Program Content

- Fundamentals for Success

- Challenge, Opportunity, and Growth: Reflections from the 2025 Benchmark

- Data Centers: A Fit-for-Purpose Benchmark for the World’s Fastest-Growing Sector

- Residential Real Estate: The Importance of Sector-Specific Insights

- Net-zero: Advancing Alignment for Infrastructure Assets

- Embodied Carbon: Measuring What Matters

- Fundamentals in Action: Celebrating the Success of GRESB Participants

- Beyond the Scores: Signals from the 2025 GRESB Benchmark

- Services, Programs, and Partnerships to Help You Advance

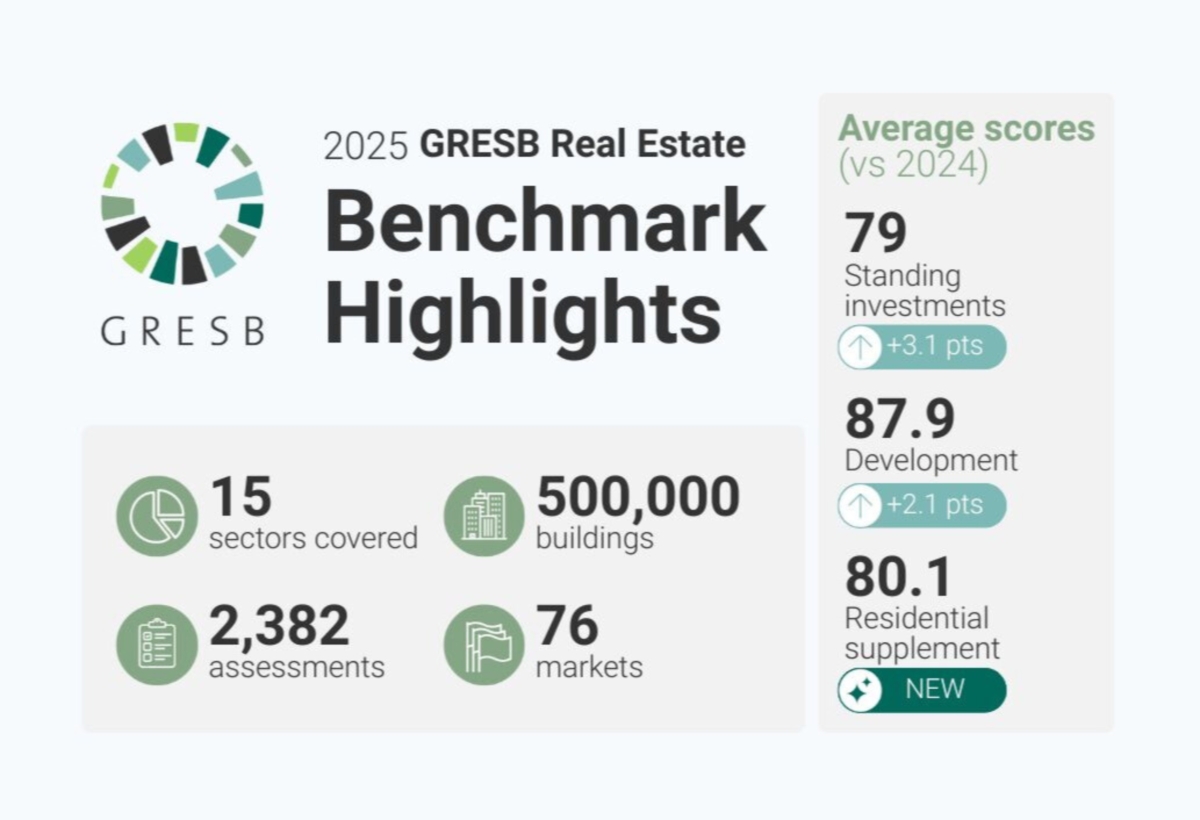

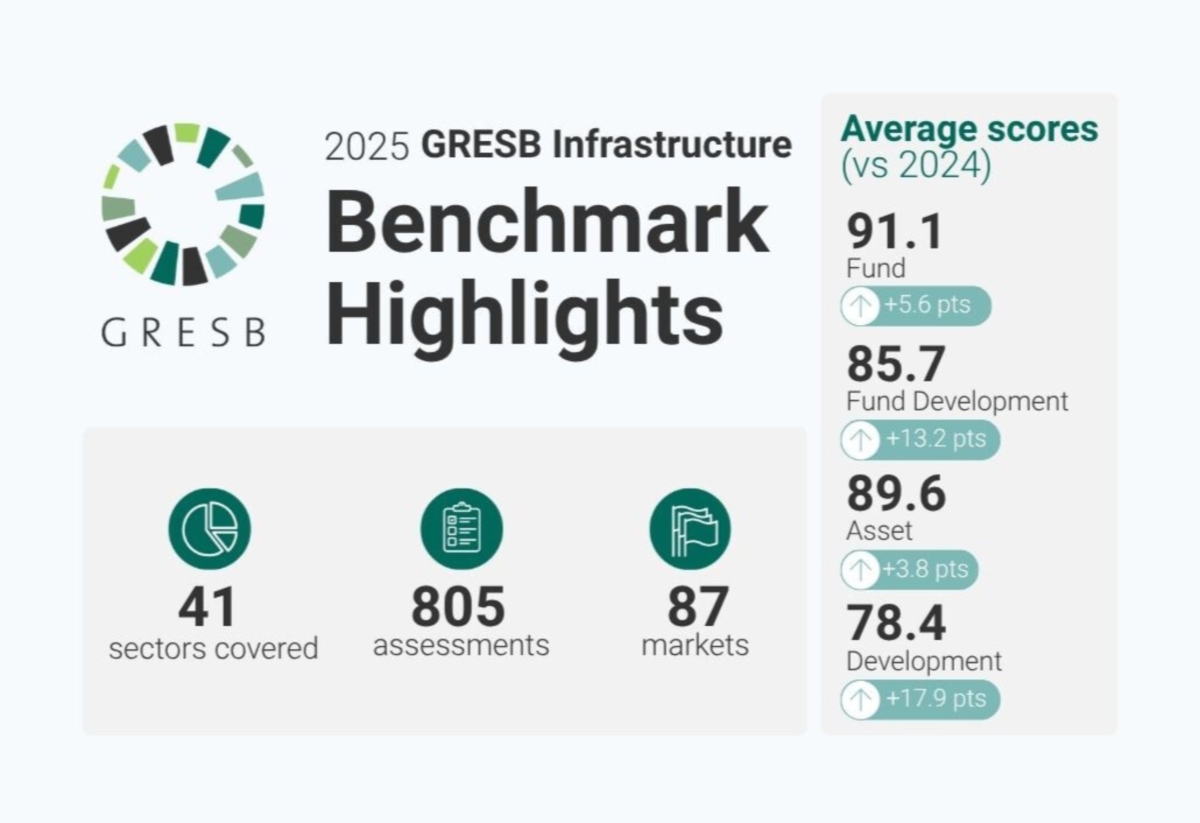

- 2025 Results Highlights

- Is ESG Dead? What’s Next for Sustainability Survey

- Join Us in Person for GRESB Regional Insights

Fundamentals for Success

Start your journey through the 2025 GRESB Global Results with GRESB’s Chris Pyke, Chief Innovation Officer, and Roxana van den Berg, Chief Product Officer. In this opening conversation, they reflect on today’s macroeconomic headwinds, shifting investor priorities, and the resilience of the GRESB community. They highlight new developments—from thematic benchmarking and a new data center assessment to the recently announced partnership with IIGCC and the rise of sustainability-linked loans in APAC. Each reflects how investor priorities and market shifts are shaping the path to resilience and sustainable growth.

Challenge, Opportunity, and Growth: Reflections from the 2025 Benchmark

In this video, Chris Pyke, Chief Innovation Officer at GRESB, explores the global forces reshaping real assets—from economic headwinds and policy uncertainty to shifting regional priorities and emerging opportunities. He reflects on how sustainability strategies are evolving across markets, why growth will increasingly depend on regional and sector-specific approaches, and how value, risk, and performance are converging to define the next chapter for real assets.

Data Centers: A Fit-for-Purpose Benchmark for the World’s Fastest-Growing Sector

One of GRESB’s most exciting developments this year is the launch of our new Data Center Benchmark, created in partnership with Infrastructure Masons. As the sector expands rapidly with AI and global digitalization, sustainability has become a prerequisite for success, from grid interaction to water efficiency. In this video, Cathy Granneman, Program Manager, Innovation at GRESB, explains how this new on-demand, modular assessment will connect ambition with measurable performance, helping the industry turn growth into lasting value.

Residential Real Estate: The Importance of Sector-Specific Insights

2025 also saw the launch of a new Residential Component within the GRESB Real Estate Assessment. Designed for pure-play residential participants, the component introduces new custom indicators and a separate Sector Insight: Residential Report. In this video, Noor van Houte, Senior Product Manager at GRESB, explains how this tailored approach to assessing the performance of residential portfolios delivers sector-specific comparisons and actionable insights, empowering participants to create value for both investors and communities.

Net-Zero Infrastructure: Advancing Alignment for Assets

In response to strong market demand, in 2025, GRESB partnered with the Institutional Investors Group on Climate Change (IIGCC) to assess the alignment of infrastructure assets with the Net Zero Investment Framework (NZIF) 2.0. Starting in 2026, participants in the Infrastructure Asset Assessment will be able to assess their alignment with NZIF through six simple, voluntary questions—making it easier for investors and managers to monitor net-zero strategies. In this video, Joss Blamire, Director of Infrastructure Standards at GRESB, explains how this collaboration will help the industry accelerate progress towards net-zero alignment.

Embodied Carbon: Measuring What Matters

The built environment accounts for 42% of global GHG emissions, with 15% stemming from materials and construction processes in the form of embodied carbon. Since 2023, GRESB has made measuring and addressing embodied carbon a core priority, expanding its coverage in the Real Estate Standard. As of 2025, half of real estate participants now track embodied carbon emissions from their development projects. In this video, Victor Fonseca, Senior Associate, Real Estate at GRESB, explains why embodied carbon is rapidly moving up the agenda and why now is the time to measure and act.

Fundamentals in Action: Celebrating the Success of GRESB Participants

The fundamentals come to life through the work of GRESB Participants. The stories below highlight how leading managers and investors are driving efficiency, creating long-term value, and building resilience in real assets.

Scape’s Story

Chris Nunn, General Manager, ESG at Scape, discusses how disciplined operational efficiency delivers measurable savings. From switching to renewables and electrifying systems to securing an AUD 2.7 billion sustainability-linked loan, Scape is cutting emissions, reducing costs, and strengthening competitive positioning. In this video, Chris reflects on how efficiency is delivering stronger performance across the portfolio.

CapMan’s Story

Anna Rannisto, Sustainability Director, Real Estate at CapMan, shares how the organization is turning sustainability practices into real market value. By embedding targets into strategy, investing in efficiency, and participating in GRESB, CapMan is reinforcing investor trust and delivering measurable results. In this video, Anna reflects on how sustainability translates into value creation in today’s market.

Readypower Group’s Story

Florin Daniel Stanciu, Group Head of HSEQ North at Readypower Group, shares how the company has embedded sustainability at the core of its business since joining GRESB in 2023. Guided by the framework, Readypower has launched a sustainability working group, deployed solar across sites, and deepened supplier partnerships to drive progress toward net zero and strengthen confidence among customers, stakeholders, and employees.

Beyond the Scores: Signals from the 2025 GRESB Benchmark

GRESB Scores are just the starting point. This session digs deeper into the data to uncover the signals shaping real assets today. The 2025 Benchmark reveals how greater transparency, ambitious targets, and measurable impact are redefining the market. New efficiency scoring shows that over one-fifth of assets already meet standards like ASHRAE, while many others are demonstrating measurable year-over-year improvements. Meanwhile, investors are looking well beyond headline scores, focusing on asset-level data, energy and GHG metrics, and progress overtime to guide capital allocation. Together, these signals show how resilience, efficiency, and transparency are driving long-term value in real assets.

Services, Programs, and Partnerships to Help You Advance

-

New in 2025, QuickStart is designed to help new and existing participants familiarize themselves with GRESB quickly so they can better navigate the assessment process. QuickStart offers one-on-one time with the GRESB Member Success Team to ask key questions and receive tailored advice. Learn more.

-

GRESB Partners provide expertise, guidance, and innovative solutions to help accelerate progress and contribute to positive change. In 2025, GRESB launched Solution Providers, a new kind of partner that connects GRESB managers to organizations offering specialized support to track and improve sustainability performance beyond the Assessment cycle. Discover GRESB Partners.

-

In 2025, GRESB invested deeply in enhancing the member experience—delivering clearer guidance, more responsive support, and higher-quality services. From reducing reporting burden to improving reliability, education, and tools, these updates ensure members can focus on what matters most: turning data into long-term value. Learn more.

-

GRESB AP recognizes individuals with the expertise to collect, manage, and report on sustainability data within the GRESB Assessments. In 2025, the program expanded with the launch of a new infrastructure credential. Since the program launch in 2024, more than 400 professionals have distinguished themselves by earning this designation. Learn more.

Is ESG Dead? What’s Next for Sustainability?

Now that you have had a chance to review GRESB’s 2025 Results, we invite you to take a five-minute sentiment survey, brought to you by GRESB and MIPIM, on how the real estate industry is evolving its approach to “ESG” and sustainability.

Your answers will be confidential, and results will be shared with survey participants in late 2025 and featured at MIPIM in 2026.

Join Us in Person for GRESB Regional Insights

Building on Global Results, the GRESB Regional Insights 2025 event series will translate the same fundamentals—clarity, resilience, and operational efficiency—into market-specific takeaways. Each in-person event will unpack the signals behind the scores for your region, highlighting what the GRESB Benchmark indicates about local risk pressures, operational improvement momentum, and how investors in your market are responding.

Co-hosted with GRESB Partners across 30+ cities worldwide, these events will pair data briefings with practical, real-world examples—so you can benchmark locally, compare peers, and turn insights into next steps for 2026 planning.