The GRESB team has received extensive feedback on the strengths and weaknesses of the five star rating system. For many, the five star system provides a unique tool to gauge global leadership. For others, there are significant limitations in its global, sector-agnostic approach. Interviews and research indicate interest in complementing a single, global rating with multiple specialized ratings tailored to various investment strategies. This article and accompanying detailed report present these potential advanced alternative ratings methods.

We invite your feedback on the proposals before their implementation for the 2026 assessment.

The challenge

The current system was originally developed in 2010 to work on a set of entities representing an evenly distributed and varied set of entities . It continues to serve the needs of many of the early participants, managers, and investors, as well as new joiners. Since 2010, however, both the size and diversity of the entities participating in GRESB have increased significantly, leading to a wider range of priorities, styles, and portfolio compositions. The global, sector-agnostic approach of the original system does not do justice to the richness of the ecosystem of entities and data that is the GRESB community today.

The challenges created by the interaction of today’s data with the background and original intention of the system can be summarised as follows:

- Generalist rating: A single, all-encompassing rating system for all themes and subjects is no longer suitable for many current uses of GRESB outputs.

- Global-only rating: A global rating system that does not account for regional or sectoral differences of context and priorities creates unintended disparities in ratings outcomes that are not due to differences in sustainability performance.

- Unclear score-ratings relationship: A rating system that only conveys the relative position of a given year’s score complicates the interpretation of how changes in scores compare to changes in ratings.

Solution exploration

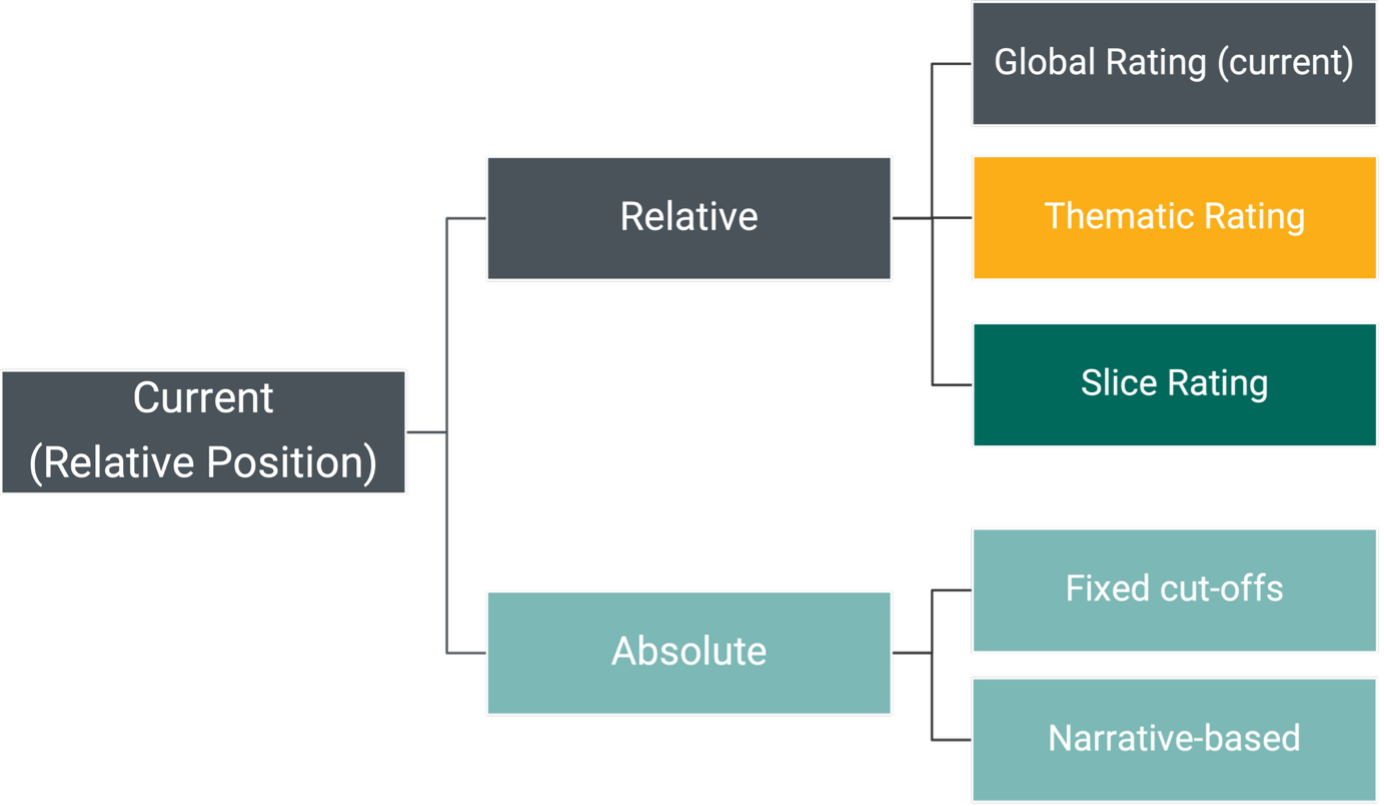

This article introduces three types of proposals. Their estimated impact on star ratings, using the most recent data, is examined in an accompanying report. These proposals are not mutually exclusive and can be combined in various ways to create a more tailored rating system that meets the diverse needs of GRESB Participants.

1. Thematic Ratings: Ratings focused on specific themes or groups of themes to allow participants to demonstrate focused improvement and excellence. Examples include:

- Energy and Carbon Rating

- Health and Wellbeing Rating

- Measured Performance Rating

2. Sliced Ratings: Consistent, comparable “slices” (subsets) of the population based on region, sector, or other relevant criteria to create more contextually relevant ratings. Examples include:

- Industrial, USA

- Residential, Europe

- Office, Japan

- Large, Industrial, Europe

3. Absolute Thresholds: Narrative-based or fixed cutoffs for scores to create more predictable and stable ratings that can evolve over time.

- Uniform width: [0, 25, 50, 75, 95, 100]

- Non-uniform width: [0, 50, 75, 90, 97, 100]

- Targeted narratives: [0, transparent managerial practices, public commitment & sustainability leadership, superior performance data coverage, superior performance achieved, highest performance achieved]

Figure 1: A paradigm shift in how funds are “rated.”

Roadmap

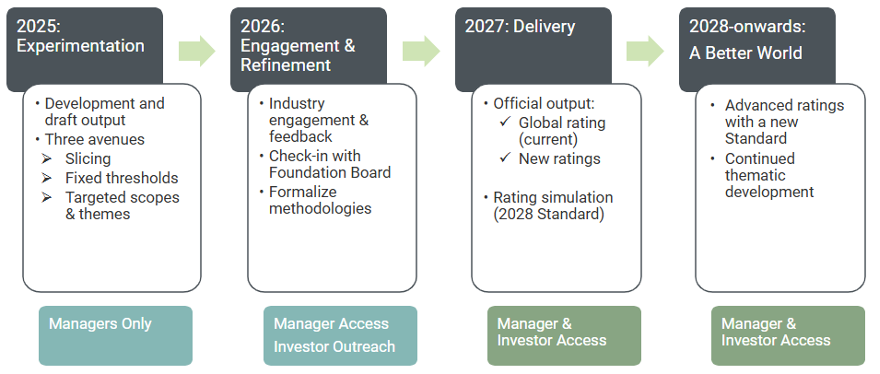

The figure below presents a proposed roadmap for implementing multiple simultaneous ratings in GRESB. More information on the roadmap can be found in the accompanying report.

Figure 2: Roadmap for implementing advanced ratings.

Share your feedback

Current GRESB Scores and Ratings are the result of the evolution of consensus among managers and investors on the relevance and materiality of sustainability criteria. They are designed to be a transparent, interpretable, and stable system of scores and ratings enabling consistent assessment of investment quality, performance comparisons globally, and differentiation of entities based on verifiable criteria and outcomes. At the same time, the system is also meant to remain flexible as the consensus continues to evolve.

We invite you to react to these proposals via the short survey below.