Built for decision-makers

What you don’t know about your buildings can quietly erode value. Understanding and then acting on performance insights have a direct impact on your portfolio’s risk profile, operational efficiency, and long-term value.

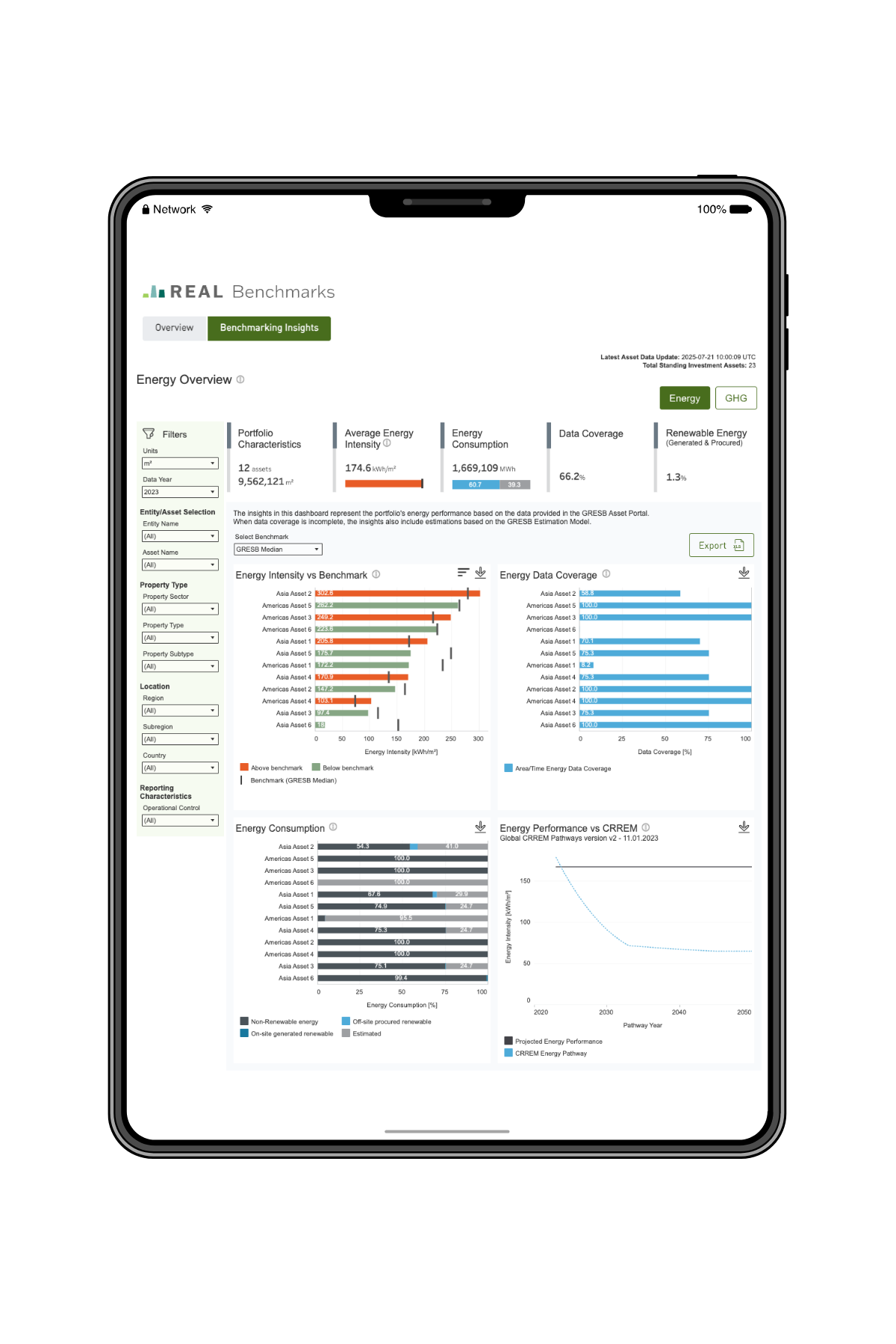

REAL Benchmarks offers a fast and cost-effective way to gain high-confidence performance insights for your assets, individually or grouped by characteristic—without public scoring, reporting, or disclosures.

Uncover portfolio risks & opportunities

- Identify underperforming or high-risk assets

- Spot green premium potential

- Screen portfolios for brown discount exposure

Bridge data gaps with confidence

- Benchmark in low-data markets

- Use real GRESB data for proxies to fill in performance gaps

- Support reporting or investment memos with credible data

Prioritize where to retrofit, refinance, or divest

- Compare assets globally against GRESB, CRREM, or ASHRAE

- Tailor strategies and actions by region, sector, and performance tiers

- Equip asset managers and tenants with performance context to act

Get a portfolio preview

GRESB is the steward of the world’s largest database of investor-owned property. If you want to see how REAL Benchmarks would cover your portfolio, submit a few details here and we’ll send you a custom preview showing the depth of the benchmark for your regional and property type coverage, typical performance ranges in these regions, and how firms like yours use REAL Benchmarks for decision making.

"*" indicates required fields

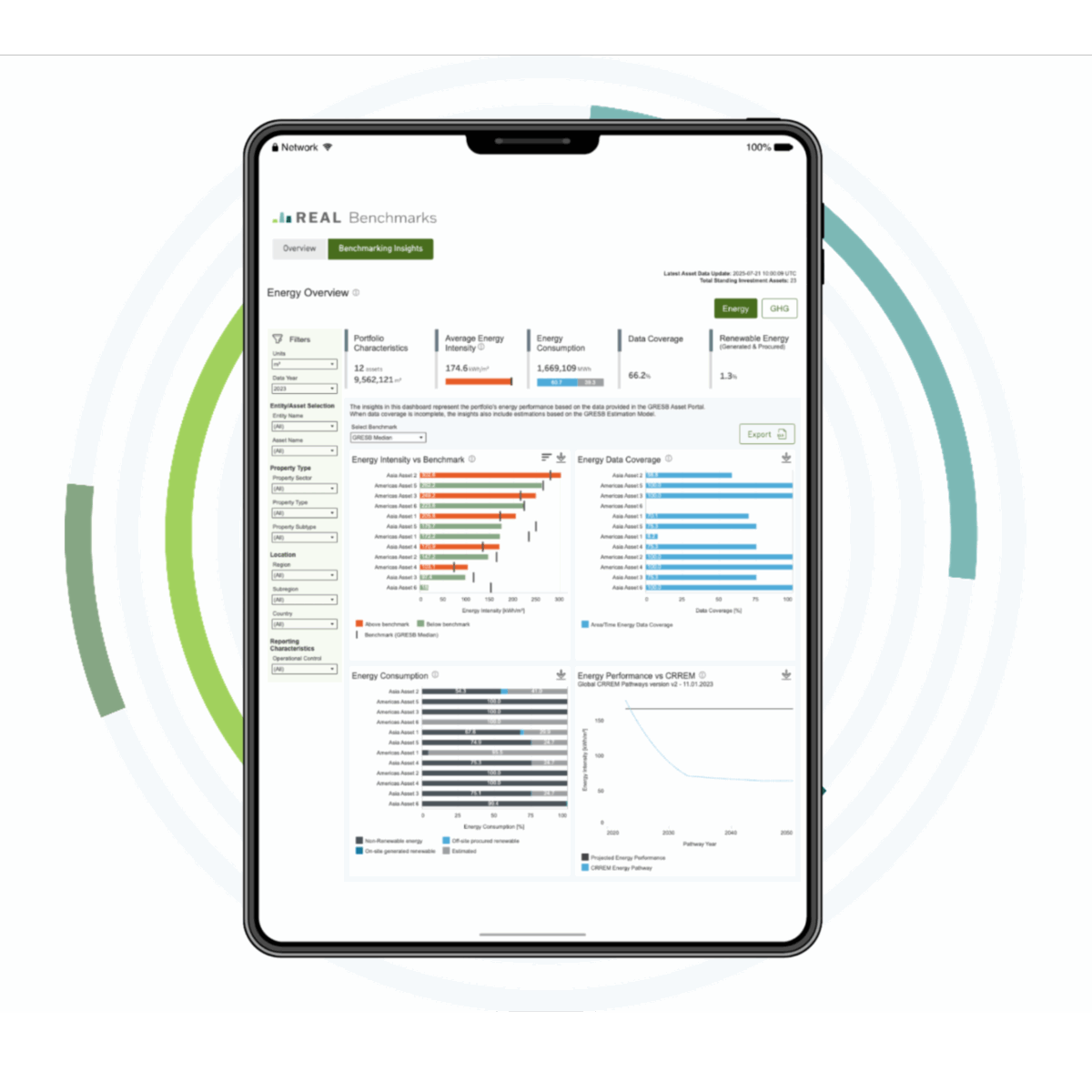

How it works

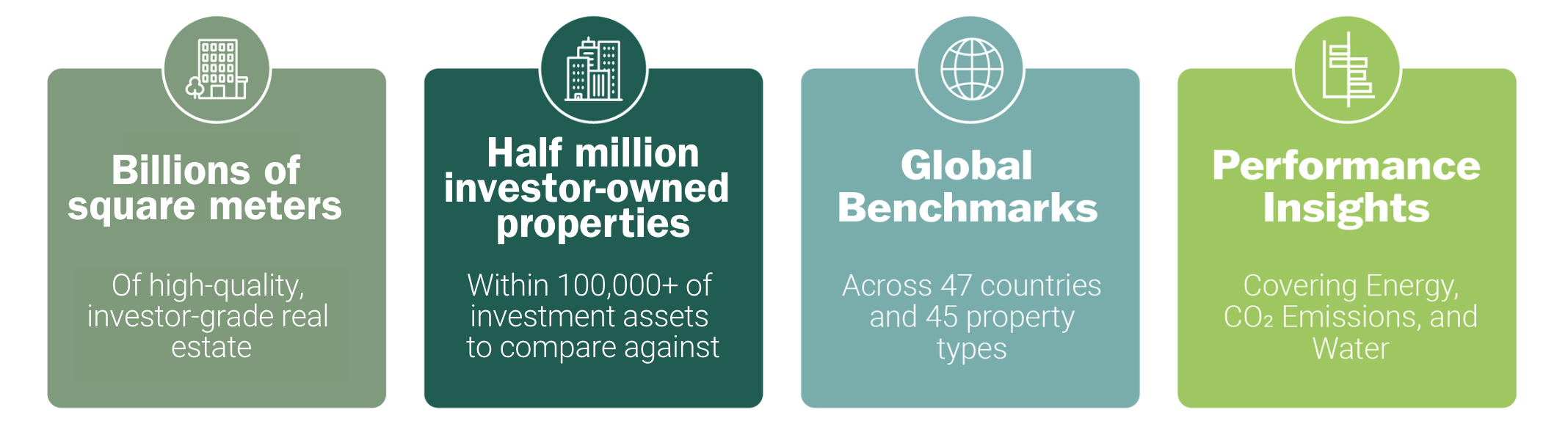

REAL Benchmarks draws from the world’s largest sustainability database of investor-owned property (over 500,000 buildings globally) and applies rigorous quality checks, anonymization, and property type and country-level geographic filtering to give you actionable answers, fast.

All you need to do is upload the asset-level data you have at hand and then use the private dashboard to explore your benchmarks and uncover insights. No submissions required, no assessments or ratings, no reporting burden—just actionable insights built from anonymized buildings and assets of more than 2,000 real estate portfolios, covering 47 countries and 45 property types.

With it you can explore insights based on:

- Your assets’ energy, GHG emissions, water, waste, and building certifications

- Benchmarks against CRREM and key thresholds from ASHRAE and GRESB

- Your emissions by scope and projected GHG performance

- Advanced estimations for any data gaps you might have

Who uses REAL Benchmarks

Originally developed for GRESB Participants, REAL Benchmarks is now available for a variety of real estate managers and companies looking for asset-level insights. Users include:

- Large, established managers looking for a performance edge

- Small companies just starting to explore how sustainability impacts the bottom line

- Those operating in low-data markets or segments

Have questions? Contact us

Reach out to us below to either get started or ask questions about REAL Benchmarks.

"*" indicates required fields

REAL Benchmarks FAQs

-

No, REAL Benchmarks is available to any real estate manager or company, regardless of whether you participate in the GRESB Assessment. REAL Benchmarks does not require you to report data to GRESB or disclose data to investors.

-

All you need is the asset-level information you already have on hand (such as location, property type, or basic performance data). REAL Benchmarks fills in any gaps using the GRESB Estimation Model, giving you credible insights even in low-data markets.

-

No, the data you provide stays private and only you can access it. There’s no disclosure, no ratings, no external reporting. It’s purely for your internal intelligence and decision-making.

-

The Assessment is a full disclosure and rating framework. REAL Benchmarks is different: it’s a tactical, no-disclosure benchmarking tool. It doesn’t score or rank you, it simply shows how your assets compare.

-

REAL Benchmarks is built from the world’s largest asset-level dataset comprising over half a million investor-owned properties across 47 countries and 45 property types.

-

The dataset is refreshed annually, aligned with the GRESB assessment cycle, ensuring timely comparability and consistency across regions and asset types.

-

Pricing depends on your portfolio’s size and scope. REAL Benchmarks is designed as a low-barrier, tactical product, making it a fast and cost-effective way to get high-confidence insights.