-

Articles

2023 GRESB Regional Insights Singapore event – Infrastructure in Asia

Read more -

Articles

Navigating sustainable financing in commercial real estate debt

Read more -

Articles

The transition risks of climate change for corporate real estate: Compliance and litigation

Read more -

Articles

Recent study shows REITs surpass private real estate on sustainability measures

Read more -

Articles

The brick and mortar of tackling climate risk for the built sector

In late July, the United Nations Secretary General Antonio Guterres issued a stern warning that “the era of global boiling has arrived.”

Read more -

Articles

The role of commercial real estate in catalyzing the low-carbon grid transformation

Read more -

Articles

You will not be starting from zero when navigating climate risk for your organization

Read more -

Articles

New GCBA sustainable finance guide published

Read more -

Articles

Green infrastructure: A strategic investment for climate resilience

Read more -

Articles

Navigating climate risk: Essential strategies for success

Read more -

Articles

Taking politics out of ESG

Read more -

Articles

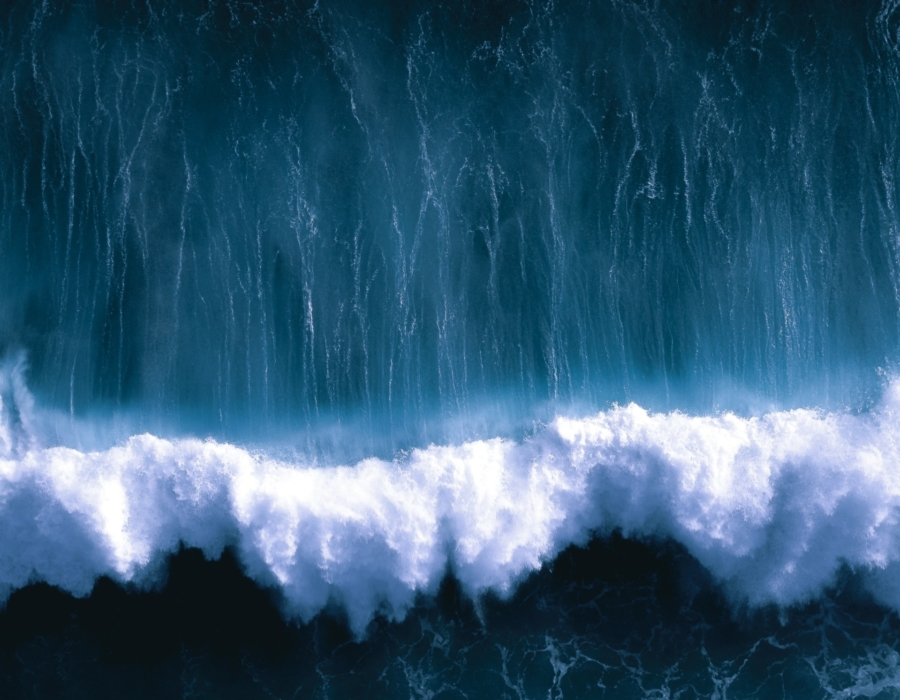

Protect properties from climate risks with smart water management

Read more -

Articles

How the EU Carbon Border tax is pushing companies to rethink their supply chains and production processes

Read more -

Articles

The real estate ecosystem & embodied carbon: More than just offsetting

Read more -

Articles

The evolution of regulatory frameworks for climate resilience: Disclosure powers change

Read more -

Articles

Automating energy management to build resilience in a dynamic regulatory environment

Read more -

Articles

Enabling health, energy efficiency, and compliance: The Role of tracer particles in ASHRAE Standard 241

Read more -

Articles

Keeping up with regulations: How incentives drive building compliance and regulatory momentum

Read more