Climate risks and occupier demand shifts pose the biggest threats to asset values

January 16, 2026. A new survey by GRESB, the global sustainability benchmark for real assets, and MIPIM, the world’s leading portfolio of property events, shows that sustainability remains a core priority for investors and managers despite recent language shifts around ESG.

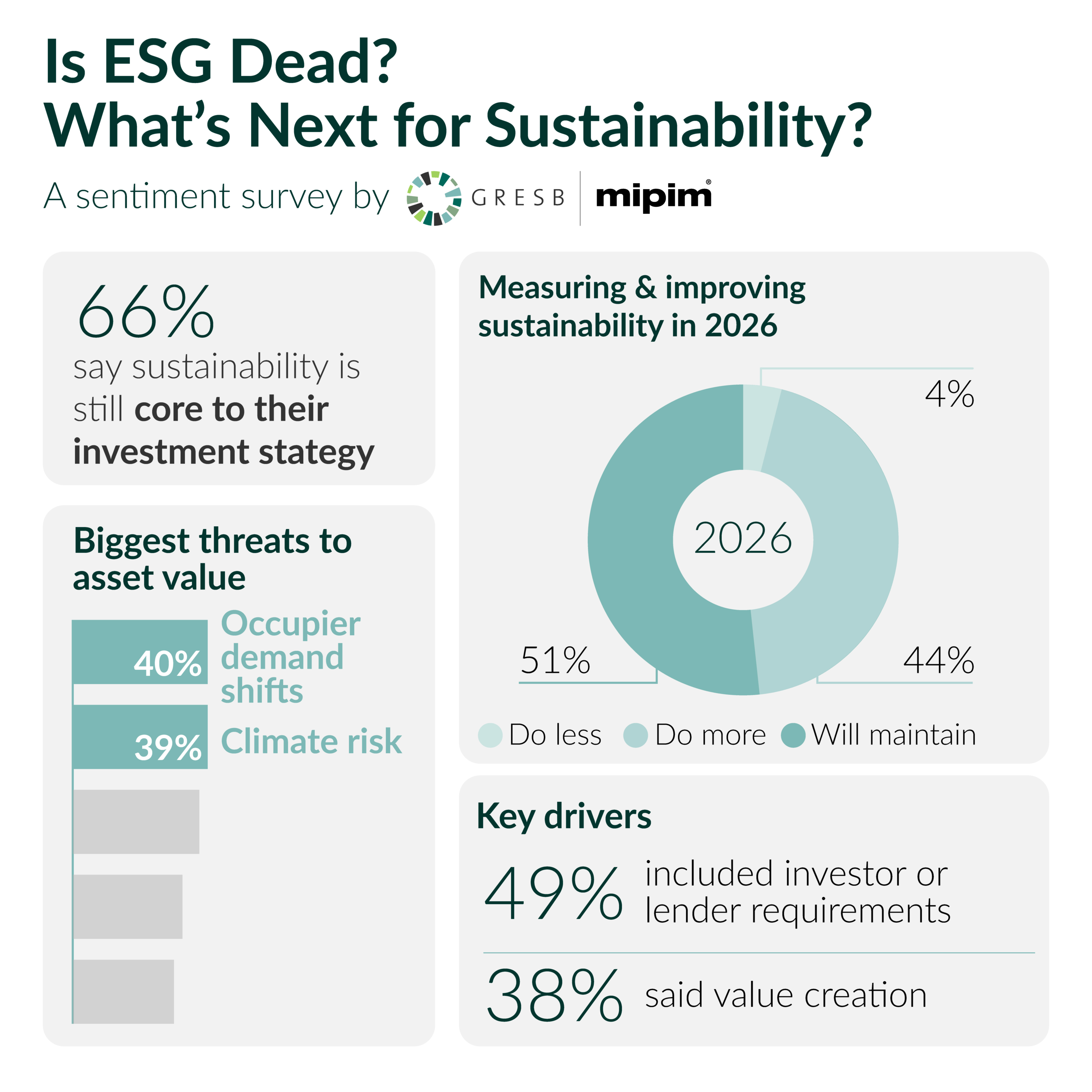

In October-November 2025, MIPIM and GRESB launched a new sustainability survey with their respective real estate communities. From nearly 200 responses across the globe, the survey found that two-thirds of respondents still see sustainability as central to their strategy, with nearly half planning to do more in 2026.

The findings challenge claims that sustainability, by whatever name, is losing ground. While 29% of firms have changed how they talk about sustainability and 14% now avoid the term “ESG” altogether, investor or lender requirements remain the strongest driver of action.

Key findings:

- 66% say sustainability is still core to their investment or operational strategy

- Only 4% expect to do less to measure and improve sustainability performance in 2026, while 44% plan to do more and 51% will maintain current levels

- 49% cite investor or lender requirements as the top driver of sustainability strategy, followed by value creation (38%) and regulation (29%)

- Climate risk and occupier demand shifts are seen as the biggest threats to asset values in 2026, both at around 40%

- Capital and ROI concerns are the main barrier to improving climate resilience (64%), far ahead of lack of urgency (30%)

Climate risk is no longer a distant concern. Nearly two in five respondents say physical climate impacts such as flooding, heatwaves and wildfires will have the biggest effect on asset values in 2026. Occupier demand shifts rank equally high, signalling a dual challenge for the industry.

Nicolas Boffi, MIPIM Director, said: “Despite significant structural challenges around viability and a rapidly changing geopolitical climate, our delegates are telling us that sustainability remains as important as ever. Investor and lender requirements are driving ESG strategy, even if they no longer call it that, and access to capital increasingly depends on credible performance. Cost concerns remain a hurdle, which is why MIPIM 2026 will see sustainability play a leading role across our programme, not least on our Road to Zero platform, which will focus on the hard numbers behind decarbonization and adaptation.”

Chris Pyke, Chief Innovation Officer, at GRESB, said: “The conversation around sustainability may be shifting, but the underlying investment drivers haven’t changed. This survey shows that sustainability remains central for most investors and managers—because it’s tied to risk management, asset value, and access to capital. The focus is moving beyond terminology toward measurable outcomes like resilience and decarbonization.”

The survey was conducted in October–November 2025 among 180 professionals across the real estate sector, primarily investors, fund managers and developers as well as advisors and asset managers.

The findings will be discussed at MIPIM 2026, including through the Road to Zero platform, which will focus on the investment case for decarbonization and resilience. GRESB will also host a dedicated Road to Zero session, “The Net Zero Reality Check: A Live Market Quiz & Debate,” where the results will be examined and debated.

MIPIM 2026 is set to build on the momentum of last year’s edition, which attracted over 20,000 delegates from 90 countries and 70% of the world’s top 100 investment managers, collectively managing more than EUR 4 trillion in assets.

Among the institutional investors already confirmed for MIPIM 2026 are Abu Dhabi Investment Authority, Canada Pension Plan Investment Board (CPPIB), GIC, Mubadala, Norges Bank Investment Management, Ontario Teachers’ Pension Plan, Qatar Investment Authority (QIA), Temasek, and The World Bank Pension Fund, underscoring the event’s position as the leading global meeting point for capital and real estate.

This year marks the introduction of the RE-Family Summit—a new, closed-door forum created exclusively for global family offices and institutional investors. Designed to foster high-level dialogue and strategic networking, the programme will focus on real estate allocation across both developed and emerging markets. By offering a selective platform for candid exchanges and long-term relationship building, RE-Family sets a new benchmark for investor engagement at MIPIM 2026.

About GRESB

GRESB is the leading benchmark and a strategic partner for sustainable investments across real assets and climate-critical industries. Together, we help the industry build more resilient, efficient, and financially attractive portfolios for long-term success.

About RX

RX is a global leader in events and exhibitions, leveraging industry expertise, data, and technology to build businesses for individuals, communities, and organisations. With a presence in 25 countries across 42 industry sectors, RX hosts approximately 350 events annually. RX is committed to creating an inclusive work environment for all our people. RX empowers businesses to thrive by leveraging data-driven insights and digital solutions. RX is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers. For more information, visit www.rxglobal.com.

RX France creates high level, world-class and market leader meeting places, covering 15 industry sectors, including MIPIM, MAPIC, Batimat, Pollutec, EquipHotel, SITL, IFTM, Big Data & AI Paris, MIPCOM, Paris Photo, Maison&Objet*… and many more. RX France’s events take place in France, Hong Kong, Italy and Mexico. For more information, visit www.rxglobal.fr.

*Organised by Safi, a subsidiary of RX France and Ateliers d’Art de France

About RELX

RELX is a global provider of information-based analytics and decision tools for professional and business customers. RELX serves customers in more than 180 countries and has offices in about 40 countries. It employs more than 36,000 people over 40% of whom are in North America. The shares of RELX PLC, the parent company, are traded on the London, Amsterdam and New York stock exchanges using the following ticker symbols: London: REL; Amsterdam: REN; New York: RELX.

*Note: Current market capitalisation can be found at www.relx.com/investors

For more information, please contact:

For press – [email protected], ING Media

+ 44 (0) 20 7247 8334