Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

1. Translating net-zero risk into action

Risk management is not new to the infrastructure sector. However, climate change will, and arguably has, imposed evolutionary pressure on developers and operators to mitigate against increasingly complex risks through emissions abatement and business adaptation. Decarbonization and net-zero commitments form the most significant part of the corporate risk-mitigation response to the impacts of climate change. Many sectors have identified that delaying net-zero infrastructure developments can have a significant impact on both physical infrastructure and the resilience of their business model in a changing external environment. For example, failure to act on climate change may increase the need for premium steels, cladding and surface coatings in construction to mitigate against severe weather events such as cyclones. Higher temperatures may require the installation of larger HVAC systems to cool commercial premises such as warehouses and office space.

Similarly, addressing climate change will likely involve an overhaul of critical infrastructure, such as roads, water, and power networks, to avoid high-risk geographies such as those prone to extreme storms, bushfires, flooding, or coastal erosion. Likewise, severe weather will likely change the operating window for key maintenance for powerlines and significantly impact global logistics such as shipping, road freight, and rail. Commercially, emissions abatement inaction will likely lead to loss of market share, increased lending costs and reduced capital access, tax penalties (e.g., carbon tax), or missed business opportunities such as entry into green premium markets. As an added complication there is a significant temporal dimension to climate risk. The most severe weather events and the full effect of environmental change, such as rising sea levels and desertification, will become apparent in time measured by decades. Consequently, the realizable benefits of decarbonization initiatives significantly lag that of the principal investment – a challenging feature for anyone trying to manage a business case or evoke interest from the boardroom.

The certainty of climate change, increasing regulatory pressure, and implementation of more sustainable business practices will force the hand of infrastructure developers and operators reluctant to launch their own net-zero initiatives. Key industry enablers, such as financiers (e.g., banks and large institutional investors) and supply chain participants (e.g., supermarkets, logistics companies, and component manufacturers) are less likely to engage with sectors or individual businesses with large carbon footprints or no program to reduce their emissions, as they move to ensure that they themselves are not sidelined in the new net-zero world. The future business environment for the infrastructure sector will be very dynamic and will require that businesses build capacity or competency in aspects of energy, materials, and feedstocks where they historically kept their distance – the importance of understanding your supply chain becomes critical at this stage. This raises a question for the infrastructure sector, how do you decarbonize and plan for net-zero? And more importantly, how can you do it cheaply and efficiently?

2. Emerging technologies with challenging business models

Two words sum up the future energy and materials environment for the infrastructure sector, “diversification” and “collaboration.” These themes are not only central to the transition to the new decarbonized economy but essential to its success. Historically the infrastructure sector has relied on a handful of carbon intensive inputs such as natural gas and oil products, coal-derived electricity and heat, and synthetic and metal-based materials produced using fossil fuels. These inputs form the basis for the infrastructure sector’s carbon footprint across scope 1 (direct emissions), 2 (indirect emissions associated with electricity use), and 3 (supply chain and external) emissions.

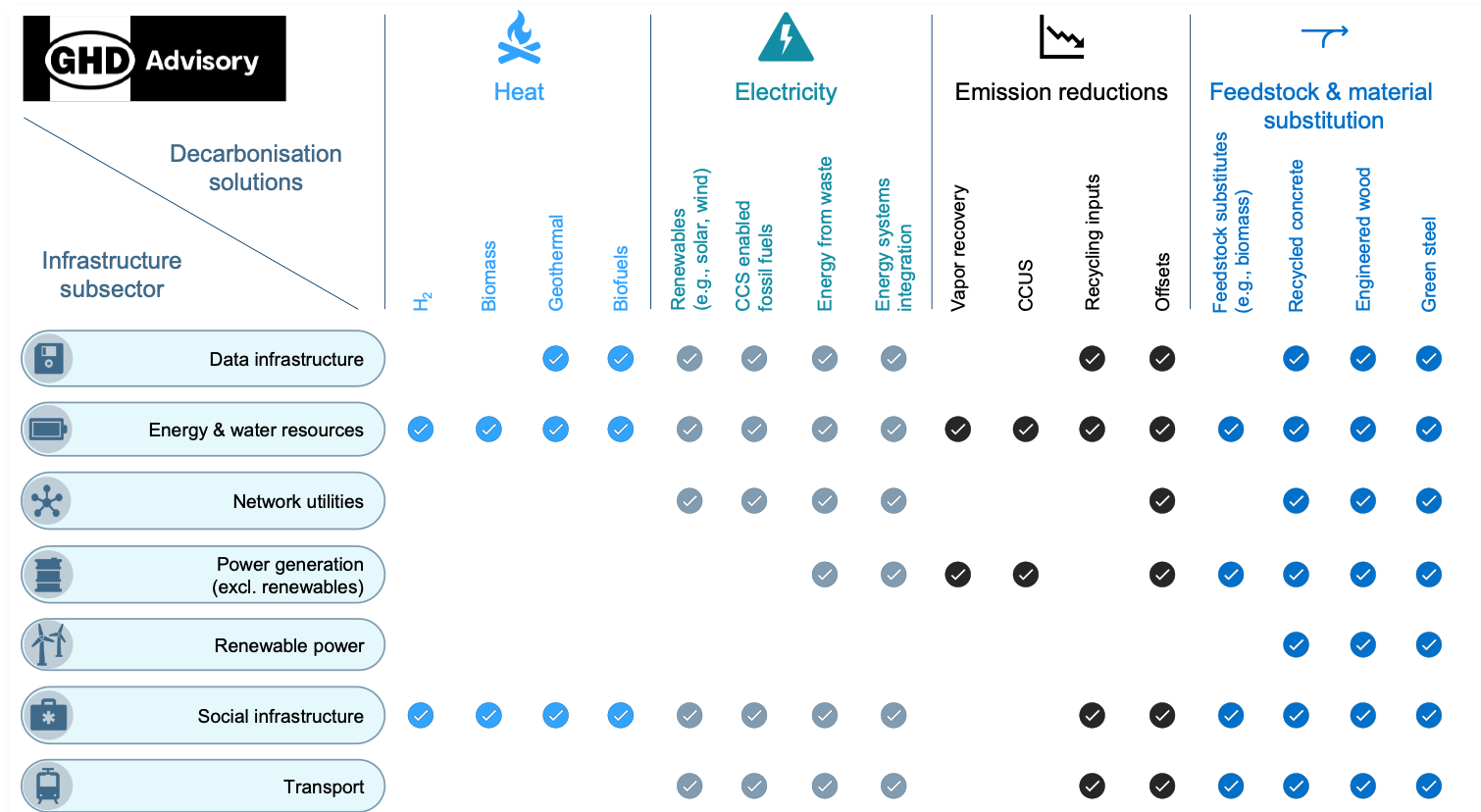

While the substitution options for these inputs are diverse and the commercial models for their acquisition varied, the infrastructure sector is very unlikely to have the inherent experience, capability, or resources to implement a transition on its own. Consequently, the second theme of the future, collaboration, will need to come into play for infrastructure to reach net zero. On the path to net zero, the infrastructure sector can select from a broad range of options. Many will be combined to provide a portfolio solution under one of four thematic options:

- Decarbonization – reducing the carbon intensity of processes or business practices through energy substitution (e.g., replacement of coal or natural gas with green H2 or biomass, etc.), electrification (e.g., replacement of onsite energy production with offsite renewables), and abatement (e.g., capturing and permanently storing CO2 with CCS technology).

- Diversification – changing the business focus of the organization to service another market need or the same market need with a net-zero product (e.g., changing steel cladding manufacturing process to plywood-based alternatives).

- Optimization – enhancing existing processes and systems to efficiently use energy resources (e.g., replacing power network transformers with more efficient models that have less power loss).

- Offsetting – purchasing carbon offsets for processes that are difficult to decarbonize (e.g., small, distributed diesel generators) or are expected to be decommissioned within the transition period.

- Divestment – is a commercial tool whereby an asset is sold and therefore the carbon emissions are no longer attributable to the business. However, this does not lead to a net benefit to society as the asset continues to produce emissions.

Though the above supergroups suggest a straightforward path or roadmap for decarbonization, the devil is in the details. There is a plethora of technology solutions that businesses can select to be a part of their net-zero portfolio. These solutions are many and varied – as are their advantages and disadvantages. How these solutions will build into one holistic decarbonization solution will vary depending on the nature of the business, geographical location of assets, technology accessibility and maturity, supply chain availability, and, of course, economics. Below we highlight both the diversity and commonality of selected decarbonization options for sub-sectors within infrastructure.

While diversity might provide a nice summation of the technology options available to the industry, appropriately selecting a wide range of solutions to best serve the unique challenges of the infrastructure sector is anything but simple. Indeed, no single decarbonization roadmap will fulfill the needs of any two organizations – even those with very similar business profiles – as solutions will need to be tailored for different geographies and climates. Risk appetite, technical and commercial capabilities, and corporate strategies will dictate how net-zero portfolios are embedded into the infrastructure industry. In this context, some level of guidance for the infrastructure sector would form a useful framework as to how the second theme, cooperation, can enable a smooth, efficient, and timely transition to net zero.

3. The need to integrate thinking around process design

In a decarbonized world the infrastructure sector will look completely different from today’s business. Where previously developers and operators viewed energy, feedstocks, and materials, through a business transaction lens, the future will require greater collaboration, integration, and partnering. Collaboration will need to come through the infrastructure sector working closely with providers like OEMs, gas and power network operators, fleet and logistics managers, and regulators. Furthermore, the success of decarbonization to net zero relies on reimagining the traditional lifecycle of materials and products to reduce the carbon footprint resulting from their manufacture, use, and disposal.

In Australia there is already a drive to establish centers of excellence in the form of “hubs” for the industry to coalesce around. The announcement in May 2022 to provide government grant funding for the establishment of hydrogen hubs (1) around Australia is a recognition of the limits the industry will face, but also realizes that within those limits there is potential for reinterpretation of how the different elements of the infrastructure sector work together and more broadly. The premise behind these hubs is that common infrastructure, such as hydrogen generation, pipelines, and storage systems will be built to service co-located industries producing and consuming a shared resource like hydrogen. Through common infrastructure the risk burden for hydrogen-based solutions can be distributed across invested parties. Co-location also benefits associated services, such as operations and maintenance providers, reducing their “commute” and enhancing the business case for international business to consider market expansion into Australia. Also, the industry does not sit outside of society and therefore hubs will simultaneously stimulate surrounding residential, commercial, and agricultural decarbonization initiatives. The key word here is co-operation between stakeholders to avoid a “tragedy of the commons” situation.

The hub-based business model is not a new concept and arguably some of the most successful industries (many outside of infrastructure) have experienced the benefits of this development and innovation model. In Germany, the establishment of Chemical Parks (2) in the early 1990s, enabled co-located chemicals businesses to take advantage of shared services and benefits. These included access to industrial heat, electricity and feedstocks, a skilled workforce, and a close affiliation with research institutions and universities. A similar hub model is being used for the blue H2 project in the UK called Zero Carbon Humber (3). Here a range of hydrogen-consuming industries, including power generation, are being built on the Humber River and will take advantage of common hydrogen infrastructure. A collaboration between more than 14 organizations, the site will be developed for both blue hydrogen (methane derived hydrogen with CCS) and will provide access to permanent CO2 storage in an offshore saline aquifer.

There are many dimensions to the challenge of decarbonization. Through a specific understanding of an infrastructure business’ unique operational challenges, the regional landscape of decarbonization activity, and commercial model options, the sector can and will decarbonize. Collaboration and diversification will help to reduce the associated risk and facilitate a smoother and more cost-effective transition. There is a strong role for Government to play in bringing together the stakeholders under a regional project umbrella to drive cooperation between parties that would not naturally be inclined to collaborate. We do not underestimate the scale of the challenge but we believe there are enough existing and emerging examples of infrastructure hubs available to prove that the model works.

References

CSIRO. Australian clean energy hydrogen industrial hubs program. HyResource. [Online] August 2022. https://research.csiro.au/hyresource/australian-clean-hydrogen-industrial-hubs-program/.

Chemical Parks. Chemical Parks. The unique advantages of the German Chemical Parks concept. [Online] August 2022. https://chemicalparks.com/.

Zero Carbon Humber. Humber. Zero Carbon Humber. [Online] 2022. https://www.zerocarbonhumber.co.uk/.