Purpose-built for real estate lenders

The GRESB Real Estate Lender Assessment is a structured, independently validated framework that evaluates how sustainability considerations are embedded within lending practices. It focuses on the elements that are most material to real estate lenders and within their directly influenced, providing a reliable way to understand and improve responsible lending practices across a loan portfolio.

Developed in close collaboration with major credit funds, insurance companies, banks, and investors, the GRESB Real Estate Lender Assessment reflects the practical constraints faced by lenders and does not require borrower or asset-level information.

Why real estate lenders participate in the GRESB Real Estate Lender Assessment

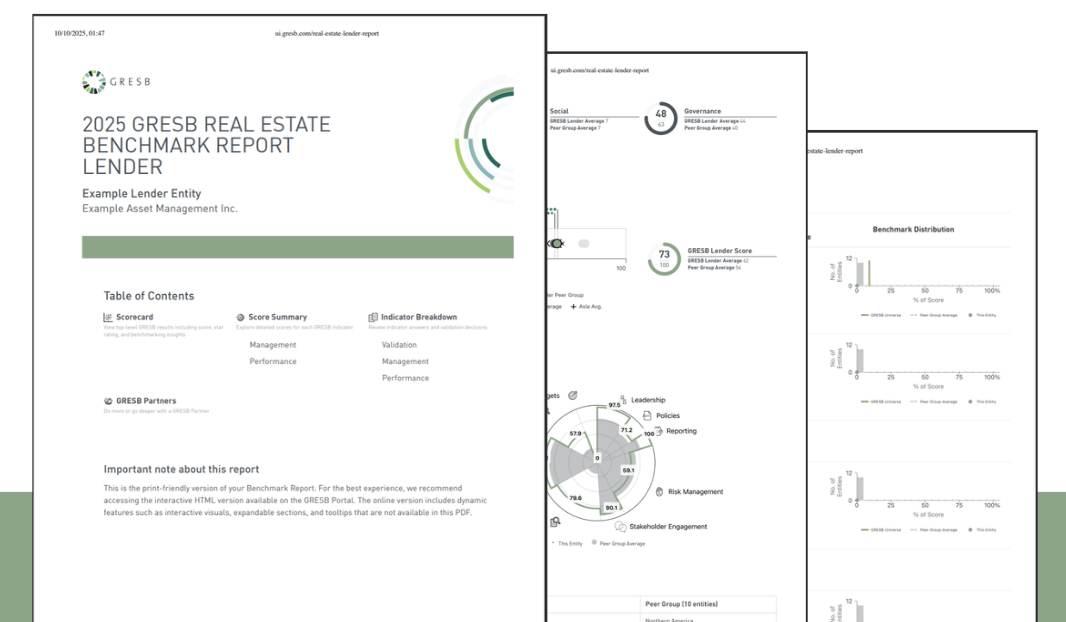

- Comparable results across peers. Receive a validated score and rating, along with benchmark comparisons that highlight strengths and areas for improvement.

- Clear input for risk and portfolio oversight. Support credit committees, investment teams, and leadership with structured insights into policies, processes, and monitoring practices.

- Alignment with investors and market expectations. Provide stakeholders with transparent, credible information on how sustainability is incorporated into lending strategy and portfolio management.

- Low-burden participation. The GRESB Lender Assessment can be completed using internal documentation, with asset-level matching being entirely optional.

How the Lender Assessment works

- Prepare. Review the Reference Guide and compile internal documents relating to governance, strategy, underwriting, and monitoring.

- Submit data while the GRESB Portal is open. Complete the assessment from April to July using your compiled information. Asset-level matching is optional and only performed when access rights are already in place.

- Validation and benchmarking. The GRESB team independently validates submissions and prepares benchmark results.

- Use your results. In October, you’ll receive your score, rating, and peer comparisons to support internal oversight and stakeholder engagement

What the Assessment evaluates

- Leadership

- Policies

- Sustainability Reporting

- Risk Management

- Loan Portfolio Management

- Property & Borrower Review

- Loan Monitoring

- Targets

- Construction Lending

- Stakeholder Engagement

Get involved

Ready to get started or want more information about whether the Real Estate Lender Assessment is right for you? Our team is available to guide you through the process and answer any questions you may have.

"*" indicates required fields

Frequently Asked Questions

-

Lenders can take part during the established GRESB reporting cycle, providing management, governance, and process-related information that covers credit strategy, underwriting, borrower review, and loan monitoring. No borrower-reported or asset-level data is required.

-

The lender assessment takes significantly less time to complete than the real estate assessment because it focuses on internal processes rather than property-level data.

-

No. Lenders can complete the assessment without requesting any information from borrowers. Optional asset-level matching is only used when existing access rights permit.

-

Peer groups will reflect lender type, geographic footprint, and investment strategy. These were determined through feedback from the 2025 pilot.

-

All lender assessment participants will receive a validated score, rating, and peer group comparison as well as indicator-level insights to support internal reviews and investor dialogue.

-

The focus of the assessment is on governance and lending processes. Future development may incorporate additional elements—such as enhanced performance indicators or portfolio-level analytics—as market readiness increases, but the aim is to keep the assessment streamlined and aligned with lender needs.