The 2026 Standard Methodology Insights report gives each GRESB Participant a tailored view of how the updates to the 2026 Real Estate Standard could affect their scoring, using their 2025 Assessment submission as the reference point. It covers both Standing Investments and Development.

Background – Why this report?

In 2024, when announcing the 2025 Standard Updates, GRESB committed to providing better mechanisms to help participants understand and anticipate how standard updates may influence their GRESB Score.

Alongside the release of the 2026 Real Estate Standard Updates, GRESB has published the 2026 Standard Methodology Insights Report to increase transparency around methodological evolution, provide early insights into potential score effects, and support market readiness ahead of the 2026 reporting cycle. The analysis uses the data submitted for the 2025 Assessment and is illustrative rather than predictive.

The 2026 GRESB results will depend on the actual 2026 Assessment submissions, applicable benchmarks, validation outcomes of evidence and inputs, and broader developments in market maturity and reporting behavior, which cannot be modeled in advance.

Scope

What it covers

The scope of this report covers two types of scoring changes as announced in the 2026 Standard Updates: (1) The General Standard Updates and the (2) Technical Refinements in methodology.

General Standard updates

This type of change relates to the topics of indicator retirement & weighting adjustments and embodied carbon—scoring changes announced in 2024 and already introduced in the 2025 Standard. The availability of 2025 data allows GRESB to provide an illustrative score recalculation (excluding elements GRESB can’t model in advance such as participant’s input change and evidence validation).

These are changes applied to indicators at the entity level and will affect both the Standing Investment and Development benchmarks.

Technical Refinements

This type of change relates to technical refinements in methodology, covering two topics: GHG scope reclassification and ownership period. It can be broken down into two distinct categories of change:

- Input change (based on updated guidance): this relates to GHG scope reclassification and requires different asset data input from participants in 2026; therefore, scores can’t be recalculated in advance. An indication of impact is provided in the report.

- Aggregation methodology change: this relates to ownership period and is an internal methodology change that doesn’t require different input from participants. Therefore, this can be recalculated, and an illustrative impact is provided in the report.

These changes apply at the asset level and will affect the Standing Investment Benchmark.

Availability

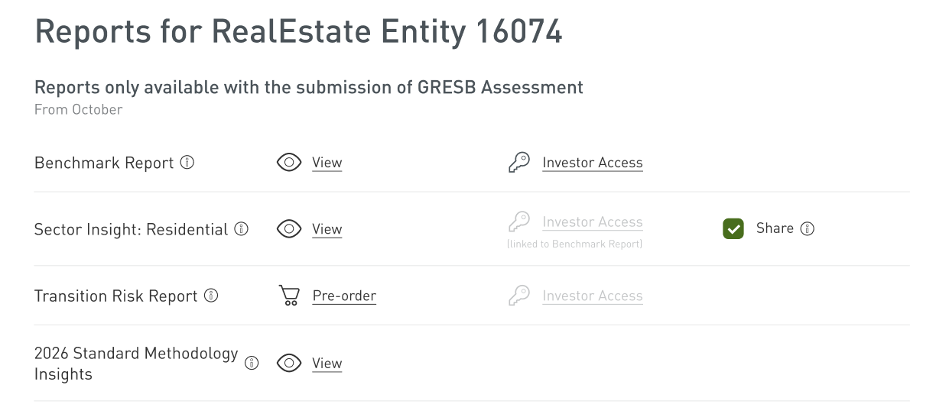

The report is available in the GRESB Assessment Portal for all participating entities that have submitted their Assessment and received a Benchmark Report. It is listed alongside other reports. The report is not available to participants who submitted a single component.

The report is not available to Investor Members and cannot be shared with investors in the GRESB Portal.

Understanding the insights

1. General Standard updates

The tables present actual 2025 scores alongside scores recalculated by applying the 2026 Standard to the same 2025 inputs. This is displayed in both absolute and percentage scores, and is divided in sections that highlight the nature of the change (retirement of indicators, scoring weight increase/decrease, and reallocation of scoring weights within indicators)

How the analysis works

Scores have been recalculated using two methods:

1. Indicator retirement & scoring weight adjustments: for this section, scores have been linearly re-scaled to align with 2026 scoring weights, without any impact on the content within the indicator. This applies to the following indicators:

a. Management Component:

i. Retired indicators: LE3, SE2.2

ii. Indicators with adjusted weights: RM6.1–4, SE5

b. Performance Component:

i. Indicators with adjusted weights: RA3–5, T1.2

c. Development Component:

i. Indicators with adjusted weights: DRE2, DRE3, DSE2.1, and DSE3.1

2. Embodied carbon: this section covers newly added content to existing indicators. Therefore, the recalculation of scores is not done by linearly rescaling 2025 scores but follows the new scoring logic introduced in the 2026 Standard Updates. This applies to the following indicators:

a. Performance Component: TC3, TC4

b. Development Component: DMA2, DWS1

Indicators requiring manual validation are flagged in the report. For this analysis, the 2025 validation decisions have been applied where available. 2026 outcomes may differ depending on the evidence submitted in 2026.

2. Technical Refinements

The table outlines the technical refinements in methodology for 2026 applied to asset-level data. These refinements affect only the Performance Component. The analysis covers the topics of GHG scope reclassification and ownership period.

How the analysis works

GHG Scope reclassification:

In 2026, Participants will be required to reclassify Tenant Spaces–Landlord Controlled emissions, which were previously reported as Scope 3 emissions, as Scope 1 and 2. Note that this only affects assets reporting the Base Building + Tenant Spaces split.

GRESB is unable to recalculate the direct impact in the emissions reclassification because: Scope 3 emissions currently cover both Tenant Spaces–Landlord Controlled and Tenant Spaces–Tenant Controlled. GHG emissions are self-reported and as such, it is not possible for GRESB to differentiate the portion of an asset’s current Scope 3 emissions that should be reclassified as Scope 1 and 2.

As a result, the report provides an indication of floor area that is subject to reclassification in 2026, and insights are flagged as:

- No impact identified: This flag is displayed when 0% of an entity’s current floor area is classified as Tenant Spaces–Landlord Controlled. In this

scenario, the GHG scope reclassification change is not expected to affect the entity’s emissions scopes in 2026. - Impact identified: This flag is displayed when an entity has assets with floor areas defined as Tenant Spaces–Landlord Controlled. In this scenario, the GHG scope reclassification change is expected to affect the entity’s emissions scopes in 2026. An indicative percentage of floor area subject to this change is displayed to inform participants of the expected impact.

- How is the percentage of floor area calculated?

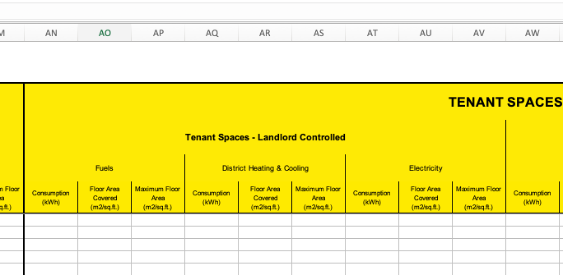

The percentage of floor area uses the total owned floor area reported under “Tenant Spaces, Landlord-Controlled” as numerator and the total owned floor area of the portfolio as denominator.

It is weighted by the percentage of ownership (area) and ownership period (time). These calculations already include the effect of other technical refinements to be introduced in 2026 (inclusion of ownership period in aggregation).

- How to identify affected assets

The assets considered in the floor area subject to this update can be easily identified in your 2025 Asset Spreadsheet, in the Energy tab under columns AN-AV.

- What is the impact?

The floor area reported in 2025 as Tenant Spaces–Landlord Controlled will be subject to the 2026 GHG scope reclassification. This will impact the emissions profile of your entity, shifting the corresponding portion of emissions previously classified as Scope 3 to Scope 1 and 2. This change was implemented to improve alignment with the GHG Protocol and removes the need for reconciliation across frameworks.

As with every year of newly submitted data in the Assessment, there will be shifts in the relative benchmarking used for scoring, and also year-on-year fluctuations in emissions factors. These two elements, together with the GHG scope reclassification, are key to defining the final score of GHG Data Coverage (area/time) and Like-for-Like metrics subject to a scoring impact. Therefore, it is not possible to anticipate the exact scoring change.

However, to provide participants with a high-level order of magnitude of possible impact, GRESB calculated an expected range of scoring impact based on assumptions extrapolated from energy consumption data reported in 2025. The expected impact on GRESB Participants’ scores ranges from -2 to +2 points, with an average increase of approximately 0.2 points.

Ownership period

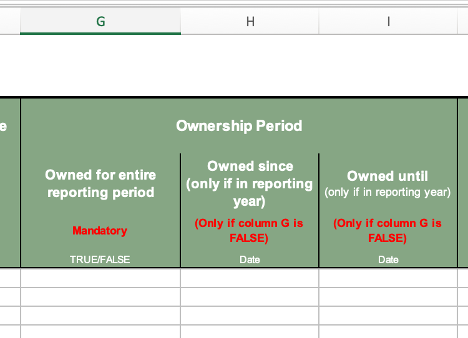

In 2026, asset-specific ownership periods will be incorporated as a weighting factor in the aggregation model.

This change has been calculated based on 2025 Assessment submissions and therefore reflects the ownership period for assets in 2024. Assets reported with ownership period shorter than a full year in 2024 will likely have different ownership periods in 2025. This is because assets that have been sold in 2024 will no longer be part of the entity’s portfolio in 2025 and newly acquired assets in 2024 will likely be owned for the entirety of 2025. In addition, GRESB cannot anticipate new acquisitions and dispositions in 2025 and their respective ownership periods, so it is not possible to anticipate the exact scoring change in 2026.

The report provides an indication of number of assets exposed in the 2025 Assessment submission and the scoring impact of this exposure. Insights are flagged as follows:

- No impact identified: This flag is displayed when none of the entity’s assets were partially owned in 2024. In this scenario, applying the 2026 Ownership Period aggregation changes would not result in a scoring impact.

- Impact identified:This flag is displayed when at least one of the entity’s assets was owned for less than the full year in 2024. In this scenario, the approximate scoring impact will be shown in the report.

- How is the impact calculated?

GRESB has replicated the aggregation of asset-level scores using the ownership period as a weight. Therefore, assets held for less than a full year will carry a lower scoring weight towards the entity’s final score. This covers indicators:

- EN1 | Energy Consumption

- GH1 | GHG Emissions

- WT1 | Water Use

- WS1: Waste Management

- BC1.1–BC1.2 | Building Certifications*

- BC2 | Energy Ratings

* Building Certifications are not scored at the asset level, but the certified floor area drawn from each asset will be weighted by the ownership period of the asset.

- How to identify the affected assets

The assets included in the count can be easily identified in the entity’s 2025 Asset Spreadsheet in the Reporting Characteristics tab under columns H and I.

- What is the impact?

This change has no direct impact on the participants’ input in 2026, as this refers to a methodological change. The scoring impact illustrates how the new aggregation change incorporates ownership period of an asset into scoring. Assets with ownership period for less than the full year will carry a lower scoring weight.

Insights in context

The insights presented in this report are based on the application of the 2026 updates to the 2025 submitted data. Therefore, they should not be interpreted as a prediction of 2026 scores. This analysis does not model the impact of (i) reporting behavior and new input, (ii) new validation outcomes, (iii) shifts in relative benchmarks for asset-level metrics, and (iv) year-on-year changes in market conditions.

This report aims to contextualize the scoring impact averages and ranges outlined in the 2026 Standard Updates for each entity, providing participants with additional insights to anticipate the potential effect of upcoming Standard updates.

Looking Ahead

GRESB remains committed to expanding the tools and resources available to help Members anticipate and respond to future Standard updates.

To better understand how your new 2026 data may influence your scores based on asset-level changes, GRESB will launch a new tool in 2026: live asset-level score simulations. For more information and early access, visit this page.

We welcome your feedback on the 2026 Standard Methodology Insights report and invite you to share suggestions or questions at [email protected].

FAQ

-

Participants who have submitted a full Assessment in 2025 can access the report in the GRESB Assessment Portal, where it appears alongside other reports.

-

No. The analysis applies 2026 methodology updates to your 2025 submission for illustrative purposes only. 2026 results will depend on your 2026 submission, benchmarks, validation, and market developments.

-

Standing Investments: Management & Performance.

Development: Management & Development (General Standard updates).

Technical Refinements are shown for the Performance Component only.

-

- General Standard updates: indicator retirements, weight changes, and newly added data to existing indicators (e.g., RM6.1-4, SE5; RA3–RA5; T1.2, TC3, TC4; DRE2-3, DMA2, DWS1,DSE2.1, and DSE3.1).

- Technical Refinements (Performance): GHG Scope reclassification and Ownership Period aggregation. Some effects cannot be exactly recomputed in advance; typical overall impacts are modest.

-

The tables show your actual 2025 scores next to recalculated scores derived from applying the 2026 methodology to the same 2025 data, so you can isolate the effect of confirmed changes.

-

The insights contained in the report are designed for participants. The report is not available to Investor Members and cannot be shared with them in the Portal. Please contact GRESB for any questions on distribution.