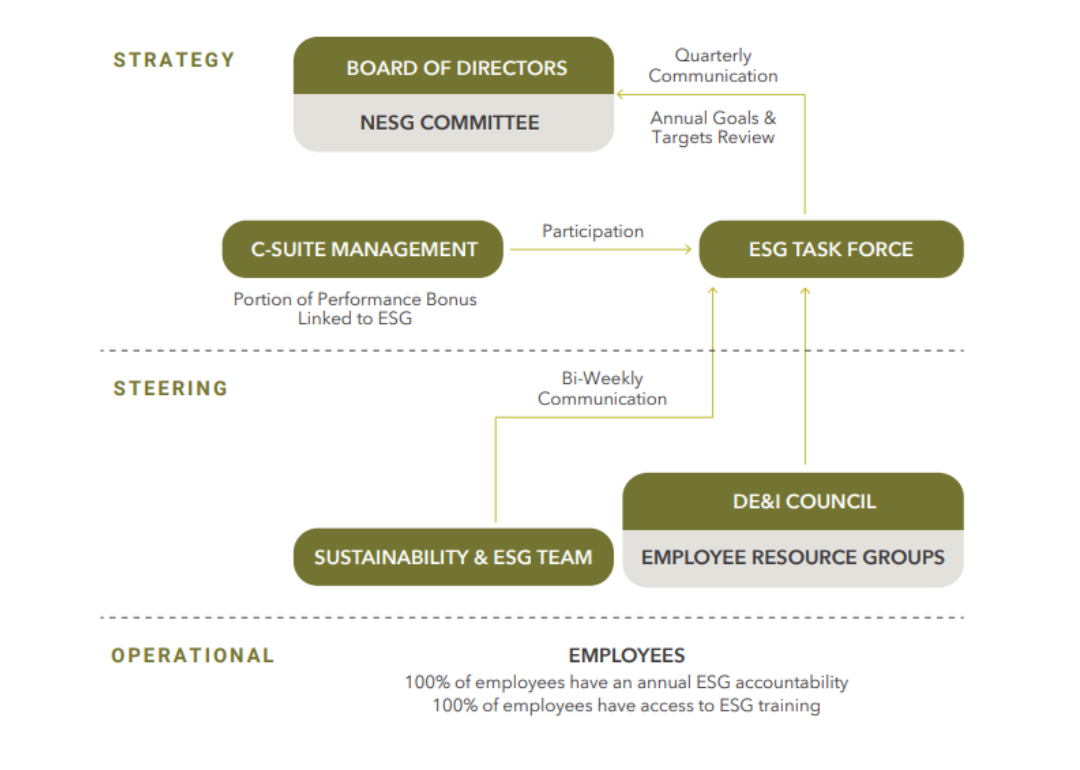

Build an execution-oriented team

Finally, establishing a dedicated ESG team to oversee a company’s ESG program and reporting—and its myriad complexities—is critical. Managing ESG strategy projects, measuring outcomes, and transparently reporting progress demands a well-structured team that can help foster company-wide accountability, one that ensures alignment between a business, the communities where it operates, its investors and other stakeholders that all have vested ESG interests as it relates to human rights, climate change, governance, and more.

At Veris Residential, we are proud to have recently published our 2022 ESG Report, which uses the GRI Standards as the basis for the disclosure, with increased transparency enhancements from TFCD and the United Nations Sustainable Development Goals on the company’s climate resiliency and corporate transparency efforts. We ensured accuracy by engaging an independent third party to perform a limited assurance engagement for certain environmental and social metrics disclosed in the report.

This article was written by Karen Cusmano, Senior Vice President and Head of Sustainability & Environmental, Social, and Governance, for Veris Residential.

References:

McKinsey: Does ESG really matter—and why?

McKinsey: Five ways that ESG creates value