What’s New in December

As we close out the year, we’re excited to bring you a forward-looking set of updates focused on the evolution of the GRESB Standards, new assessment options for the industry, and our list of priorities to continue improving our offerings in 2026 and beyond.

In this edition, you’ll find:

- GRESB CIO Chris Pyke on the road ahead for 2026

- The new 2026 Standard Methodology Insights Report for Real Estate Participants

- On-demand 2026 Standards Updates & Road Ahead webinars—and the opportunity to sign up for the upcoming public consultation

- A closer look at sector-specific scoring for industrial real assets

- Our upcoming GRESB Real Estate Lender Assessment webinar

- New sustainability-linked loans guidance for real estate

We would like to take a moment to thank GRESB Investor Members, Participants, Partners, and the wider real assets community for their continued collaboration, insights, and engagement throughout the year.

We wish you a restful holiday season and a successful start to the new year, and we look forward to continuing our work together in 2026 and beyond.

The Road Ahead for 2026

In his end-of-year reflection, GRESB Chief Innovation Officer Dr. Chris Pyke looks back on a year marked by economic uncertainty, shifting sustainability sentiment, and continued resilience across the real estate and infrastructure markets—and outlines what lies ahead for GRESB in 2026.

The article highlights five priorities shaping the next phase of the GRESB experience, including further streamlining and predictability, a deeper focus on asset-level performance, greater sector specificity, the evolution of ratings, and a multi-year transition toward more performance-centric Standards and Assessments. Together, these priorities signal GRESB’s commitment to reducing reporting burden while sharpening the connection between quality data, real-world performance, and investment decision-making.

2026 Standard Methodology Insights Report for Real Estate

The new 2026 GRESB Standard Methodology Insights report is now available to Real Estate Participants in the GRESB Portal.

Following the release of the 2026 GRESB Real Estate Standard Updates, this new report enhances transparency around methodological changes and provides participants with early, illustrative insights into potential scoring impacts ahead of the 2026 Assessment cycle.

The analysis in the report applies the 2026 Standard to the data submitted for the 2025 GRESB Real Estate Assessment. The insights in the report are purely illustrative and not predictive—2026 results will ultimately depend on new data submissions, shifts in relative benchmarking, broader market developments, and reporting behavior that cannot be modeled in advance.

Learn more about the 2026 Standard Methodology Insights report for Real Estate Participants.

2026 GRESB Standards Updates and the Road Ahead Webinars Now on Demand

Earlier this month, GRESB hosted a series of 2026 GRESB Standards Updates and Road Ahead webinars offering a first look at these updates and deeper insight into how the Standards will continue to mature over the long term.

The webinars are now available on demand. Watch the sessions below:

Real Estate Road to Performance

The sessions also highlighted the extensive industry engagement planned for 2026 and explored how the latest changes advance the Foundation’s vision of rewarding measured, real-world performance.

As an investor-led body, the GRESB Foundation governs the Standards to ensure they evolve in line with investors’ priorities and market maturity. The evolution of the Real Estate Standard toward performance-based scoring is a natural and necessary step in aligning with investor expectations and needs, reflecting both market readiness and the growing emphasis on impact and accountability within the investment landscape.

You can read more about the Real Estate Road to Performance and the core principles guiding it on the GRESB website.

Your Opinion Matters

As an industry-led initiative, the GRESB Foundation highly values stakeholder input in shaping the Road to Performance for the Standard.

A public consultation will therefore be held starting February 2026. Members and stakeholders will be invited to comment on the Road to Performance, including the overall direction of travel, milestones, and implementation strategy.

Sector-Specific Scoring for Industrial Real Assets

Real estate sectors differ substantially in materiality, data availability, and operating models. In our latest article, GRESB’s Chris Pyke, Parag Cameron-Rastogi, and Charles van Thiel explore how sector-specific scoring could better reflect the operating realities of industrial real assets, including logistics and warehousing.

Based on a 2025 survey of industrial managers, the analysis examines limitations of the current sector-agnostic model and outlines alternative approaches under consideration—ranging from adjusted scoring weights to materiality-driven indicators and more relevant performance metrics. The results of the survey will help inform the broader evolution of the GRESB Assessments scheduled for implementation by 2028, subject to the approval of the Foundation Board.

Read the article for a deeper look at the survey results and analysis.

Assessing Sustainability in Real Estate Lending: A Lender-Focused Framework

Building on a successful multiyear collaboration with real estate lenders and investors, the GRESB Real Estate Lender Assessment is a structured, independently validated framework purpose-built for lenders. It evaluates how sustainability considerations are embedded across lending practices—from risk management and due diligence to loan portfolio oversight—delivering validated, comparable insights for credit and investment teams.

The assessment focuses on the elements that are most material to lenders and within their direct influence, providing a reliable way to understand and improve responsible lending practices across a loan portfolio–without requiring borrower–or asset-level data.

Join Us for our Lender Assessment Webinar

Join us online on January 29, 2026 for an overview of the GRESB Real Estate Lender Assessment, covering why it was developed, how it works in practice, and how it supports benchmarking, oversight, and credible engagement for lending and credit teams.

Real Estate Sector Guidelines for Sustainability-Linked Loans

Sustainability-Linked Loans (SLLs) are an increasingly important financing tool, linking loan terms to a borrower’s sustainability performance. To support more robust market practice, GRESB has developed sector-specific guidelines for SLLs in real estate, with support and input from the Asia Pacific Loan Market Association and SMBC Bank International.

The guidance applies the core components of the Sustainability-Linked Loan Principles to real estate entities, offering practical considerations for borrowers, lenders, and advisors across KPI selection, Sustainability Performance Targets, reporting, and verification. It is relevant both to formally labelled SLLs and to SLL-like financing structures. While SLLs remain bespoke by design, the guidelines aim to promote greater consistency and comparability across the market.

We would like to thank all the market participants who provided practical feedback along with the Asia Pacific Loan Market Association (APLMA) and the Loan Market Association (LMA) for their support, which will help ensure alignment with how sustainability-linked structures are assessed and implemented in market practice.

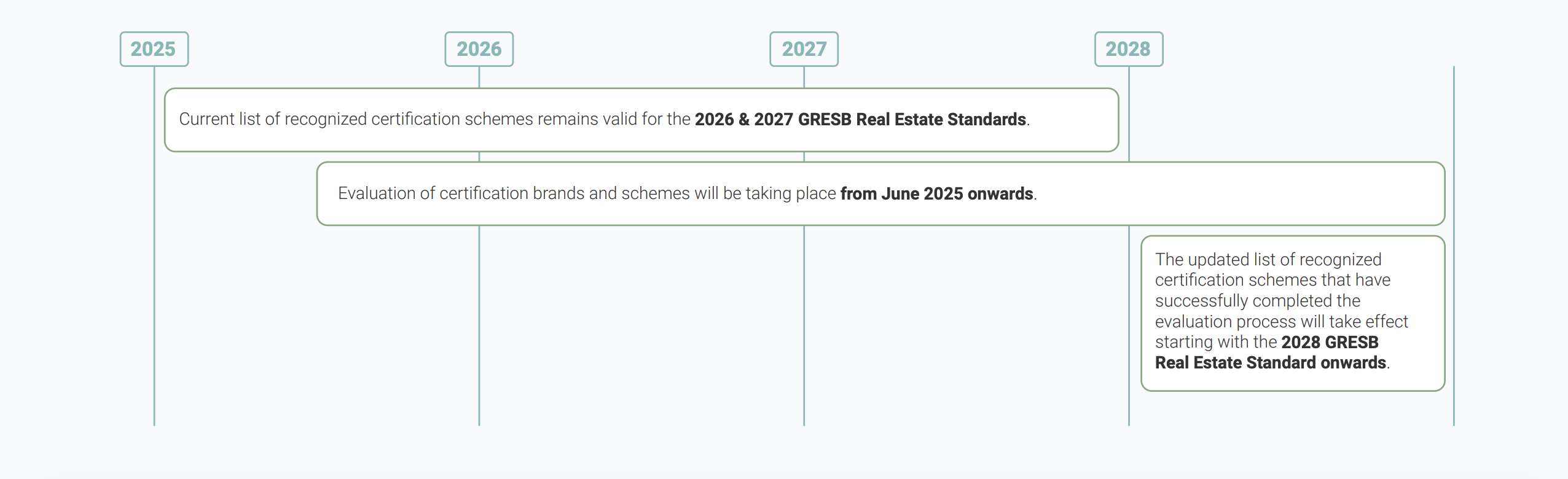

Building Certifications Evaluation Update

The building certification evaluation process, launched in mid-2025, continues to progress with strong engagement across the industry. To date, more than 20 certification brands have submitted materials for review in response to GRESB’s updated evaluation criteria.

As part of this work, the GRESB Foundation has aligned the timing of outcomes from the evaluation process with the planned evolution of the GRESB Real Estate Standard in 2028 (previously 2027). This adjustment provides an additional year with no changes to the current list of GRESB-recognized building certification schemes, supporting a smoother and more predictable transition for participants and certifiers.

For the latest updates and a running tracker on the status of certification brands, please visit the Building Certifications page.

GRESB Quarterly, Americas & Oceania

The year-end editions of the 2025 GRESB Quarterly, Americas and Oceania newsletters are here. Read them below.

GRESB Quarterly, Americas

Sponsored by GRESB Global Partner Longevity Partners, this edition shares valuable insights on evidence-based pathways for decarbonization and a look back at GRESB’s in-person gatherings throughout the Americas region this season.

GRESB Quarterly, Oceania

GRESB’s Sarah Blankfield wraps up 2025 and looks ahead to an exciting 2026, with highlights including insights from our Oceania events, a preview of Chris Pyke’s visit to Sydney in March 2026, and a round-up of partner news, insights, and resources.

2025 GRESB Member Survey

Your feedback is essential to shaping how GRESB continues to improve its insights, tools, and the member experience.

Your input will help us:

- Enhance the usability and impact of GRESB tools

- Improve how insights and analytics are delivered

- Strengthen the overall member experience across all regions and sectors

The survey takes only two minutes to complete and is open to all GRESB members.

Foundation Update

Standards Committee Membership Update

The Foundation Board recently voted to add one new member to the Standards Committees: Michael Long (HongKong Land) joined the Real Estate Standards Committee (RESC). The GRESB Foundation Standards Committees represent a diversity of organizations, sectors, and geographies, and we are grateful for their commitment to advance the GRESB Standards. On behalf of the GRESB Foundation Board Chair, Katie Jowett, the RESC Chair and the entire Foundation Board, we are excited to welcome Michael to the Foundation!

The selection process continues to be highly competitive due to the number of exceptional applicants received by the Foundation Board. The Foundation will continue to accept applications on a rolling basis and will review applications before the beginning of the next standards development cycle (Q3 2026).

Data Center Working Group

The Data Centers Working Group met in person for a third time during the iMasons’s Climate Accord Summit in Santa Monica, California. The working group includes more than 20 representatives from across the automation, energy management, computing, technology, and asset management sectors to develop new data center-specific sustainability benchmark.

The group discussed the preliminary results from the Data Center Pilot Assessment, which has received input from more than 40 organizations, including Ada Infrastructure, Affinius Capital, Portus Data Centers, CBRE IM, EcoDataCenter, EdgeCore, GI Partners, GreenScale Data Centres, Harrison Street, Nuveen, PGIM,PIMCO, Prime Data Centers, Sabey Data Centers, STACK Infrastructure, and Stream Data Centers. The full assessment will open to the whole market in the first half of 2026.

Read more about GRESB’s focus on data centers on the GRESB website. To read more about the iCA Summit and data center meetings, check out the recent LinkedIn posts by Chris Pyke and Sarah Welton.

Foundation Members In-Person Meeting

Members of the GRESB Foundation, including the Board, the Real Estate and Infrastructure Standards Committees, and the Data Center Working Group, will gather in person in London for an in-person meeting early next year. There will be several strategy meetings and an economic market update session; the group will also tour an iconic building, a data center, and a bus terminal outside of London.

The Pulse by GRESB

The Pulse by GRESB is an informative content series featuring the GRESB team, partners, GRESB Foundation members, and other experts, published on Spotify, Apple Podcasts, and YouTube. Listen to the latest episodes below:

Green Financing at the Crossroads: From Asset-Level Data to Market Transformation

GRESB’s Katy Aylward speaks with Antonio Marotta, Regional Director at Catalyst, and Juan Palacios, Assistant Professor at Maastricht University and Visiting Assistant Professor at the MIT Center for Real Estate, about how sustainability performance is reshaping real estate’s access to capital—from the evolution of green financing to the role of asset-level data and benchmarking.

Contribute to GRESB Insights

Industry insights from our partners and members into “Social value” and other rolling topics:

- Building a low-carbon future: The role of alternative materials in reducing embodied carbon | Verdani Partners

- The ROI of relationships: Why responsiveness is the ultimate retention strategy | Grace Hill KingsleySurveys

- The “S” factor: Why social sustainability matters in student living | Utopi

- Why tenant engagement matters when it comes to social topics | Torvik Gruen AI UG (haftungsbeschränkt)

- Scaling data centers responsibly in the AI era | SeaBridge

- Investing in resilience: Making physical climate risk a financial priority for real estate | ClimateFirst

- Tenant satisfaction as a strategic pillar of social sustainability | AktivBo

- Turning compliance into a competitive edge: How ESG can be transformed into an investment strategy | Rider Levett Bucknall

- How real estate investors can prepare for 2030–evidence-based pathways for decarbonization | Longevity Partners

Interested in contributing? Check out the 2026 GRESB Editorial Calendar for fixed monthly topics and submission guidelines. The topic for January is “Sustainability Fundamentals”.

Careers

GRESB is growing and looking for new people! Our most recently added open positions:

- Working Student – Finance and Business Support | Amsterdam

- Senior Financial Controller | Amsterdam

What are we reading

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletter.